IRA

IRA stands for Individual Retirement Account, but it isn’t necessarily that simple! Whether you have (or are curious about) a Roth IRA or Traditional IRA, be sure you understand the rules.

Frequently Asked Questions:

What is an IRA?

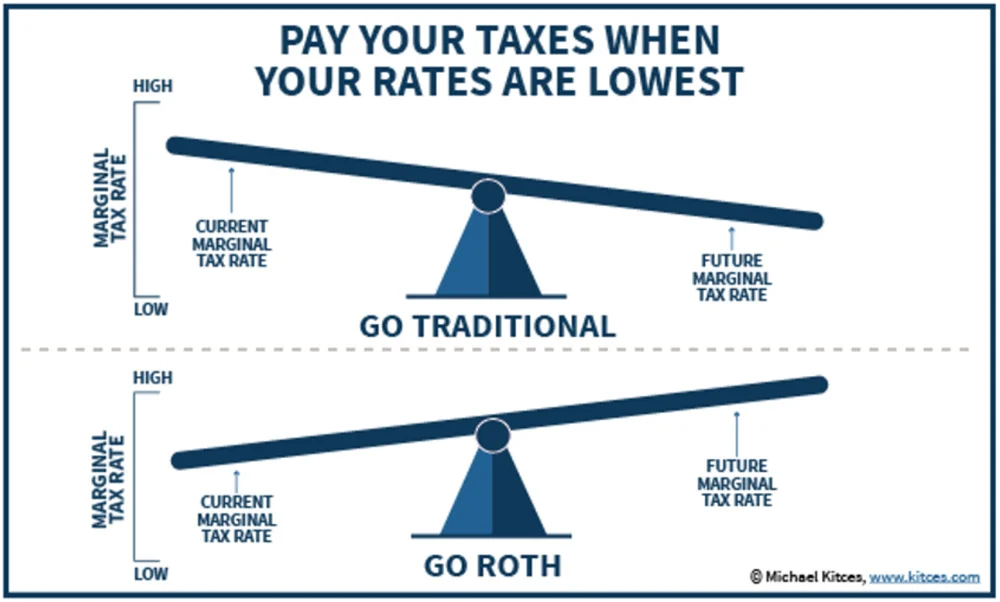

IRA stands for Individual Retirement Account. With a Traditional IRA, contributions are potentially tax-deductible. When withdrawals are made in the future, the full withdrawal amount (contributions and earnings) is taxed. With a Roth IRA, contributions are not tax deductible and are made with after-tax money. Roth IRA withdrawals, however, if considered qualified, are tax-free (contributions and earnings). When determining which type of IRA to contribute towards, your current vs. future tax bracket should be a consideration:

*The above chart is a starting point when deciding whether to contribute to a Traditional or Roth IRA. There are various other factors to consider. You should discuss your contribution decision with your financial adviser and tax professional.

How much can I contribute?

The IRS limits annual contributions to a Traditional IRA and Roth IRA to $7,000/year (in 2024). Those who are 50 and older are allowed to make an additional catch-up contribution of $1,000/year for a total of $8,000. If you are contributing to a Roth and Traditional IRA, your total contribution cannot exceed these limits.

You must also have earned income (aka dollars from working – not investment related income) to be able to contribute to an IRA. If you’re married and only one spouse is working, a contribution can be made on the non-working spouse’s behalf as long as earned income by the working spouse exceeds the total contribution level.

IRAs offer a tremendous amount of investment freedom and flexibility. Individual stocks, bonds, mutual funds, exchange traded funds (ETFs) and even real estate can potentially be held within this retirement vehicle. Always remember, your IRA is not the investment – it’s simply the vehicle that houses the investments you own.

How can you invest money within an IRA?

Do I qualify to make an IRA or Roth IRA contribution?

You can contribute to a traditional or Roth IRA whether or not you participate in another retirement plan through your employer or business. However, you might not be able to deduct all of your Traditional IRA contributions if you or your spouse participates in another retirement plan at work. Roth IRA contributions might be limited if your income exceeds a certain level.

