Contributed by: Center Investment Department

Contributed by: Center Investment Department

Rotation. The transformation that turns a figure around a fixed point in mathematics. So far 2021 has been a story of rotation for markets. Two of the worst sectors in 2020, energy and financials, have become the best performing sectors so far in 2021. If you looked at your December 31st statement and made changes based on return only – you would have missed significant gains…an old but good lesson that past performance isn’t necessarily indicative of future returns.

Last year technology benefited the most from the pandemic as people shopped from home, worked from home and looked for entertainment at home. This year markets have been influenced heavily by the deployment of vaccinations and the hope that we can return to normal soon.

Google trends show increased interest in searches for flights and hotels which is an early sign of pent-up demand for travel that will follow in coming months.

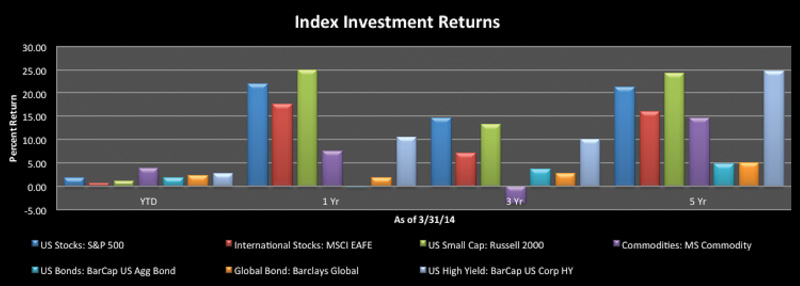

Year to date, through 4/1/2021, a diversified portfolio made up of 40% S&P 500 Index, 20% MSCI EAFE Index and 40% Barclays US Aggregate Bond index is up about 2.4% showing a nice start to the year. The Federal Reserve has reiterated they are “not even thinking about raising interest rates” according to Chair Jerome Powell. Despite that, the market has pushed long-term rates higher, pricing in several rate increases before the end of 2023 despite the Fed chair’s messaging. This has created a challenging return environment to longer dated bonds but results in more attractive interest rates today than we have witnessed in a while.

Economy

Inflation remains muted although we are seeing small pockets due to supply chain disruptions. Between bottlenecks on the west coast and the blockage of the Suez Canal, it takes goods longer and longer to reach our shores. A lack of velocity of money continues to be a headwind to higher inflation and the main reason why we haven’t seen it pick up substantially even though the supply of money has grown drastically with monetary and fiscal stimulus. As long as banks don’t have a large incentive to loan money (via higher interest rates) inflation may continue to be muted.

Initial jobless claims, an early indicator for the direction of unemployment, have dropped to the lowest level recently since the pandemic began. This should support a continued decline in the unemployment rate.

Government and Stimulus

The American Rescue Plan Act of 2021 was signed in law this past quarter. This resulted in stimulus checks to the public. Check out our recent blog for more details. These checks are anticipated to be spent rather than saved. Check out the graph below showing the spending spike in January after the $600 check was received. The additional $1,400 checks started getting delivered the week of March 17th. I expect we will see another spike in consumer spending for March and April.

President Biden hasn’t wasted any time turning attention to the next stimulus plan in the form of the infrastructure bill. It is likely this bill will not get passed unless mostly “paid for” by other means than deficit financing. Bargaining on tax hikes has already started in Washington, at least behind the scenes. It’s going to be a long process, but we can say with high conviction that taxes will likely increase at the corporate and individual levels. We continue to watch how this will affect markets and you, our clients.

Impact of Tax Reform on the Stock Market

In wait of details around the Biden administration’s tax reform, which is speculated to increase the corporate tax rate from 21% to 28% and increase GILTI tax rate (foreign tax rate) from 11% to 21%, many are pondering the implications of change on the stock market. Portfolio strategists believe growth stocks will be most impacted by tax reform. Some economists estimate that a 28% tax rate could decrease corporate earnings by 9% in 2022. However, we have to do a bit of perspective-taking before jumping to conclusions about what this means for investors.

