Contributed by: Matt Trujillo, CFP®

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

Key Highlights:

Personal exemptions, which were previously used to reduce adjusted gross income, have been eliminated entirely

The standard deduction has been increased to $12,000 for single filers (previously $6,350) and $24,000 for joint filers (previously $12,700)

Several deductions that used to be available to tax filers that itemized their deductions have been eliminated or reduced such as:

The deduction for state and local taxes is now capped at $10,000 as opposed to the unlimited amount that was deductible under previous tax law

Lowers the threshold for mortgage interest deductibility; now only the interest on debt up to $750,000 is eligible to be deducted as opposed to $1,000,000 under previous tax law

Miscellaneous itemized deductions have been eliminated entirely as a category; these deductions included things like unreimbursed business expenses, tax preparation fees, and investment fees.

The child tax credit is expanded to $2,000 per child and is refundable meaning even if you have zero tax liability you can still get a check back from the IRS for this credit

This credit was previously $1,400 per child and would begin to phase out for joint filers at $110,000 of adjusted gross income; the credit now doesn’t begin to phase out until you reach $400,000 of adjusted gross income (for joint filers)

If you are curious to know more about how the changes may impact your specific situation please contact our office to discuss!

Matthew Trujillo, CFP®, is a Certified Financial Planner™ at Center for Financial Planning, Inc.® Matt currently assists Center planners and clients, and is a contributor to Money Centered.

Check out our other Tax Reform articles:

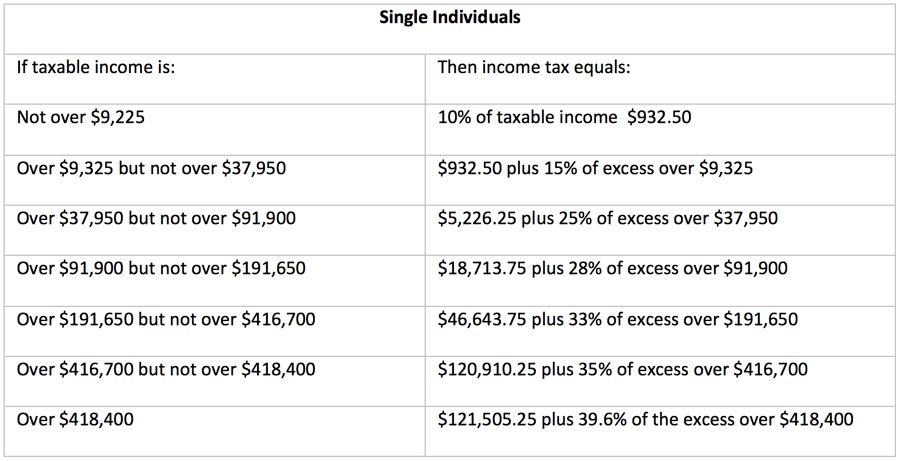

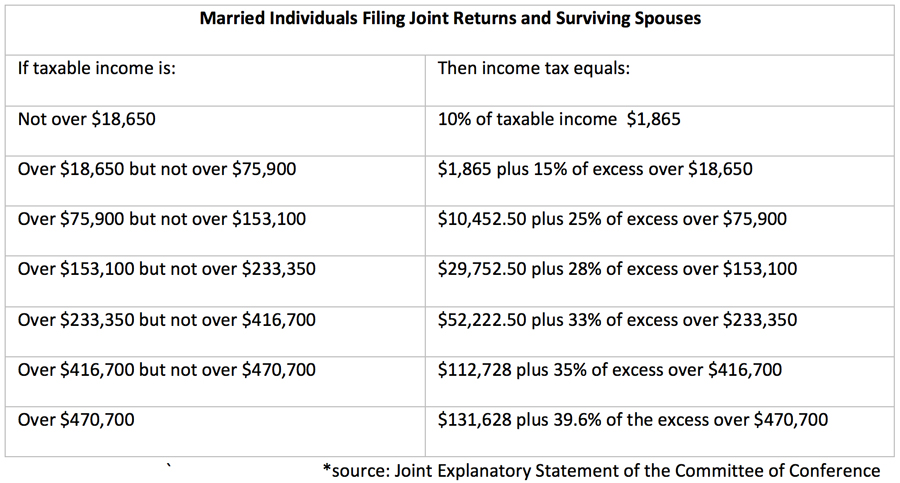

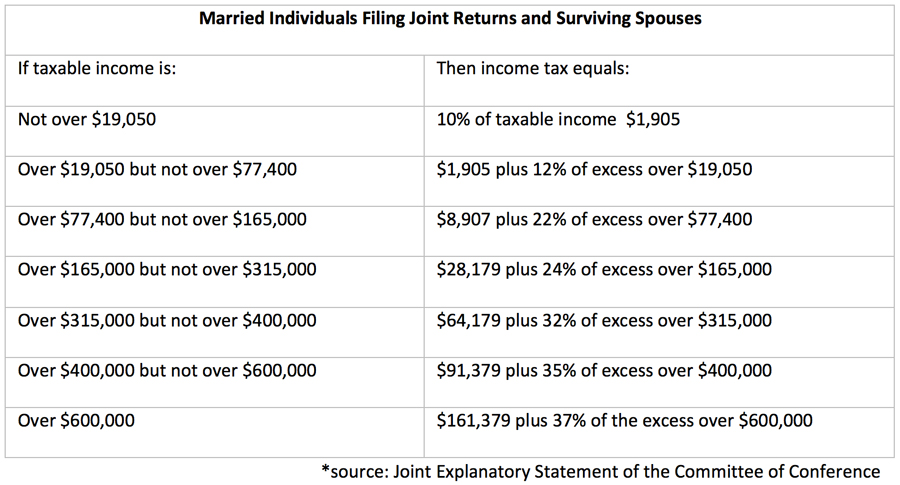

Changes to Federal Income Tax Brackets

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. This material is being provided for information purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.