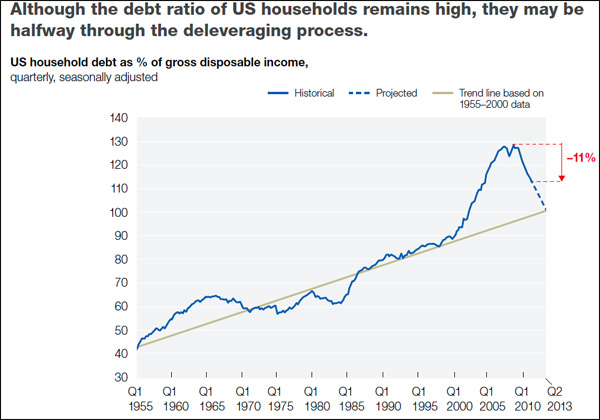

It seems as though we American’s should be giving ourselves a pat on the back. Ever since the financial crisis we have shown a noticeable improvement in our debt levels as a percent of gross disposable income. About half of the excess debt (amount above the trend line or average growth in ratio of debt to disposable income) built up since the year 2000 has been eliminated. The growth in debt over the past ten years sprang from the availability of home equity loans and most of this availability has dried up since the decrease in property values.

Unfortunately our government can’t say the same yet. While government debt is leveling off and slowly drifting downward looking at forward estimates, our politicians have a lot of work to do over the next decade or so tightening their belts.

It is quite common for households and corporations to lead the way in debt reduction during an economic recovery. After all, it is far easier for us to reduce our spending (even though it may not feel like it!) since we don’t have to worry about winning the next election. Also, governments delay their debt reduction in order to attempt to stimulate the economy by spending more so individuals and households can have healthier balance sheets. Later the government can work to reduce their own debt.

When looking under the hood we may not have as much to be proud of as we thought. Sadly, much of the consumer debt reduction has come in the form of foreclosure and defaults. Coming out the other side of this, consumers will have either less or more expensive credit available to them (partially due to lower credit scores and also due to no home equity to borrow upon) and thus won’t be able to fuel the economy quite so much as the government has come to expect in the last decade.

Reduced consumer spending could make the government’s job much more difficult reducing their own debt. The U.S. government is highly unlikely to default on their debt like consumers did so they would need to depend on GDP growth (among other factors like Inflation) to shrink overall debt levels. And with consumers not spending as much it is unclear where this rebound in GDP will come from.

It seems logical to say “Enough is enough!” and make the hard cuts necessary to win this battle over debt in the coming years. However, nothing is ever that simple when it comes to deciding what programs to actually cut and how that may affect other aspects of the meager economic recovery.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Angela Palacios, CFP® and not necessarily those of RJFS or Raymond James.