Checkout our current blog posts HERE. See you there!

Euro 101: Scandals

What does the country of Greece have in common with companies like Enron, WorldCom and Tyco International? The answer: Accounting scandals of epic proportions!

What does the country of Greece have in common with companies like Enron, WorldCom and Tyco International? The answer: Accounting scandals of epic proportions!

History Lesson 4

In 1992 the creation of the Maastricht Treaty required all members of the Eurozone to limit their Deficit spending and total debt levels in relation to their Gross Domestic Product (GDP), laying the groundwork for later establishment of the Euro as a common currency. The parameters for Government finance are:

- The yearly deficit that the individual country runs may not exceed 3% of the annual GDP of the country. Exceptions to this must be approved.

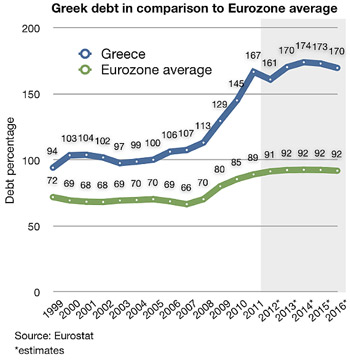

- Government Debt as a percent of GDP must not exceed 60%; however, there are only a couple of Eurozone countries that meet this criteria now. As a whole the Eurozone countries average over 90% as shown in the chart below.

Because of these requirements, countries like Greece (who far exceeds the 60 % acceptable level at 161% Debt to GDP) and Italy got more creative with their accounting methods and ignored internationally agreed upon standards in order to stay part of the Eurozone and use the Euro as their currency. Leaders masked their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions (like leaving out large military expenditures or billions in hospital debt) as well as the use of complex currency and credit derivatives structures.

Two years ago Greece had to fess up to these lies because they were unable to repay their debt. There was a loss of confidence prompting the rescue by other Eurozone countries, as they were the holders of much of this debt, and the International Monetary Fund.

This brings us to where we are today and one of the major questions the world is debating... ”Whether or not the Euro will survive”. I will discuss some of these opposing viewpoints in the next and final installment of this series.

Source: Spiegel Online International

Link to:

Lesson 1: A Little History Behind the Euro Zone Crisis

Lesson 2: Who’s in the Euro Zone and Why Was It Established?

Lesson 3: The Beginning of the End

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Center Included in 2012 Crain's List Largest Money Managers

The Center has been recognized among the top 25 largest money managers in Crain's Detroit Business. To view the Crain's List, please click on image below.

The Center has been recognized among the top 25 largest money managers in Crain's Detroit Business. To view the Crain's List, please click on image below.

Click here to view the profile of Timothy W. Wyman, CFP®, JD.

When Should You Take Social Security?

Baby boomers, on average, are living longer than any previous generation. While that’s good news, it also presents new challenges.

Baby boomers, on average, are living longer than any previous generation. While that’s good news, it also presents new challenges.

-

1) A longer life increases the likelihood that you’ll have increased medical and long-term care expenses.

2) The value of your nest egg will be more significantly impacted by increases in the cost of living over a longer term

When you consider these factors, it’s more important than ever to make calculated decisions about when to begin drawing Social Security benefits within the context of your overall retirement income plan.

According to the Social Security Administration, 74% of retired Americans drawing retirement benefits are receiving permanently reduced amounts. Reduced benefits are the result of filing when you first become eligible for benefits at age 62. Social Security rules are built around full retirement age (FRA), which is the age at which you are entitled to your full retirement benefit or Primary Insurance Amount (PIA).

The reason the PIA is an important number to know is because it is the base amount on which:

• Reductions will be made

• Increases given or

• On which spousal benefits are determined

Eligible Americans who turn 62 this year must wait until age 66 to begin receiving full payments. But they can receive smaller payments beginning as soon as age 62, or larger lifetime payments beginning as late as age 70. The net effect of filing at age 62 will be a 25% permanent reduction of annual benefits. On the other hand, those waiting until age 70 will see their benefit bumped up by 8% for every year they wait to file from age 66 to age 70. That’s a permanent 132% increase in benefit amount for life!

Here is a hypothetical example illustrating how the math works:

If Boomer Betsy decides to apply at age 62, or waits until FRA of 66, or delays to age 70. Boomer Betsy’s PIA is $2,230.

Age 62: Benefit amount is permanently reduced by 25% from $2230 to $1672

Age 66: Full retirement age benefit of $2230

Age 70: Benefit increases 8% per year from age 66 to 70 increasing from $2230 to $2943

Of course, there’s no telling how many years you will be collecting benefits but with careful planning, a strategy can be developed to improve potential lifetime benefits of Social Security by structuring the benefits to begin at optimal times based on your financial plan.

