The Center has been recognized among the top 25 largest money managers in Crain's Detroit Business. To view the Crain's List, please click on image below.

The Center has been recognized among the top 25 largest money managers in Crain's Detroit Business. To view the Crain's List, please click on image below.

Click here to view the profile of Timothy W. Wyman, CFP®, JD.

Money Centered BLOG

The Center has been recognized among the top 25 largest money managers in Crain's Detroit Business. To view the Crain's List, please click on image below.

The Center has been recognized among the top 25 largest money managers in Crain's Detroit Business. To view the Crain's List, please click on image below.

Click here to view the profile of Timothy W. Wyman, CFP®, JD.

Baby boomers, on average, are living longer than any previous generation. While that’s good news, it also presents new challenges.

Baby boomers, on average, are living longer than any previous generation. While that’s good news, it also presents new challenges.

When you consider these factors, it’s more important than ever to make calculated decisions about when to begin drawing Social Security benefits within the context of your overall retirement income plan.

According to the Social Security Administration, 74% of retired Americans drawing retirement benefits are receiving permanently reduced amounts. Reduced benefits are the result of filing when you first become eligible for benefits at age 62. Social Security rules are built around full retirement age (FRA), which is the age at which you are entitled to your full retirement benefit or Primary Insurance Amount (PIA).

The reason the PIA is an important number to know is because it is the base amount on which:

• Reductions will be made

• Increases given or

• On which spousal benefits are determined

Eligible Americans who turn 62 this year must wait until age 66 to begin receiving full payments. But they can receive smaller payments beginning as soon as age 62, or larger lifetime payments beginning as late as age 70. The net effect of filing at age 62 will be a 25% permanent reduction of annual benefits. On the other hand, those waiting until age 70 will see their benefit bumped up by 8% for every year they wait to file from age 66 to age 70. That’s a permanent 132% increase in benefit amount for life!

If Boomer Betsy decides to apply at age 62, or waits until FRA of 66, or delays to age 70. Boomer Betsy’s PIA is $2,230.

Age 62: Benefit amount is permanently reduced by 25% from $2230 to $1672

Age 66: Full retirement age benefit of $2230

Age 70: Benefit increases 8% per year from age 66 to 70 increasing from $2230 to $2943

Of course, there’s no telling how many years you will be collecting benefits but with careful planning, a strategy can be developed to improve potential lifetime benefits of Social Security by structuring the benefits to begin at optimal times based on your financial plan.

Have a social security question? Send me an email.

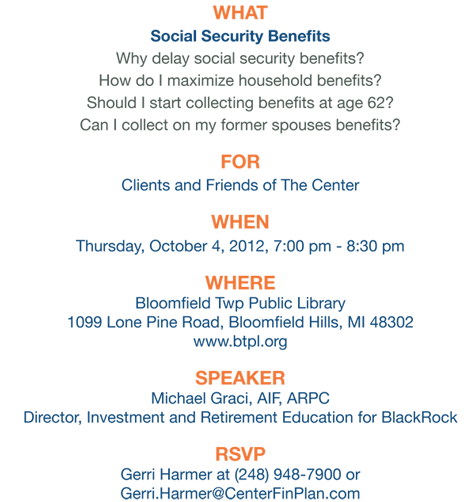

Click Here to get information on our upcoming seminar on Social Security Planning.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Tim Wyman, CFP® recently began participation in Leadership Oakland - just as Laurie Renchik, CFP® did one year ago. The program is intended to help selected participants (about 50 per year) learn about Oakland County, our region and state in order to be informed contributors within our communities.

Tim Wyman, CFP® recently began participation in Leadership Oakland - just as Laurie Renchik, CFP® did one year ago. The program is intended to help selected participants (about 50 per year) learn about Oakland County, our region and state in order to be informed contributors within our communities.

Tim recently attended a 2.5 day Retreat with 50 of his newest friends. He traveled to Roscommon Michigan to the R. A. MacMullan Conference Center. The group spent their time getting to know more about Oakland County, each other, and themselves and their leadership potential. The rustic camp setting provided a great learning and relationship building container. Although Tim commented that the bunk houses made college dorm rooms look spacious!

Tim and the other participants will engage in future sessions including; Economy & Government, Human services & Non Profits, Health & Environment, Diversity & Inclusion, Justice System, Education, Arts & Culture, Shaping the Future, and finally a class project.

Checkout our current blog posts HERE. See you there!

Fall is in the air. The hot days of summer are behind us. It’s getting darker earlier and kids have headed back-to-school. Saturdays are filled with non-stop college football and Sundays the NFL. With all those distractions, it’s easy to miss some important dates that are quickly approaching, but we want to make sure you don’t. So, don’t forget:

Fall is in the air. The hot days of summer are behind us. It’s getting darker earlier and kids have headed back-to-school. Saturdays are filled with non-stop college football and Sundays the NFL. With all those distractions, it’s easy to miss some important dates that are quickly approaching, but we want to make sure you don’t. So, don’t forget:

For help with any of these, please contact your Center planner for additional information. Then you can get back to enjoying fall for all its worth!

