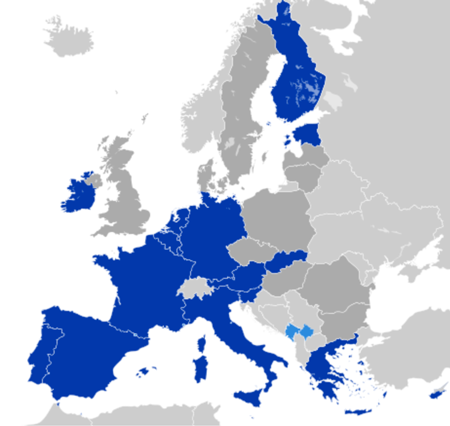

When you think of Europe, your mind might immediately start plotting your “bucket list” of vacation destinations. That happens whenever I see a map like the one below, but this picture actually brings us to the next lesson on Europe. Could you imagine changing currencies every time you drove up to the Upper Peninsula or over to Chicago? While we are somewhat used to that when we go over the bridge to Canada, most of the United States is not. However, that is what living in Europe was like until 1999, when the Euro Zone was established.

When you think of Europe, your mind might immediately start plotting your “bucket list” of vacation destinations. That happens whenever I see a map like the one below, but this picture actually brings us to the next lesson on Europe. Could you imagine changing currencies every time you drove up to the Upper Peninsula or over to Chicago? While we are somewhat used to that when we go over the bridge to Canada, most of the United States is not. However, that is what living in Europe was like until 1999, when the Euro Zone was established.

Lesson #2

What is the Euro Zone?

In contrast to the European Union’s large membership of 27 countries, the Euro Zone consists of only 17 of those 27 countries. This is an Economic and Monetary union of these countries. They have all accepted the Euro as their sole legal currency. The Euro Zone currently consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

According to the European Commission, the benefits of the euro are diverse and are felt on different scales, from individuals and businesses to whole economies. They include:

- More choice and stable prices for consumers and citizens

- Greater security and more opportunities for businesses and markets

- Improved economic stability and growth (Okay, maybe this one is up for debate)

- More integrated financial markets

- A stronger presence for the EU in the global economy

- A tangible sign of a European identity

The European Central Bank (ECB) was established to administer the Euro Zone. The ECB controls monetary policy similar to our Federal Reserve Bank in the U.S. Their main goal is to keep inflation under control by setting interest rates. Lately they have had to become a buyer of member countries bonds in order to help bring their rates (borrowing costs) down for countries like Spain and Italy.

I was fortunate enough to spend three years living in Germany after the Euro Zone was created. We found ourselves traveling from Germany to other Eurozone countries for long weekends as easily as driving to Chicago for a visit. If I felt this way as an individual, you can imagine the impact this has had for business.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.