Contributed by: Jaclyn Jackson, CAP®

Contributed by: Jaclyn Jackson, CAP®

This is part one of a two-part blog series. We'll talk about diversification generally in this blog, then zoom in on international equity diversification during the second part of the series.

Amid geopolitical tension and pandemic backlash, equities have taken a beating; bond prices have fallen as the Fed raises rates, and even cash under the mattress is no match for inflation. Looking at our current market environment, I am reminded of the Motown classic sung by Martha and The Vandellas, "Nowhere to Run." For decades, investment professionals have preached the merits of asset allocation and portfolio diversification, but what do you do when it all stinks?

The answer is simple (but the action is hard): Stay the Course! That advice doesn't feel helpful during market turbulence, but honestly, it's the best advice for long-term investors. Let me explain…

Why Diversification Works

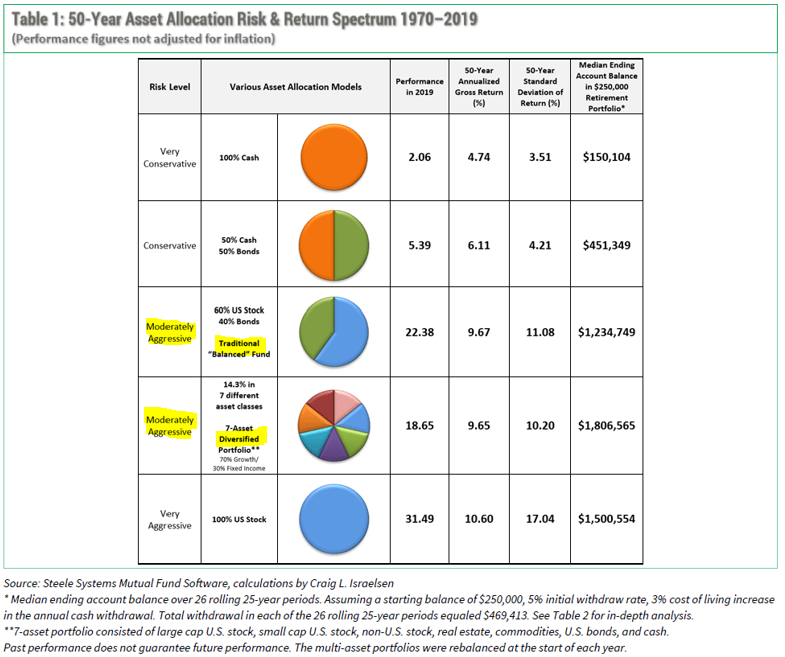

Craig L. Israelsen, Ph.D. and Executive-in-Residence in the Personal Financial Planning Program at Utah Valley, did compelling research around portfolio diversification worth reviewing. He compared five portfolios representing different risk levels and asset allocations over 50-years, from 1970 to 2019. While there is much to glean from his research, let's focus on his comparison of two moderately aggressive portfolios (as they most closely resemble the average investor experience):

Traditional “Balanced” Fund: 60% US stock, 40% bond asset allocation

Seven Asset Diversified Portfolio: 14.3% allocation to seven different asset classes (asset classes included large U.S. stock, small-cap U.S. stock, non-U.S. developed stock, real estate, commodities, U.S. bonds, and cash)

In 2019, a year dominated by the S&P 500, the Traditional "Balanced" Fund (having a larger composition of the S&P 500) predictably outperformed Seven Asset Diversified Portfolio. On the other hand, over the 50-year period, the latter had a similar annualized gross return with a lower standard deviation. An investor with a diversified portfolio experienced comparable returns without taking as much risk.

Grounding his research in numbers, Israelsen evaluated a $250,000 initial investment for each portfolio over 26 rolling 25-year periods from 1970 to 2019 and assumed a 5% initial end-of-year withdrawal with a 3% annual cost of living adjustment taken at the end of each year. The Traditional "Balanced" Fund had a median ending balance of $1,234,749 after 25 years compared to the Seven Asset Diversified Portfolio median ending balance of $1,806,565.

The research illustrates why planners have a high conviction in diversification. The Seven Asset Diversified Portfolio provided risk mitigation (as measured by standard deviation) and supported robust returns even with annual withdrawals.

Stay Tuned

We've discussed the merits of diversification in a general sense. In part two of the series, we'll speak more directly about international equities and explain why we believe it is still a diversifier worth holding.

Jaclyn Jackson, CAP® is a Senior Portfolio Manager at Center for Financial Planning, Inc.® She manages client portfolios and performs investment research.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Jaclyn Jackson, CAP®, and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Standard deviation measures the fluctuation of returns around the arithmetic average return of investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns.