In most books that discuss asset allocation, the author will mention at some point the relevance of strategic asset allocation and it being a prominent component to the investor’s outcome, which is typically measured in volatility and return. At the Center for Financial Planning one of our core investment beliefs works with strategic asset allocation. We believe there is an appropriate mix of assets that can help investors pursue their personal set of goals during volatile market conditions.

In most books that discuss asset allocation, the author will mention at some point the relevance of strategic asset allocation and it being a prominent component to the investor’s outcome, which is typically measured in volatility and return. At the Center for Financial Planning one of our core investment beliefs works with strategic asset allocation. We believe there is an appropriate mix of assets that can help investors pursue their personal set of goals during volatile market conditions.

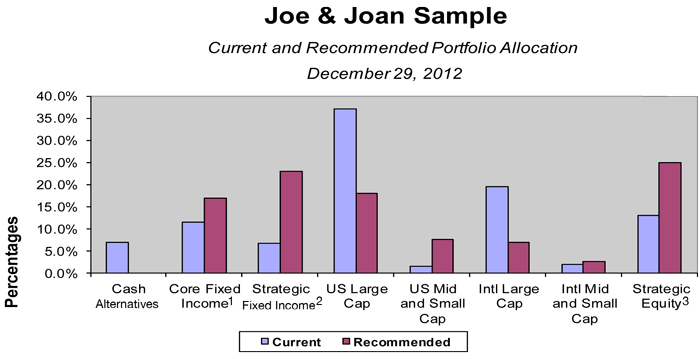

Below is a chart of a new client that recently came in for a financial plan overhaul. You can see they had quite a difference in their current allocation to that of our recommended strategic allocation. The current allocation in blue is overweight US Large Cap stocks and International Large Cap stocks while underweight in some of the more non-correlated assets like Strategic Income and Strategic Equity. We were able to look over their outside investments in 401k’s, and 403b’s to help obtain what we determined to be a suitable mix, designed to keep them within their volatility comfort range as well as on track to reach their return expectations over the long haul.

These asset allocations are presented only as examples and are not intended as investment advice. Actual investor results will vary. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Although derived from information which we believe to be reliable, we cannot guarantee the completeness or accuracy of the information above. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investments mentioned may not be suitable for all investors. Any opinions are those of Matthew Cope and not necessarily those of RJFS or Raymond James. Investing involved risk and asset allocation does not ensure a profit or protect against a loss.

1. Core Fixed Income includes: U.S. Government bonds and high quality corporates

2. Strategic Fixed income includes: Non U.S. bonds, TIPS, less than high quality corporates and other bonds not in core fixed.

3. Strategic Equity includes: Hybrid managers, REITS, hedgeing strategies, commodities, etc.