Growing up, my sport of choice through high school and college – or at least the sport I didn’t get cut from in tryouts -- was Golf. The term sport is, I think, loosely applied to the game of golf. Anything you can do while eating, drinking and socializing sounded like my kind of sport. While golf isn’t the type of sport you take a time-out in, I still learned to recognize the value a time-out can offer. A time-out gives you a chance to catch your breath, look around and assess the situation.

Growing up, my sport of choice through high school and college – or at least the sport I didn’t get cut from in tryouts -- was Golf. The term sport is, I think, loosely applied to the game of golf. Anything you can do while eating, drinking and socializing sounded like my kind of sport. While golf isn’t the type of sport you take a time-out in, I still learned to recognize the value a time-out can offer. A time-out gives you a chance to catch your breath, look around and assess the situation.

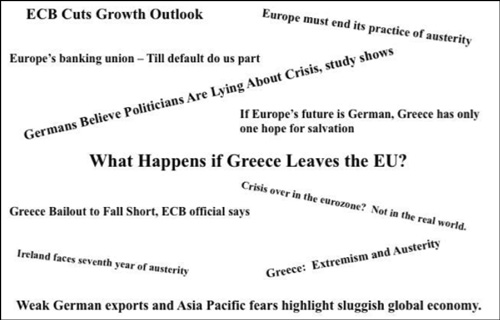

Recently I took a time-out from my daily duties at The Center to attend a conference in Chicago that gathered some excellent investment managers in one place to discuss current investing themes. One presentation summarized cleanly a theme our investment committee has been working on for the past several months…investing around the world (especially in Europe). It has been compelling to us because the EU recovery lags behind the rebound the United States has enjoyed. With headlines as seen below it appears there could be an excellent investment opportunity for certain investors.

Source: Harris Associates L.P.

When headlines are at their worst, investment opportunity is usually at its greatest. Europe emerging from their recession could have a strong positive impact on international equities in general. So take a time-out to notice what is happening on the international front. While other investors aren’t slowing their game, take a moment to step back and assess. A time-out can be an excellent tool to uncover investment opportunities.

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing involves risk and investors may incur a profit or loss.