Checkout our current blog posts HERE. See you there!

Playing Catch-Up with Retirement Planning

Contributed by: Matt Trujillo, CFP®

What happens if you don’t start saving for retirement in your 20s or 30s? Recently I’ve had a few initial meetings with potential clients who have, for various reasons, had to delay their retirement planning until later in life (i.e. late 40s to mid-50s). In many cases I heard things like, “Will I ever retire?” and, “Should I even bother trying?” I tell them: Where there’s a will there’s a way.

Here are 4 things you should be doing if you are trying to play catch-up with retirement planning.

Save a lot of money: This almost goes without saying. If you have nothing or very little saved for retirement, then you are likely going to need to save at least 20-25% of your income to catch up, depending on your time horizon before retirement.

Consider taking more risk than your peers: Typically people in their mid-50s who have been saving for retirement for many years, don’t need to take significant risks in their portfolio to meet their retirement income goals. Often times a balanced 60% stock and 40% bond portfolio can generate sufficient risk adjusted returns. However, if your nest egg is small, then you may not have the luxury of having this type of portfolio. If you’re playing catch-up, you may consider allocating more of your capital to diversified stocks.

Get a handle on cash flow: Nobody likes budgeting, but if you are going to save the percentage of income necessary to catch up, then you will need to have a good base level of understanding of where your money is going on a monthly basis.

Put a plan in place: Get a written financial plan so you know what you need to be doing to get on the right track! Also, consider working with someone who will keep you accountable in terms of saving money.

These recent conversations with clients have ended with a reassuring message from me: Don’t lose heart! Everyone has to start somewhere!

Matthew Trujillo, CFP®, is a Certified Financial Planner™ at Center for Financial Planning, Inc. Matt currently assists Center planners and clients, and is a contributor to Money Centered.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of Matt Trujillo, CFP® and not necessarily those of Raymond James. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The Center Family has Grown

Contributed by: Nick Defenthaler, CFP®

After 9 long months of waiting, my wife Robin and I welcomed our son, Brek Lee Defenthaler into the world on Friday, July 31st! He really gave his mom a run for her money but she was a rock star and is a hero in my book after enduring almost 18 hours of labor. Everyone tells you that nothing can prepare you for the moment you meet your child for the first time, and it is so true. Seeing our son's face for the first time was an incredible memory that will remain vivid for our entire lives. Robin and I have been home enjoying our new addition for the past week and half and have truly enjoyed introducing Brek to our family and friends. We are beyond thankful and feel so blessed with everything God has given our family.

Nick Defenthaler, CFP® is a CERTIFIED FINANCIAL PLANNER™ at Center for Financial Planning, Inc. Nick is a member of The Center’s financial planning department and also works closely with Center clients. In addition, Nick is a frequent contributor to the firm’s blogs.

What You Need to Know about Stock Options

Contributed by: Nick Defenthaler, CFP®

As a professional, there are various ways you can be compensated for your work. Although not as prevalent as they once were, stock options still exist in many different companies and can often be negotiated into your overall compensation package. Stock options are intended to give you motivation and incentive to perform at a high level to help increase the company’s stock price which will, in turn, have a positive impact on the value of your own stock options. There are various forms of stock options and they can certainly be confusing and even intimidating. If you’ve ever been offered options, your initial thought might have been, “I know these things can be great, but I really don’t have a clue what they are or know what to do with them!” For starters, there are two common forms of stock options NSOs & RSUs.

NSO: Non-qualified Stock Options

Non-qualified stock options, or NSOs, have been around and very popular for decades. The mechanics, however, can be a bit tricky which is partly why you don’t see them quite as much as you used to. There are various components to NSOs, but to keep things simple, the company’s stock price must rise above a certain price before your options have value. Taxes are typically due on the difference between the market value of the stock upon “exercising” the stock option and what the stock price was when the option was “granted” to you. Upside potential for NSOs can be significant but there’s also a downside. The options could expire making the stock worthless if it does not rise above a certain price during the specified time frame.

RSU: Restricted Stock Units

Restricted Stock Units, or RSUs, have become increasingly popular over the past 5 – 10 years and are now being used in place of or in conjunction with NSOs because they are a little more black and white. Many feel that RSUs are far easier to manage and are a more “conservative” form of employee stock option compared to NSOs because the RSU will always have value, unless the underlying company stock goes to $0. As the employee, you do not have to decide when to “exercise” the option like you would with an NSO. When the RSUs “vest”, the value of the stock at that time is available to you (either in the form of cash or actual shares) and is then taxable. Because you do not truly have any control over the exercising of the RSU, it makes it easier and less stressful for you during the vesting period. However, because the RSUs vest when they vest, it does take away the opportunity to do the kind of pro-active planning available with NSOs.

Stock Options and Tax Planning

As you can see, stock options have some moving parts and can be tough to understand. There are many other factors that go into analyzing stock options for our clients and we typically also like to coordinate with other experts, like your CPA because tax planning also plays a large part in stock option planning. If stock options are a part of your compensation package, it is imperative to have a plan and make the most of them because they can be extremely lucrative, depending on company performance and pro-active planning. Please reach out if you ever have questions about your stock options – we work with many clients who own them and would be happy to help you as well!

Nick Defenthaler, CFP® is a CERTIFIED FINANCIAL PLANNER™ at Center for Financial Planning, Inc. Nick is a member of The Center’s financial planning department and also works closely with Center clients. In addition, Nick is a frequent contributor to the firm’s blogs.

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!

