![]() Contributed by: Logan Dimitrie, CFP®

Contributed by: Logan Dimitrie, CFP®

The holidays are a wonderful time for family and friends to come together; Some enjoy hot cocoa by the fire, search for the pickle ornament on the Christmas tree, savor delicious latkes during Hanukkah, or celebrate one of the many other cherished traditions.

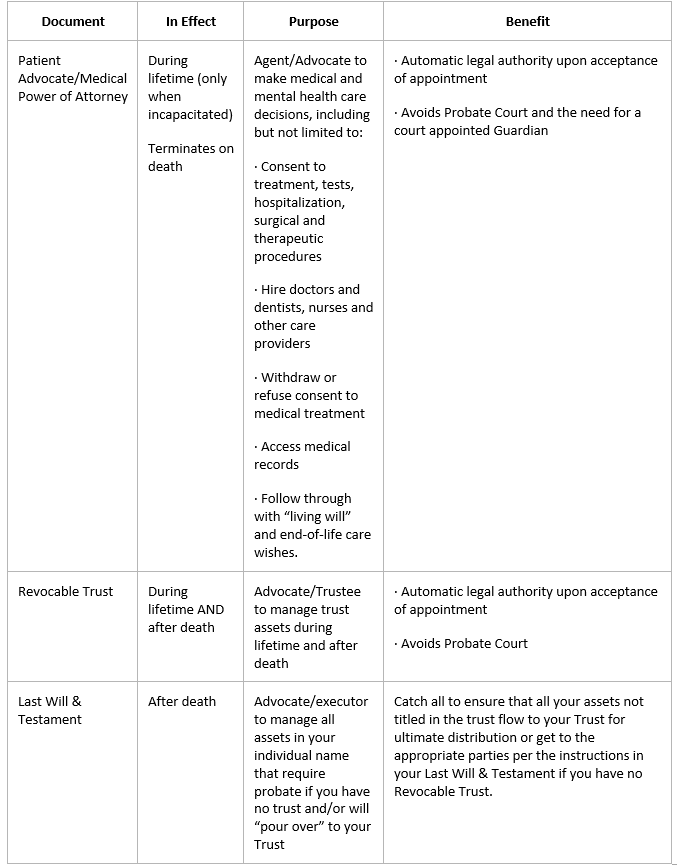

Unfortunately, for many, this season can also be when they first notice signs of cognitive decline in aging parents. While there are plenty of resources to help identify these signs, communicate concerns, and take steps from a health perspective, one area often overlooked is financial and estate planning.

We frequently hear from families who feel unprepared when financial questions arise. Some don’t even know what needs to be done to keep bills paid or protect assets. To help, we’ve outlined key questions you should be able to answer before a crisis occurs:

Important Questions to Ask

Do you know who is authorized to manage finances if Mom or Dad needs support?

Who is listed as the attorney-in-fact on your parents’ Financial Power of Attorney (POA)?

Is the POA springing, meaning it requires additional documentation from a doctor before you can act?

Do your parents have a trust? If so, who is named as trustee in the event they need assistance?

Do you know where these documents are located?

Would you know which accounts bills are paid from? Or how to ensure payments continue?

Are their Individual Retirement Accounts set up for Automatic Required Minimum Distributions to avoid penalties if missed?

Do you have contact information for their attorney, CPA, and CFP®?

Next Steps

If you can’t confidently answer these questions, consider scheduling a Proactive Family Meeting. If your parents don’t already have an organized record system, download our Personal Financial Record System—a simple tool to keep track of essential information in case someone else needs to step in.

And don’t forget about yourself! Cognitive decline isn’t the only reason someone might need help managing finances. Having your own system in place is equally important.

Additional Resources

For guidance on approaching memory concerns, check out the Alzheimer’s Association article:

https://www.alz.org/help-support/i-have-alz/10-steps-to-approach-memory-concerns-in-others

If you have questions or would like to discuss this further, please don’t hesitate to reach out.

Logan Dimitrie, CFP® is a CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® Logan specializes in Financial Independence, Early Retirement, Financial Planning for caregivers and Longevity Planning. Logan has been featured on the Caffeinated Conversations podcast.

Opinions expressed are those of the author and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Generally, if you take a distribution from a 401k prior to age 59 ½, you may be subject to ordinary income tax and a 10% penalty on the amount that you withdraw, in addition to any relevant state income tax. Contributions to a Donor Advised Fund are irrevocable. Changes in tax laws or regulations may occur at any time and could substantially impact your situation. Raymond James financial advisors do not render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.