Do you ever dream of going to work, not because you have to, but because you want to? That’s the number one goal of most Americans over 40. But most financial gurus say that some of the headwinds facing the decision to retire are as daunting as ever.

Do you ever dream of going to work, not because you have to, but because you want to? That’s the number one goal of most Americans over 40. But most financial gurus say that some of the headwinds facing the decision to retire are as daunting as ever.

Consider these Retirement Headwinds:

- Low portfolio return expectations

- Lower bond returns: Over time, bonds generally provide long-term returns similar to the coupon percentage they make (i.e. if the coupon of a bond is 5% and held to maturity, you will receive 5% annually until maturity if there is no default). Interest rates on the 10 year treasury recently went below 1.7%. This is the lowest yield on the 10 year Treasury in over 50 years. Since most bond yields are positively correlated with the 10 year treasury, the argument could be made that all yields are lower than their historical average. According to the Wall Street Journal, rates on the 10 year Treasury touched the lowest yields in modern history.

- Lower than average stock returns: Historically the stock market (S&P 500) has traded at an average Price to Earnings ratio of 15, but has ranged between 7 and the low 30’s (Price to Earnings, or P/E is the ratio of a company’s current share price compared to its per-share earnings) . Today the P/E is around 12.[i] If the P/E is contracting (i.e. when the P/E shrinks), the price investors are willing to pay for the combined earnings of the companies trading in the market declines. This usually results in a decline in the value of the stock market. This is happening for a few reasons. One economic study points to the Baby Boomers. Baby Boomers are entering the stage of life when they generally need to be more conservative. They may feel that it is no longer suitable to invest in the stock market. This pool of money that has been added to over the last 30 years now needs to be used. The largest segment of our population with a sizable amount of investment resources is likely being more cautious and, thus, selling more equities than they are purchasing. You can read the full FRBSF economic letter here.

- Volatility: Markets may continue to move erratically, which tends to cause poor behavioral finance decisions (basically buying high and selling low). This is not new or necessarily worse than before, but still a major challenge for inexperienced investors and advisors.

- Inflation: Higher inflation may be coming in many different ways.

- High government debt: As a portion of GDP, government debts can kindle higher prices.

- Currency devaluation: Low dollar value can cause resources to cost more. For example, higher oil prices are likely the result of oil sales being denominated in U.S. dollars.

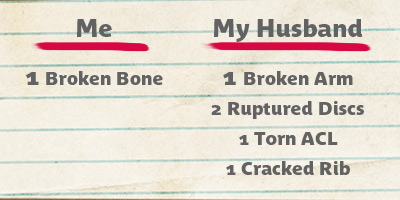

- Health care costs: People are living longer due to advancements in medical and biomedical technology. Many don't realize the financial burden a few extra years will be for this generation, but it's expensive to be on those meds and have that 2nd hip replacement.

- Increased tax rates – The debt will need to be paid by someone. You can see some of the new Pension taxes that where just pushed onto retirees in the state of Michigan last year. The extra 4.35% Pension tax adds up year after year. There are more tax hikes coming at the federal level next year, too.

- Currency devaluation: Low dollar value can cause resources to cost more. For example, higher oil prices are likely the result of oil sales being denominated in U.S. dollars.

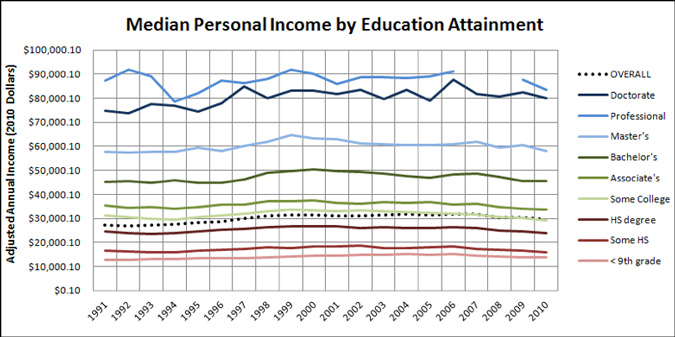

- Real median personal income: Adjusted for inflation 2010 dollars (as shown by Wikipedia using census data) are flat after inflation over the last 20 years - so it’s been difficult for the average American to save more without changing their lifestyle.

With all these headwinds, surely there are some tailwinds working in our favor? Well, even though I’m a “glass half full” kind of guy, I just don’t see any. So that means investors need to make adjustments to compensate for the headwinds. Coming up in my next blog, I’ll explain some ways to do that.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. The opinions expressed in the FRBSF Economic Letter are those of the authors and not necessarily those of Raymond James. Diversification does not assure a profit or protect against loss.

[1] Yahoo! Finance