There are inherent risks in investing (you can’t control the market) but there are potential payoffs that help people tolerate that risk (like funding retirement). To better understand your own tolerance for risk, you need to first get the gist of asset allocation. Asset allocation is a technique used to spread your investment dollars across different asset classes. Stocks, bonds, and cash or cash alternatives, among others, are generally the most common components of an asset allocation strategy.

Determining risk tolerance

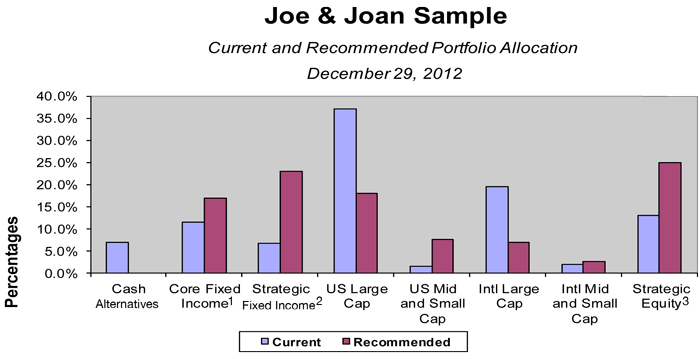

Deciding on an appropriate allocation is an important exercise because it may be the most important investment decision you make due to the impact it can have on your overall return. Your financial goals, time frame and personal resources all contribute to the equation. A risk profile questionnaire is a widely accepted method to help advisors and investors make asset allocation decisions.

However, there are two significant limitations to relying solely on a risk questionnaire to make the asset allocation decision. First, the way people think about risk is not stable and very often varies with market conditions. Behavioral science research tells us that when the market goes up, the pain of past plunges typically fades as investors feel they can accept more risk. The dynamic reverses when markets correct or go down. Suddenly, the market elicits fear in the hearts of investors and tolerance for risk diminishes.

The second limitation with risk questionnaires is they don’t measure an individual’s need to take risk. The purpose of an investment portfolio is to support the financial planning objectives or desired lifestyle. The plan will articulate the why as well as the how. It helps answer questions like, “So, can I retire?” or, “Do I have enough to feel confident?” The specific goals and time frames are the determinants of how much risk to take, even if there is a willingness to take on additional risk.

Committing to an asset allocation

Picking an asset allocation is important, but committing to it is even more important; especially in light of our changing attitudes about risk and reward. Don't hesitate to get professional help if you need it. And be sure to periodically review your portfolio to ensure that your chosen mix of investments continues to serve your investment needs as your circumstances change over time.

Laurie Renchik, CFP®, MBA is a Lead Financial Planner at Center for Financial Planning, Inc. In addition to working with women who are in the midst of a transition (career change, receiving an inheritance, losing a life partner, divorce or remarriage), Laurie works with clients who are planning for retirement. Laurie was named to the 2013 Five Star Wealth Managers list in Detroit Hour magazine, is a member of the Leadership Oakland Alumni Association and in addition to her frequent contributions to Money Centered, she manages and is a frequent contributor to Center Connections at The Center.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Asset allocation does not ensure a profit or guarantee against a loss.