Housing, as an industry, during the last down cycle beginning in 2007 went through the mother of all housing bear markets. We all know the problems that relaxed lending standards and cheap money caused. Many are wondering if it will happen again.

Housing, as an industry, during the last down cycle beginning in 2007 went through the mother of all housing bear markets. We all know the problems that relaxed lending standards and cheap money caused. Many are wondering if it will happen again.

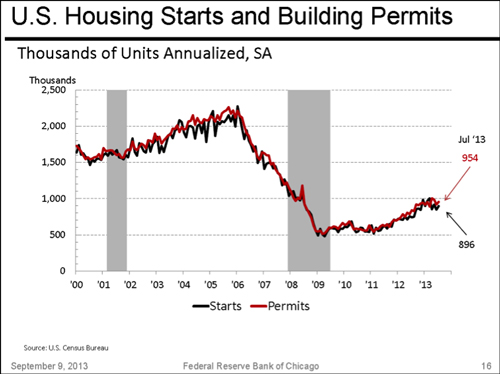

New housing permits and housing starts are moving strongly upward again (as shown below). But it took a while to work through the overhead supply that was sitting on the marketplace. In 2007, there were 4.3 million homes on the market in the US. That number has dropped to 2.3 million homes over the last 6 years.

The US economy requires about 1.4 million new units a year for:

- New home owners (demographics)

- Demolitions (replacement of old homes)

But only about 900,000 new homes are being built annually. We are continuing to cut through that supply in the market place. At this rate there will not be a home left to purchase in America in about 5 years.

So, I would say that we are already at what historically looks like a tight supply market (which usually impact prices). As shown on the “Home Prices” chart below, we are seeing that as prices go up all across the country. Over the last 12 months prices have increased some 20% nationally according to the Case-Shiller index.

Furthermore take into consideration the still encouraging “affordability index” which indicates that it’s still cheaper to buy than rent (as shown above). We believe All signs indicate we have a bull market in housing underway without the same ominous signs we saw at the end of the last housing bull market.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc. Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions. In 2012 and 2013, Matt was named to the Five Star Wealth Managers list in Detroit Hour magazine.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The information contained in this report does not purport to be a complete description of the markets or developments referred to in this material, and is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. Be sure to contact a qualified professional regarding your particular situation before making an investment decision.