Well, since I believe that 96% of statistics are made up, and most political stats are probably the worst offenders, I’m going to stick to the facts. People often ask me, “What is better for the markets, a Democrat or a Republican president?” I wanted to be sure to be as non-partisan a possible and give you just the facts. If we measure presidential returns since 1900 (where we have meaningful market data) the performance of the markets stacks up like this:

Well, since I believe that 96% of statistics are made up, and most political stats are probably the worst offenders, I’m going to stick to the facts. People often ask me, “What is better for the markets, a Democrat or a Republican president?” I wanted to be sure to be as non-partisan a possible and give you just the facts. If we measure presidential returns since 1900 (where we have meaningful market data) the performance of the markets stacks up like this:

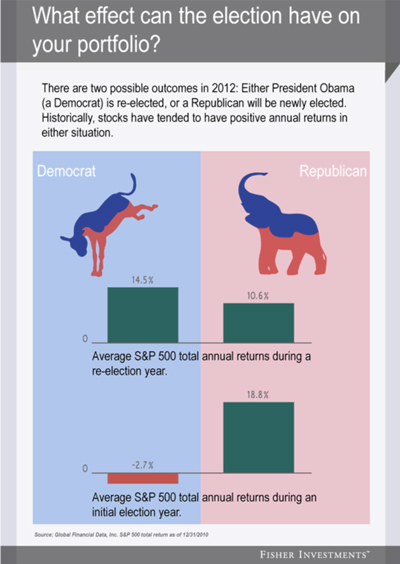

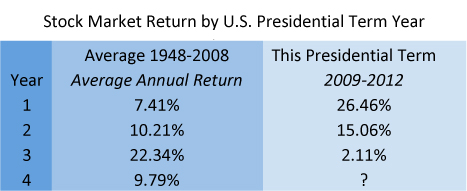

Looking at the chart above, you see that the Dems have the advantage when it comes to the median. The best returns came during the administrations of Democrats Bill Clinton and then Franklin Roosevelt. The period from 1913 – 1920 was difficult, but markets in the 1920s were great. The so-called roaring ‘20’s under Calvin Coolidge, a Republican president, was the era when the market boomed on easy money and no bank controls. Obama's performance, using this yardstick of economic health, has been above average – only slightly below that of Republicans Dwight Eisenhower in the 1950s and Ronald Reagan in the 1980s.

Also, I might add, since Congress holds the purse strings and writes the checks, it might not be the president that we should be measuring. However, that is what people want to know. No one has ever asked me what party holding the majority in Congress provides for better stock market returns. The question from people has always been: “What president is better for the market?”

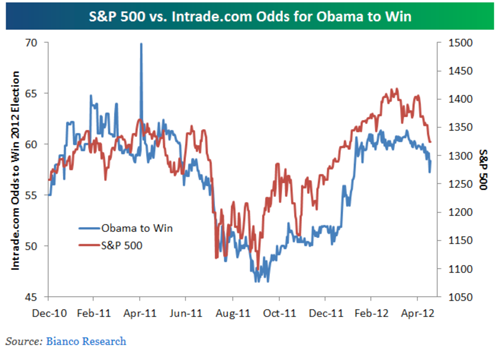

The current sitting president would like this news because strong stock markets usually get presidents reelected. And the reelection is usually a good indicator of a good stock market going forward, especially if we see a Democrat in the Oval Office and a Republican-controlled Congress, which has been the best combination in politics for market returns.

Courtesy of Stock trader’s almanac

So this is all very exciting news for Democrats, but consider that any statistician would say we have a few thousand years to go before we have a fair sample set; 17 presidents doesn’t prove much. With that said, I’m sure that I will be asked this question many more times in my career.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U. S. stock market. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. You cannot invest directly in an index.