Contributed by: Josh Bitel, CFP®

Contributed by: Josh Bitel, CFP®

Like most people, you have probably thought of the possibility of an early retirement, enjoying your remaining years doing whatever brings you joy and being financially independent. Whether you have your eyes set on traveling, lowering your golf score, spending more time with your family, or any other hobbies to take up your time, you may wonder… How much money does it actually take to retire at age 55?

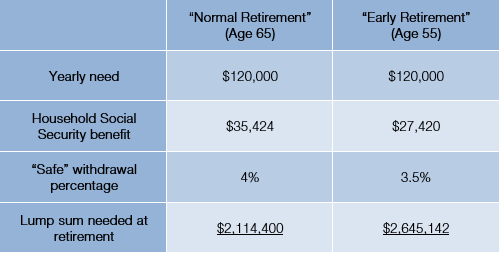

If you have thought about retirement, you are likely familiar with the famous “4% rule”. This rule of thumb states that if you withdraw 4% of your investment portfolio or less each year, you will more than likely experience a ‘safe’ retirement, sheltered from the ebbs and flows of the stock market as best you can. However, some may not know that this rule assumes a 30-year retirement, which is typical for most retirees. If we want to stretch that number to 40 years, the withdrawal rate is slightly lower. For this blog, we will assume a 3.5% withdrawal rate; some professionals have argued that 3% is the better number, but I will split the difference.

A key component of a retiree’s paycheck is Social Security. The average working family has a household Social Security benefit of just under $3,000/month. For our calculations, we will assume $35,424/year for a married couple retiring at age 65. For a couple retiring ten years sooner, however, this benefit will be reduced to compensate for the lost wages. The 55-year-old couple will collect $27,420/year starting as soon as they are able to collect (age 62).

For simplicity’s sake, we will assume a retirement ‘need’ of $10,000/month in retirement from all sources. A $120,000/year budget is fairly typical for an affluent family in retirement nowadays, especially for those with the means to retire early. Of course, we get to deduct our Social Security benefit from our budget to determine how much is needed from our portfolio to support our lifestyle in retirement. (Note that we are assuming no additional income sources like pensions or annuities for this example). As the 4% (or 3.5%) safe withdrawal rule already accounts for future inflation, we can apply this rule to determine an approximate retirement fund ‘need.’ See the following table for the results:

As you can see, over $500,000 in additional assets would be needed to retire ten years earlier. These rules can be applied to larger or smaller retirement budgets as well. While this exercise was heavily predicated on a rule of thumb, it is worth noting that no rule is perfect. Your experience could differ considerably from the assumptions listed above.

This exercise was your author’s best attempt to simplify an otherwise exceptionally complex life transition. This is merely scratching the surface on what it takes to retire comfortably. To increase your financial plan’s success rate, many other factors must be considered, such as tax treatment of distributions, asset allocation of your investments, life expectancy, etc. If you are interested in fine-tuning your own plan to try to retire earlier, it is best to consult an expert.

Josh Bitel, CFP® is a CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® He conducts financial planning analysis for clients and has a special interest in retirement income analysis.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Examples used are for illustrative purposes only.