Income Rules differ between a Traditional and Roth IRAs:

Traditional IRA: Anyone can make an IRA contribution, but it may not be deductible. Below are the income limits in place for 2024:

If married and you and your spouse are not covered by an employer sponsored plan:

Full deduction regardless of income

If you are covered by an employer sponsored plan:

Fully deductible if Modified Adjusted Gross Income is less than $77,000 (single) or $123,000 (joint)

Partially deductible if Modified Adjusted Gross Income is between $77,000 and $87,000 (single) or $123,000 and $143,000 (joint)

No deduction if Modified Adjusted Gross Income is over $87,000 (single) or $143,000 (joint)

If you are covered by an employer sponsored plan and your spouse isn’t:

Fully deductible if Modified Adjusted Gross Income is less than $230,000 (joint)

Partially deductible if Modified Adjusted Gross Income is between $230,000 and $240,000 (joint)

No deduction if Modified Adjusted Gross Income is over $240,000

Roth IRA: You cannot make contributions if your Modified Adjusted Gross Income for 2024 exceed the limits shown below:

Full contribution if Modified Adjusted Gross Income is less than $146,000 (single & head of household) or $230,000 (joint)

Partial contribution if Modified Adjusted Gross Income is between $146,000 and $161,000 (single & head of household) or $230,000 and $240,000 (joint)

No contribution if Modified Adjusted Gross Income is over $161,000 (single & head of household) or $240,000 (joint)

A Roth IRA Conversion is the practice of moving existing traditional (pre-tax) IRA funds into a Roth IRA. This transfer is a taxable event, and the pre-tax amount that is moved is taxed as ordinary income. It is essentially seen as a traditional IRA withdrawal. This transaction is not subject to Roth IRA annual contribution limits, and there are no income limitations.

What is the benefit of a Roth conversion?

The benefit of a Roth IRA is that, as long as certain conditions are met, withdrawals are tax free and not subject to Required Minimum Distributions (RMDs). Roth Conversions are, in very basic terms, beneficial when the amount of tax due at the time of conversion from pre-tax to Roth is less than would be due in the future when funds are withdrawn from the traditional IRA. Essentially, it is a strategy used to pay tax at a lower rate now AND the funds maintain the ability to grow tax-free for years to come. The idea behind the benefit of pre-tax savings is that individuals could save more during working years when tax rates are higher due to income, and would be able to withdraw the funds at lower rates when income is more modest in retirement. This theory is not always relevant, and Roth conversions can be especially advantageous during lower income years.

What is a Roth Conversion?

What is the difference between a Roth Conversion and a Backdoor Roth Conversion?

While a Roth Conversion is essentially seen, in terms of taxes, as a traditional IRA withdrawal, and therefore not subject to annual contribution limits, a Backdoor Roth Conversion is seen as a Roth IRA annual contribution, which is currently limited to $7,000 per year, or $8,000 per year (limits from 2024) for those 50 and over. The reason this is referred to as a “backdoor” conversion, is because these transactions are coordinated in a way to avoid the annual income limits, making a back-door Roth Conversion beneficial for those whose income falls above the annual limits, which would prohibit a direct annual Roth IRA contribution. There are some unique rules that must be followed closely in order to make this transaction effective and allowable, and this is not recommended without the assistance of financial professionals.

Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount may be subject to its own five-year holding period. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion.

When can I access my IRA funds?

Rules differ between a Traditional and Roth IRAs.

Traditional IRA: Generally, if you withdrawal funds prior to age 59 ½ from your IRA, you will pay income tax and an additional 10% penalty tax on the withdrawal amount. There are some regulations that allow you make to penalty-free withdrawals prior to age 59 ½, but you will still pay income tax.

Roth IRA: A Roth IRA owner can withdraw contributions at any time without paying taxes. However, only “qualified” Roth IRA distributions that include earnings are tax-free. A distribution is deemed “qualified” when money has been in the account for at least five years and the owner is at least 59½ years old. If the Roth IRA has been open for 5 years, the First-Time Homebuyer clause allows tax free withdrawals of up to $10,000 to purchase a home.

For more helpful information regarding IRAs, click here to visit the IRS website to learn more.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.