![]() Contributed by: Nick Defenthaler, CFP®, RICP®

Contributed by: Nick Defenthaler, CFP®, RICP®

In 2026, Medicare Part B premiums for 95% Americans will be $206.50/mo. However, the other 5% will have to face what’s known as the Income Related Monthly Adjustment Amount or IRMAA and pay higher Part B and D premiums. Each year, the chart below (projection for 2026 – income parameters are based on 2024 Modified Adjusted Gross Income) is updated and in most cases, premiums increase gradually with inflation as do the income parameters associated with each premium tier.

Source: Kiplinger

Receiving communication that you’re subject to IRMAA and facing higher Medicare premiums is never a pleasant notification to receive. With proper planning, however, there are strategies to potentially avoid IRMAA both now and into the future.

But first, let’s do a quick refresher on the basics

Medicare bases your premium on your latest tax return filed with the IRS. For example, when your 2026 Part B and D premiums are determined, Medicare will use your 2024 tax return to track income. If you are married and your Modified Adjusted Gross Income (MAGI) was over $218,000 in 2026 ($109,000 for single filers), you’re paying more for Part B and D premiums aka subject to IRMAA. Unlike how our tax brackets function, Medicare income thresholds are a true cliff. You could be $1 over the $218,000 threshold and that’s all it takes to increase your premiums for the year! As mentioned previously, your Part B and D premiums are based off of your Modified Adjusted Gross Income or MAGI. The calculation for MAGI is slightly different and unique from the typical Adjusted Gross Income (AGI) calculation as MAGI includes certain income “add back” items such as tax-free municipal bond interest. Simply put, while muni bond interest might function as tax-free income on your return, it does get factored into the equation when determining whether or not you’re subject to IRMAA.

Navigating IRMAA with Roth IRA Conversion and Portfolio Income

Given our historically low tax environment, Roth IRA conversions are as popular as ever. Especially now, given the extension of our current tax rates as a result of the ‘One Big Beautiful Bill (OBBB)” that was passed in July 2025 (click HERE to read our comprehensive overview of the new legislation). When a Roth conversion occurs, a client moves money from his or her Traditional IRA to a Roth IRA for future tax-free growth. When the funds are converted to the Roth, a taxable event occurs, and the funds converted are considered taxable in the year the conversion takes place. Because Roth IRA conversions add to your income for the year, it’s quite common for the conversion to be the root cause of an IRMAA if proper planning does not take place. What makes this even trickier is the two-year lookback period on income. So, for clients considering Roth conversions, the magic age to begin being cognizant of the Medicare income thresholds is NOT at age 65 when Medicare begins, but rather age 63 because it’s that year’s tax return that will ultimately determine your Medicare premiums at age 65!

Now that there are no “do overs” with Roth conversions (Roth conversion recharacterizations went away in 2018), our preference in most cases is to do Roth conversions in November or December for clients who are age 63 and older. Reason being, by this time, we will have a very clear picture of total income for the year. I can’t tell you how many times we’ve seen situations where clients confidently believe their income will be a certain amount, but it ends up being much higher due to an unexpected income event.

Another way to navigate IRMAA is by being cognizant of income from after-tax investment/brokerage accounts. Things like capital gains, dividends, interest, etc. all factor into the MAGI calculation previously mentioned. Being intentional with the asset location of accounts can potentially help save thousands in Medicare premiums.

Ways to Reduce Income to Potentially Lower Part B and D Premiums

Qualified Charitable Distribution (QCD)

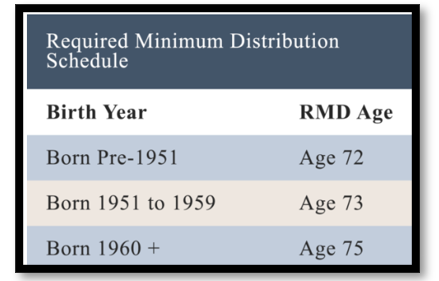

If you’re subject to Required Minimum Distributions (RMD), gifting funds from your IRA directly to a charity prevents income from hitting your tax return. This reduction in income could help shield you from IRMAA. QCDs can begin as early as 70.5, however, they become especially powerful in reducing income tax when RMDs begin.

