What does the country of Greece have in common with companies like Enron, WorldCom and Tyco International? The answer: Accounting scandals of epic proportions!

What does the country of Greece have in common with companies like Enron, WorldCom and Tyco International? The answer: Accounting scandals of epic proportions!

History Lesson 4

In 1992 the creation of the Maastricht Treaty required all members of the Eurozone to limit their Deficit spending and total debt levels in relation to their Gross Domestic Product (GDP), laying the groundwork for later establishment of the Euro as a common currency. The parameters for Government finance are:

- The yearly deficit that the individual country runs may not exceed 3% of the annual GDP of the country. Exceptions to this must be approved.

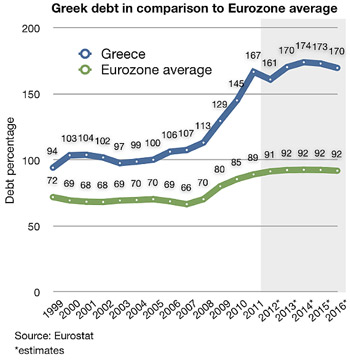

- Government Debt as a percent of GDP must not exceed 60%; however, there are only a couple of Eurozone countries that meet this criteria now. As a whole the Eurozone countries average over 90% as shown in the chart below.

Because of these requirements, countries like Greece (who far exceeds the 60 % acceptable level at 161% Debt to GDP) and Italy got more creative with their accounting methods and ignored internationally agreed upon standards in order to stay part of the Eurozone and use the Euro as their currency. Leaders masked their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions (like leaving out large military expenditures or billions in hospital debt) as well as the use of complex currency and credit derivatives structures.

Two years ago Greece had to fess up to these lies because they were unable to repay their debt. There was a loss of confidence prompting the rescue by other Eurozone countries, as they were the holders of much of this debt, and the International Monetary Fund.

This brings us to where we are today and one of the major questions the world is debating... ”Whether or not the Euro will survive”. I will discuss some of these opposing viewpoints in the next and final installment of this series.

Source: Spiegel Online International

Link to:

Lesson 1: A Little History Behind the Euro Zone Crisis

Lesson 2: Who’s in the Euro Zone and Why Was It Established?

Lesson 3: The Beginning of the End

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.