When you’re approaching retirement, it can be hard to determine how much you would like to spend when you stop working. It’s a scary thought for most. You wonder: Have I saved enough? Is what I want to spend reasonable and safe? It can seem a bit overwhelming, but hopefully part one of this two-part blog series will help to simplify that discussion.

When you’re approaching retirement, it can be hard to determine how much you would like to spend when you stop working. It’s a scary thought for most. You wonder: Have I saved enough? Is what I want to spend reasonable and safe? It can seem a bit overwhelming, but hopefully part one of this two-part blog series will help to simplify that discussion.

How much does my lifestyle really cost?

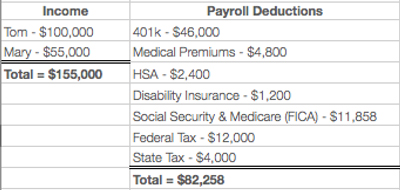

Start the conversation by figuring out your current cost of living. To illustrate, look at an example of how this figure might be much less than you think. Tom and Mary are both age 58 and plan to retire at age 62. The discussion of retirement planning is becoming increasingly important to them as they near retirement. Tom works for Ford and earns $100,000/yr and Mary works as a teacher earning $55,000/yr. Tom and Mary are great savers and each contribute the maximum to their 401k each year ($23,000 each, $46,000 total for 2014). They have health insurance through Mary’s work and pay $400/mo for excellent coverage – they also save $200/mo towards a Health Savings Account (HSA) to be efficient with their out-of-pocket medical expenses each year. They each pay into a group disability policy that costs $100/mo in total. Of course, we can’t forget about taxes. In 2013, they paid $12,000 in federal tax and $4,000 in Michigan state tax. Social Security and Medicare (FICA) cost them $11,858 (7.65% on their income). Below is a breakdown of these payroll deductions on an annual basis:

Assuming no additional dollars are saved beyond the 401k, Tom and Mary are actually living on $72,742/yr ($155,000 – $82,258) – only 47% of what they are earning. This is a great starting point but this is where we start to explore a bit by asking questions like:

- Are they happy with their current lifestyle?

- Do they feel constrained right now and want to spend more on things like travel in retirement?

- Or, do they already travel and do the things they love on their $72,742/yr lifestyle?

- What personally meaningful things do they want to accomplish once they are retired?

These kinds of questions open the discussion surrounding retirement spending and goals. It is also worth mentioning that there will be several expenses and payroll deductions that will ultimately disappear or significantly reduce upon retirement. I will go into detail on these items and show how things change in retirement in part two of this blog series – stay tuned!

Nick Defenthaler, CFP® is a Certified Financial Planner™ at Center for Financial Planning, Inc. Nick currently assists Center planners and clients, and is a contributor to Money Centered and Center Connections.

Any opinions are those of Center for Financial Planning, Inc. and not necessarily those of RJFS or Raymond James. Any example is hypothetical in nature and is used for illustrative purposes only. Individual cases will vary. C14-026770