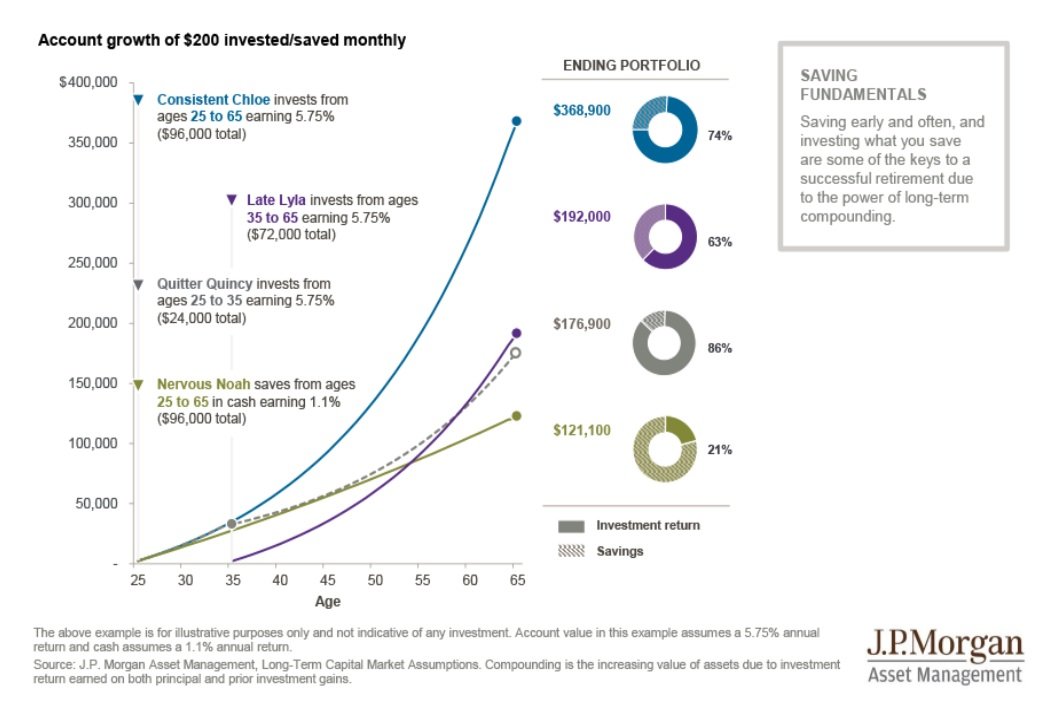

Taxes throughout your lifetime are nearly impossible to predict, so tax diversification is almost as important as the decision to save itself. Taxes are the biggest enemy to retirement and one of your single most significant costs. Therefore, when you are establishing your career, your younger years are the most impactful time to start saving, as shown by the chart below. In this hypothetical example, an investor starting young (Consistent Chloe) has the potential to accumulate far more – teal colored line and ending portfolio value - than a person who waits until age 35 (Late Lyla) – purple colored line and ending portfolio value - to start saving.

Our younger years also offer us a unique opportunity to save in a Roth IRA (tax-free savings) account; however, this is when we are least likely to think of expanding our retirement income options. What if that growth you see in the example above happened all in a tax-free account? This can help you dodge the bullet of taxes later in life.

As we mature in our careers, our income (and tax brackets) naturally increase, and it often becomes more important to invest within tax-deferred accounts. In turn, this gets us tax deductions today that were not always important before.

In our later stages of saving, perhaps when considering early retirement or before social security and Medicare kick in, we would need to start saving into our taxable account buckets to have money readily available for current expenses. This would bridge the gap if accessing our tax-deferred buckets (usually the largest portion of our assets) come with too many strings attached, such as early withdrawal penalties.

So, we know it is important to save and diversify our tax buckets for savings, but are there differences in how we should diversify those asset buckets?

We have all heard that asset location can also be an important tool for diversification. This means placing portions of our investments in certain accounts because of the additional tax benefits that it provides. For example, placing taxable bonds in your tax-deferred accounts to shelter the ordinary income they spin-off or focusing on equities for high growth in our Roth accounts. This makes a lot of sense for someone in the accumulation stage; however, there needs to be even more careful thought applied for someone in or nearing retirement.

There is also such thing as too much of a good thing. Going to extremes and putting all of your bonds in tax-deferred accounts or all of your most aggressive positions in your Roth accounts can lead to some significant shortcomings. Diversifying your investments by tax buckets is important because it gives you the flexibility in any given year to draw from a certain tax profile based on your current situation and cash flow needs. What if you want capital gains only? Take from taxable investments. Need to remodel your house and take a large withdrawal but doing so could push you into a higher cap gains bracket? Take from your Roth. But what if you need to take from that Roth IRA and the markets have corrected 25% that year? In this case, you might be hesitant to take the money out because you want to give it time to experience the rally back that may be on the horizon. You get the picture of where issues could arise. Asset location is a great tool to mitigate taxes, but always be aware that some diversification may always be appropriate in each tax bucket.

It is important to properly diversify on many different levels, and a financial planner can help you do just that. If you have any questions on this topic or others, don’t hesitate to reach out!

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Examples used are for illustrative purposes only.