Contributing to Tax Deductible Retirement Account such as a 401k or 403b Plan

Depositing funds into one of these retirement accounts reduces MAGI and could help prevent IRMAA.

Deferring Income into Another Year

Whether it means drawing income from an after-tax investment account for cash flow needs or holding off on selling a stock that would create a capital gain towards year-end, being strategic with the timing of income generation could prove to be wise when navigating IRMAA.

Accelerating Business Expenses to Reduce Income

Small business owners who could be facing higher Medicare premiums might consider accelerating expenses in certain years which in turn drives income lower if they’re flirting with IRMAA.

Putting IRMAA into Perspective

At the end of the day, higher Medicare premiums is essentially a form of additional tax, which can help us put things into perspective. For example, if a couple (both over 65) decides to do aggressive Roth IRA conversions to maximize the 22% tax bracket and MAGI ends up being $230,000, their federal tax bill will be approximately $29,000. This translates into an effective/average tax rate of 14.78% ($34,000 / $230,000). However, if you factor in the IRMAA the clients will face, which will end up being close to $2,000 (total for the couple between the higher Part B and D premiums), this additional “tax” ends up only pushing the effective tax rate to 15.65% - less than a 1% increase! I highlight this to not trivialize a $2,000 additional cost for the year, as this is real money we’re talking about here. That said, I do feel it’s appropriate to zoom out a bit and maintain perspective on the big picture. If we forgo savvy planning opportunities to save a bit on Medicare premiums, we could end up costing ourselves much more down the line. However, not taking IRMAA into consideration is a miss in our opinion as well. Just like anything in investment and financial planning, a balanced approach is prudent when it comes to navigating IRMAA – there is never a ‘one size fits all” solution.

Fighting back on IRMAA

If you’ve received notification that your Medicare Part B and D premiums are increasing due to IRMAA, there could be ways to reverse the decision. The most common situation is when a recent retiree starts Medicare and in the latest tax return on file with the IRS, is showing a much higher level of income. Retirement is one example of what Medicare would consider a “life changing event” in which case form SSA-44 (click HERE to complete the form online or download the PDF) can be completed and submitted with supporting documentation which could lead to lower premiums. Other “life changing events” would include:

Marriage

Divorce

Death of a spouse

Work stoppage

Work reduction

Loss of income producing property

Loss of pension income

Employer settlement payment

Medicare would not consider higher income in one given year due to a Roth IRA conversion or realizing a large capital gain a life changing event that would warrant a reduction in premium. This highlights the importance to plan accordingly with these items as discussed earlier.

If you disagree with Medicare’s decision in determining your premiums, you have the ability to have a right to appeal by filing a “request for reconsideration” using form SSA-561-U2 (https://www.ssa.gov/forms/ssa-561-u2.pdf)

As you can see, the topic of IRMAA is enough to make anyone’s head spin. To learn even more, visit the Social Security administration’s website dedicated to this topic - https://www.ssa.gov/benefits/medicare/medicare-premiums.html#anchor5. Prudent planning around your Medicare premiums is just one example of many of the work we do for clients that extends well beyond managing investments, that we believe adds real value over time.

If you or someone you care about is struggling with how to put all of these pieces together to achieve a favorable outcome, we are here to help. Our team of Financial Planners offer a complimentary “second opinion meeting” to address your most pressing financial questions and concerns. In many cases, by the end of this 45–60-minute discussion, it will make sense to continue the conversation of possibly working together. Other times, it will not but our team can assure you that you will hang up the phone walking away with questions answered and a plan moving forward. We look forward to the conversation.

Nick Defenthaler, CFP®, RICP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® Nick specializes in tax-efficient retirement income and distribution planning for clients and serves as a trusted source for local and national media publications, including WXYZ, PBS, CNBC, MSN Money, Financial Planning Magazine and OnWallStreet.com.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) I the U.S. which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Any opinions are those of Nick Defenthaler and not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation.

The hypothetical case study is for illustrative purposes only. Individual cases will vary. Prior to making any investment decision, you should consult with your financial advisor about your individual situation.

Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount may be subject to its own five-year holding period. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion.

Municipal Bonds May be subject to state, local, and alternative minimum tax.