The holiday season is the perfect antidote to the sadness of yet another beautiful fall ending. Once the last leaves have fallen off of the trees and the smell of them burning in our fire pits has wafted away, it is promptly replaced with good food, family and the smell of something baking in my oven. The holiday season is an exciting time of the year with many of us frantically buying Christmas presents, and some even planning New Year’s celebrations. However, in the middle of the holiday hustle and bustle, it is important to stop and put your taxpayer hat on.

The holiday season is the perfect antidote to the sadness of yet another beautiful fall ending. Once the last leaves have fallen off of the trees and the smell of them burning in our fire pits has wafted away, it is promptly replaced with good food, family and the smell of something baking in my oven. The holiday season is an exciting time of the year with many of us frantically buying Christmas presents, and some even planning New Year’s celebrations. However, in the middle of the holiday hustle and bustle, it is important to stop and put your taxpayer hat on.

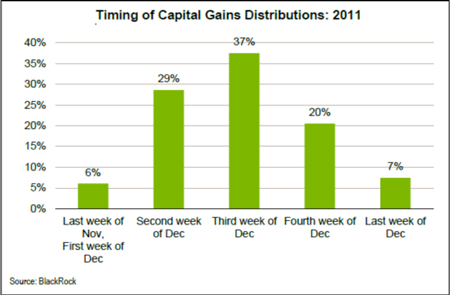

Typically from mid-November to the end of the year investment companies must pay out their capital gains distributions. As you can see from the chart below, the majority of firms tend to distribute in December.

If you own mutual funds in a taxable account and the distributions are anticipated to be large, you should weigh the advantages and disadvantages of owning the investment and incurring the capital gain. By incurring the capital gain you are increasing your basis in the investment. This year is a unique year with the complications of the fiscal cliff. It may be a good time to incur those gains this year to have fewer in coming years! You will want to consult with your tax advisor and financial planner to determine this for yourself.

Many companies will release estimates in October and November as a service to their shareholders, but not all do. You can typically find these by checking the company’s website. So take some time out from all the shopping mall traffic this holiday season and talk to your financial planner today!

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.