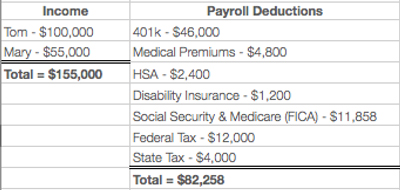

Determining how much you actually spend each month is really the first step in dialing in on how much money you need or want in retirement. (If you missed it, check out my last blog on this!) With so many payroll deductions (taxes, 401k savings, medical premiums, insurance, etc.) it can be pretty staggering when you crunch the numbers and see what you’re truly spending each month. It’s probably much less than you thought! The good news is that several of these payroll deductions will disappear or be significantly reduced when you retire. Let’s dive in and take a look at some of those items to shed some light on what might be your “number” for desired retirement spending.

Determining how much you actually spend each month is really the first step in dialing in on how much money you need or want in retirement. (If you missed it, check out my last blog on this!) With so many payroll deductions (taxes, 401k savings, medical premiums, insurance, etc.) it can be pretty staggering when you crunch the numbers and see what you’re truly spending each month. It’s probably much less than you thought! The good news is that several of these payroll deductions will disappear or be significantly reduced when you retire. Let’s dive in and take a look at some of those items to shed some light on what might be your “number” for desired retirement spending.

The Good News on Taxes

There’s a good chance your tax liability will be lower in retirement. Two items that go away upon retirement are Social Security and Medicare tax (FICA). As an employee, you are responsible for kicking in 6.2% to Social Security and 1.45% to Medicare – a total of 7.65%. Think about it, that’s $7,650/yr if you earn $100,000 annually. Kiss those taxes goodbye on your last day of work.

When you begin to receive your Social Security benefit, the benefit may or may not be taxable, depending on your adjusted gross income (AGI). However, most clients see at least some taxation of benefits. Per SSA.gov, the maximum amount of your benefit that can be subject to federal tax is 85%. Meaning if you were receiving $35,000/yr in benefits, the maximum taxable amount that would be included in your AGI would be $29,750 ($35,000 x 85%). In addition, most states, including Michigan, do not tax Social Security benefits.

Pension , IRA, qualified retirement plan (401k, 403b, etc.) distributions will be included in your income for the year on the federal level – these income sources are treated as ordinary income. This is why being cognizant of your current and future tax bracket is so important in proactive tax planning. A few years ago, Michigan began taxing these income sources on the state level, but the amount that is included in taxable income for the year is dependent on your age and total benefits.

Forget Saving for Retirement

One of the many benefits of being retired is that you no longer have to save for retirement! The maximum 401k contribution for someone over the age of 50 in 2014 is $23,000. We commonly see clients saving the maximum while in the latter half of their working years. For a couple who both maximize their retirement plans at work, we are talking about a $46,000/yr outflow that will no longer exist upon retirement.

Getting Rid of Debt

The goal of many is to be debt free (or close to it) upon retirement. If your mortgage (not including taxes and insurance – unfortunately those items never go away) is $1,500/mo, this is $18,000/yr in savings … a huge amount if you are able to eliminate your house payment prior to retirement. With rates as low as they have been, it often makes sense to keep the mortgage because it’s “cheap money”. However, being debt free in retirement is a very personal decision and is typically more of a “what makes you sleep better at night” decision rather than a strictly “numbers” decision.

Adding it All Up

When you factor in what you are saving for retirement, taxes, and having a mortgage, many clients are shocked to realize that those items can eat up close to 50% of total gross income. So, if a client has joint income of $200,000 we may propose $100,000 in retirement spending (when we do, they often look at us like we’re crazy). But if we back out their total 401k savings of $46,000, Social Security and Medicare tax of $15,300 ($200,000 x 7.65%), their $1,500/mo or $18,000/yr mortgage and a total tax reduction of approximately $10,000 because less total dollars are being generated, that is a total of almost $90,000 that will no longer exist in retirement. So what does that mean? It means the couple can live the equivalent of their current $200,000 lifestyle on $110,000 in retirement – pretty close to the suggestion of $100,000 in retirement spending!

For this reason, I cringe when I hear advice like, “You need $2,000,000 to have a fighting chance at retiring,” or, “You will spend 70% of your current income in retirement.” Everyone’s situation is different and many folks are probably living on a heck of a lot less than they actually think. If you’re retiring in the next 10 years, I urge you to walk through this process. Really start thinking about what you want to spend when that time comes. It will help you plan accordingly and will hopefully significantly improve the chances of you reaching your retirement goals.

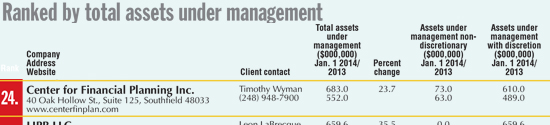

Nick Defenthaler, CFP® is a Certified Financial Planner™ at Center for Financial Planning, Inc. Nick currently assists Center planners and clients, and is a contributor to Money Centered and Center Connections.

Any opinions are those of Center for Financial Planning, Inc. and not necessarily those of RJFS or Raymond James. Any example is hypothetical in nature and is used for illustrative purposes only. Individual cases will vary. Every investor’s situation is unique. Please consult with your financial advisor about your individual situation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. Investors should consult a tax advisor about any possible state tax implications. C14-026884

If you think yoga and finance have nothing in common, you are wrong. It may not be obvious at first glance, but let me explain. On June 1st, Kim and I participated in a 90-minute Bikram Yoga session on the lawn of the Detroit Institute of Arts with another 350 other people. The idea was to share time together and nurture our body while enjoying the sun.

If you think yoga and finance have nothing in common, you are wrong. It may not be obvious at first glance, but let me explain. On June 1st, Kim and I participated in a 90-minute Bikram Yoga session on the lawn of the Detroit Institute of Arts with another 350 other people. The idea was to share time together and nurture our body while enjoying the sun.