Face it, there are some things men tend to be better at and some things come easier to women. Let’s take investing for example. Studies have shown, time and again, that women make much better investors over the long-term than men*. Two factors are at play here: risk and emotion.

Investment decisions are often driven by emotion more so than anything else for individuals (and professionals too!) And, sorry guys, but as I’m sure you are aware we women have written the book on emotional swings. As such, we are more in tune with our emotions as we have to control these swings often. Yes, I know it seems impossible that we are controlling our emotions but believe me, you’d hate to see us when these emotions run unchecked.

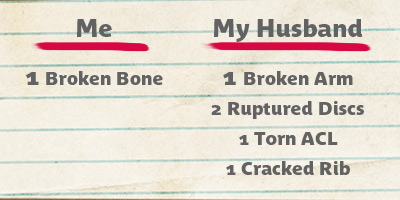

Women tend to take fewer risks than men in many aspects of life. Just look at my major injury history versus my husbands (not that I’m keeping score)

And that is only in the 16 years since I’ve known him!

While taking less risk normally means less return, it does not always work out that way.

By using and managing our emotions instead of repressing them, like men stereotypically tend to, women may make better investment decisions. Because most women have fine-tuned (I’m not claiming perfected) our impulse control, we're more likely to resist overreacting which could lead to trading too much on the latest CNBC report, whether that be selling during market panics or jumping on the bandwagon too far into a rally.

I’d love to see these studies continuously revisited by the academics to see if this data holds true especially if we experience a much longer run to this bull market. But for now it might be a good idea to get in touch with your feminine side!

*Inside the Investor’s Brain (Wiley Trading, 2007)

Boys will be boys: Gender, overconfidence, and common stock investing, by Brad M. Barber and Terrance Odean, The Quarterly Journal of Economics, February 2001.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Angela Palacios and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Angela Palacios and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance is no guarantee of future results.