Have a social security question? Send me an email.

Click Here to get information on our upcoming seminar on Social Security Planning.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Tim Wyman Attends Leadership Oakland Class of XXIII

Tim Wyman, CFP® recently began participation in Leadership Oakland - just as Laurie Renchik, CFP® did one year ago. The program is intended to help selected participants (about 50 per year) learn about Oakland County, our region and state in order to be informed contributors within our communities.

Tim Wyman, CFP® recently began participation in Leadership Oakland - just as Laurie Renchik, CFP® did one year ago. The program is intended to help selected participants (about 50 per year) learn about Oakland County, our region and state in order to be informed contributors within our communities.

Tim recently attended a 2.5 day Retreat with 50 of his newest friends. He traveled to Roscommon Michigan to the R. A. MacMullan Conference Center. The group spent their time getting to know more about Oakland County, each other, and themselves and their leadership potential. The rustic camp setting provided a great learning and relationship building container. Although Tim commented that the bunk houses made college dorm rooms look spacious!

Tim and the other participants will engage in future sessions including; Economy & Government, Human services & Non Profits, Health & Environment, Diversity & Inclusion, Justice System, Education, Arts & Culture, Shaping the Future, and finally a class project.

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!

You're Invited: Navigating Medicare Insurance

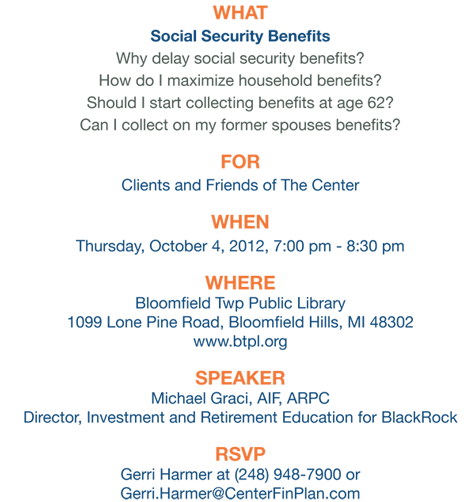

You're Invited: Maximize Social Security Benefits

Important October Dates Are Quickly Approaching

Fall is in the air. The hot days of summer are behind us. It’s getting darker earlier and kids have headed back-to-school. Saturdays are filled with non-stop college football and Sundays the NFL. With all those distractions, it’s easy to miss some important dates that are quickly approaching, but we want to make sure you don’t. So, don’t forget:

Fall is in the air. The hot days of summer are behind us. It’s getting darker earlier and kids have headed back-to-school. Saturdays are filled with non-stop college football and Sundays the NFL. With all those distractions, it’s easy to miss some important dates that are quickly approaching, but we want to make sure you don’t. So, don’t forget:

October 1, 2012:

- Deadline to establish SIMPLE IRA Plan for the 2012 Plan Year

- Deadline to set up a new Safe-Harbor 401(k) plan for 2012 plan year

- If you attain age 50 or over on or before December 31, 2012 October is a good time to consider making pre-tax catch-up contributions to your 401(k) - up to $5500 for 2012.

October 15, 2012:

- Self-employed business owners have until October 15 to establish a SEP IRA for 2012

- Last day to re-characterize your Roth IRA conversion if there is a loss

- Medicare open enrollment begins, ending Friday December 7th

- Final day to file your tax return if you have an extension

For help with any of these, please contact your Center planner for additional information. Then you can get back to enjoying fall for all its worth!

Center Sponsors 2012 Vine & Dine to Benefit Gleaners Food Bank

The Center proudly supported the local community and Gleaner’s Community Food Bank of Southeastern Michigan through the celebration of food, wine and art! The 9th Annual Vine & Dine, hosted by the Birmingham Bloomfield Chamber of Commerce, included an outstanding selection of wines, a strolling buffet featuring fine restaurants and caterers.

The Center proudly supported the local community and Gleaner’s Community Food Bank of Southeastern Michigan through the celebration of food, wine and art! The 9th Annual Vine & Dine, hosted by the Birmingham Bloomfield Chamber of Commerce, included an outstanding selection of wines, a strolling buffet featuring fine restaurants and caterers.

This year's event was held Wednesday September 5th at the Birmingham Bloomfield Art Center. More than 300 business representatives and residents in Beverly Hills, Bingham Farms, Birmingham, Bloomfield Hills, Bloomfield Township and Franklin attended.

Gleaners Community Food Bank provides surplus donated and low cost food and related personal care products to people in need in southeastern Michigan. For more information about Gleaner's Community Food Bank of Southeastern Michigan, please visit their website at: www.gcfb.org