The Center proudly supported the local community and Gleaner’s Community Food Bank of Southeastern Michigan through the celebration of food, wine and art! The 9th Annual Vine & Dine, hosted by the Birmingham Bloomfield Chamber of Commerce, included an outstanding selection of wines, a strolling buffet featuring fine restaurants and caterers.

The Center proudly supported the local community and Gleaner’s Community Food Bank of Southeastern Michigan through the celebration of food, wine and art! The 9th Annual Vine & Dine, hosted by the Birmingham Bloomfield Chamber of Commerce, included an outstanding selection of wines, a strolling buffet featuring fine restaurants and caterers.

This year's event was held Wednesday September 5th at the Birmingham Bloomfield Art Center. More than 300 business representatives and residents in Beverly Hills, Bingham Farms, Birmingham, Bloomfield Hills, Bloomfield Township and Franklin attended.

Gleaners Community Food Bank provides surplus donated and low cost food and related personal care products to people in need in southeastern Michigan. For more information about Gleaner's Community Food Bank of Southeastern Michigan, please visit their website at: www.gcfb.org

Imagine you get a call from your grandmother. She asks that you take her to the bank because the neighbor that usually takes her is busy, and she needs to get another certified check. On the way to the bank, your grandmother shares that the lottery company promises that this is the final fee that needs to be paid for her award check to be issued – it has only cost her $1,000 and the award will be $100,000. “What!?!”

Imagine you get a call from your grandmother. She asks that you take her to the bank because the neighbor that usually takes her is busy, and she needs to get another certified check. On the way to the bank, your grandmother shares that the lottery company promises that this is the final fee that needs to be paid for her award check to be issued – it has only cost her $1,000 and the award will be $100,000. “What!?!”

This isn’t just a made-up story meant to scare you. In fact, Susan Tompor of the Detroit Free Press wrote an article about this very topic recently in an article titled “Time to Look Out for Granparents’ Money”. It is also consistent with the types of scams that the State of Michigan Offices for Services to the Aging are reporting and trying to combat.

In the Free Press article, Susan Tompor referenced a recent survey conducted by the Investor Protection Trust and the Investor Protection Institute that identified the top three areas of senior scams:

These scammers take advantage of the trust and good will of older adults. If you are an older adult, a family member of an older adult, or professional that works with older adults, be aware of possible senior financial fraud. Take steps to protect yourself or the older adults you know by:

If you have questions about this additional Elder Care Planning issues, contact me at Sandy.Adams@CenterFinPlan.com.

Europe is no stranger to crisis. Not all of their crises are self-imposed, however. Popular as it may be to blame the Europeans for the current crisis, we must dig a bit deeper to get at some of the root causes of today’s problems and look more globally.

Europe is no stranger to crisis. Not all of their crises are self-imposed, however. Popular as it may be to blame the Europeans for the current crisis, we must dig a bit deeper to get at some of the root causes of today’s problems and look more globally.

In 1971, President Nixon pulled out of the Bretton Woods Accord removing the gold backing from the US Dollar (during Bretton Woods the US dollar had been pegged to the price of gold and all other currencies were pegged to the US dollar), allowing the dollar to float as it does today. This action had far-reaching consequences. Shortly thereafter, many European countries followed suit with their currencies.

Nations, including the US, started to increase their reserves by printing money in large amounts essentially decreasing the value of their currencies. Because oil was priced in US dollars, this resulted in an immediate pay cut to the oil producers. The Organization of Petroleum Exporting Countries (OPEC) eventually answered by pricing a barrel of oil against gold instead.

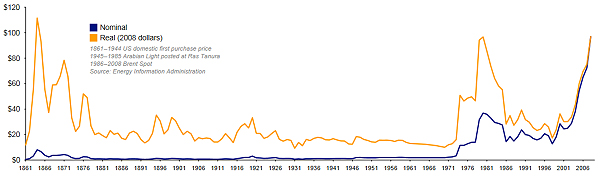

This domino effect ultimately caused the "Oil Shock" of the mid-1970s. For two decades prior, the price of oil in U.S. dollars had risen very slowly and steadily by less than two percent per year. Look at the blue (Nominal) line in the graph below, that is the oil price unadjusted for inflation. Suddenly after 1971, oil became extremely volatile and expensive.

http://en.wikipedia.org/wiki/1973_oil_crisis

http://en.wikipedia.org/wiki/1973_oil_crisis

To add insult to injury, oil exports were limited to many European nations. This led to a drastic slowdown in the European standard of living in the 1970’s causing the local governments to take on more and more debt to mitigate these effects. And so it began until the establishment of the Maastricht Treaty, which I will discuss in our next lesson.

Lesson 1: A Little History Behind the Euro Zone Crisis

Lesson 2: Who’s In the Euro Zone and Why Was It Established?

The information contained in this report does not purport to be a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and are not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.