1) Tax reform must go through Congress. Economists don’t believe a 28% tax rate will pass through congress. In fact, Goldman Sachs and UBS Financial Services assume a 25% tax rate will pass. Goldman believes that may look more like a 3% corporate earnings clip, while UBS believes it may be 4%. Either way, that is much more modest than the 9% some are considering with a 28% tax rate.

2) Keep in mind, many forecasters are tempering market expectations already for S&P 500 company profits in 2022. If the tax hike is less than expected or delayed from the expected timeline there could still be a catalyst for robust market returns in 2022 even with corporate tax rate increases.

3) Tax reform may not thwart economic growth. Based on what Biden has proposed in the past, some of the proceeds of tax increases will probably go towards infrastructure spending. Note: that could help balance the impact of increased tax rates because infrastructure spending usually expands the economy.

4) Investors are agile. If growth positions are suspected to be impacted most by tax reform, investors can adjust their strategies to include companies best equipped to handle tax changes. Not to mention, some companies may even issue special dividends during this time. When Barack Obama was re-elected in 2012, companies suspected tax hikes (which never came to fruition). Subsequently, 20 of them issued special dividends. All that to say, there may be some opportunity for investors to pick up investment income.

5) The last and most important thing to understand when considering the implications of tax reform on the stock market is that historically, there isn’t much correlation between stock market returns and tax reform. As demonstrated by the chart below, the S&P 500 has been up when taxes both increase and decrease. Clearly, there is opportunity to meet investment goals no matter the tax policy, so investors should not stray from investment discipline.

Other Headlines: SPACs

More SPACs (Special Purpose Acquisition Company) were created last year than the previous TEN years, and interest in these “blank-check companies” continued to climb in the first quarter of this year. In fact, more money has already been raised in one quarter this year than all of last year’s record year. Here’s a quick look at what they are and why they are taking off.

First, what is a SPAC? It is a public shell company that raises money to buy a private company. The basic steps look like this:

Manager creates a SPAC

Investor puts $10 into it

Manager buys part of a private company for $10

The private company merges with my public SPAC, and boom – you own $10 worth of a company that is now public (OR you think I picked a bad company, and you take your $10 back).

On the surface it seems like a sweet deal; you either get a piece of a hot new company, or you take your $10 back. There are some unique risks to SPACs, though. The big one is obviously that after the merger you are typically left with a small, unproven company. Smaller, private companies are typically quite risky. The company’s stock price might not go up after it becomes public. It might even fall 50, 60, 70%. Ouch! Also, if you don’t like the deal after it is announced, you just missed out on whatever returns you would’ve had elsewhere. Last year, the S&P 500 returned almost 18% (almost 70% from the market bottom on March 23rd)...many investors sat in a SPAC all year only to reject the deal and missed out on huge potential gains.

There’s no definitive reason why SPACs are taking off, but it does show that there are investors willing to take on a high-risk investment. Maybe there is excess cash in the markets, investor exuberance, something to do with low-interest rates, high valuations or low return expectations elsewhere, or confidence in big name SPAC managers; but whatever it is, it has been a lucrative undertaking for those creating the SPACs as the costs paid to the managers/sponsors are not cheap.

Portal Updates

Just a reminder that we have a Center for Financial Planning Inc. app available in the app store for your investment portal! If you don’t have access to the portal yet, please reach out and we can set this up for you! Also, we now have the capability to allow you to aggregate your other accounts in this portal for a complete view of you assets in one place! If you want to learn more, check out our tutorial videos here.

As always, if you have questions please don’t hesitate to reach out to us! Thank you for the continued trust you place in The Center!

Any opinions are those of the author and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Diversification and asset allocation do not ensure a profit or protect against a loss. Dividends are not guaranteed and must be authorized by the company's board of directors. Special Purpose Acquisition Companies may not be suitable for all investors. Investors should be familiar with the unique characteristics, risks and return potential of SPACs, including the risk that the acquisition may not occur or that the customer's investment may decline in value even if the acquisition is completed. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance is not a guarantee or a predictor of future results. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.