6 Ways to Get Healthy AND Spend Less

Contributed by: Gerri Harmer

If you could choose one of these items in retirement, which would you pick?

A vacation home

Shiny red convertible

Good health

A younger version of yourself would have probably gone for option 1 or 2. But many of us find when we get to retirement, our priorities change. Without good health, all the other choices are irrelevant if you can’t enjoy them. Many of us dream of living a very active lifestyle when we retire with some money in our pockets. Wouldn’t it be amazing if we could have all the options? Wouldn’t it be even more amazing if it only took adapting just a few new habits to improve our long-term health?

Here are 6 ways to lean into better health while spending less:

1. Start giving up that bad habit. Most things that are bad for your health are bad for your wallet. Smoking, junk food, fast food and pop can all be eliminated, adding money to your bottom line.

2. Go outside. Breathe the air and get fit by walking, gardening or bike riding. Better yet, head to the park to toss a Frisbee, join in on a sport, or hit a trail. No need to pay fees for gym memberships during the summer.

3. Buy local or grow your own. Farmers markets usually have a great variety of organic fruits and vegetables. You support your community and pay a fraction of the grocery store prices. Better yet, start your own garden and save even more.

4. Sleep 15 minutes more. Give your body a little more time to repair itself. Go to bed early or prep for your morning the night before so you can sleep an extra 15 minutes.

5. Drink water. Experts recommend drinking 8 glasses a day. Before you allow yourself even a drop of anything else, drink a glass of water first. You’ll be surprised how much energy you gain while flushing all the bad stuff. Water is one of the least expensive beverage options especially when it comes from your filtered fridge instead of a bottle.

6. Sit with nature. Reset your stress levels by simply listening to the birds, taking in the scenery or feeling the breeze on your face. It costs nothing and gives you peace and calm.

It might be difficult to change radically overnight, but leaning toward better habits may lead to a smoother, more permanent change in your health. And it doesn’t hurt that you’ll be saving money along the way!

How to Apply for Social Security Retirement Benefits

Contributed by: Matt Trujillo, CFP®

There are a few different ways you can apply for social security retirement benefits. The easiest and most time efficient is simply to set up an account at https://secure.ssa.gov/iClaim/rib and apply for benefits online. You can also apply over the phone by calling 800-772-1213 (or 800-325-0778 if you are hard of hearing).

Of course, you can always stop down to a social security office and apply in person. For some of the more advanced social security strategies like file and suspend and restricted application, you will have to stop into a branch as these options are not available online. You can find your local social security office by clicking this link.

If you are currently living outside of the United States you can apply for benefits by contacting the Office of International Operations. For more information visit their website here.

When to Apply for Social Security Benefits

It’s a good idea to apply for benefits a month or two earlier than you want your benefits to actually start. This is because social security benefits are paid the month after they are due. For instance, if you want your benefits to start in July, you will receive your first benefit check in August. If you want to receive your first benefit check in July, you need to be eligible for benefits in June and tell the SSA that you want your benefits to start in the month of June so that you will actually receive a check in July.

Social security can be a very confusing topic. It’s a great idea to consult with a qualified professional before applying for benefits as your decisions in this area can be permanent and irreversible.

Matthew Trujillo, CFP®, is a Certified Financial Planner™ at Center for Financial Planning, Inc. Matt currently assists Center planners and clients, and is a contributor to Money Centered.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of Matthew Trujillo, CFP® and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

3 Tips on Setting Up a Trust from the RJ Trust School

Contributed by: Matt Trujillo, CFP®

I recently had the opportunity to attend Raymond James Trust School in Cleveland, Ohio with about 30 other financial professionals. It was a great refresher, but I learned some new things as well. Below are three of my key take-aways from the RJ Trust School that may help guide you in making decisions about a trust.

3 Take-Aways from the RJ Trust School:

Sometimes to save money people will have a will drafted which calls for a trust to be set up at their death. This type of trust is called a “Testamentary Trust”. One of the issues with structuring your estate plan in this fashion is that with a Testamentary Trust the probate period will continue until the trust terminates which could be as much as 90 years in some states! This is a long time for creditors to submit claims against an estate, and something to keep in mind when you are considering having documents drafted.

Trusts aren’t just about avoiding estate taxes! There are many other reasons to have assets held in trust name. Here are a few that were mentioned at RJ Trust School:

If the beneficiary is a spendthrift and you are worried they might spend all the assets in a short period of time

If the beneficiary just doesn’t understand money well and will struggle with financial management

If the beneficiary doesn’t have time to manage additional financial matters

If the beneficiary has potential credit problems and if they inherited assets outright their creditors could seize the assets

If the beneficiary is in a bad marriage and inherit assets outright, a soon to be ex-spouse might have a claim

If the beneficiary has special needs it might be better to have inheritance held in trust so they don’t lose government funding

If you’re married, you should strongly consider filing form 706 electing portability at the death of the first spouse, even if you don’t have a taxable estate at that time. With the recent changes in estate tax law a lot of people think they automatically get their spouse’s estate tax exemption as well as their own. However, as the instructor at RJ Trust School pointed out, you only get both exemptions if you file the appropriate paperwork electing for “portability” at the first death. For example, if an estate didn’t have estate tax issues at the first death, but grew significantly after the date of death, it could now be subject to estate taxes. That’s a situation that could have been avoided by filing form 706.

If you are considering implementing some estate planning documents or amending the one you currently have in place, you should meet with a qualified estate planning attorney first!

Matthew Trujillo, CFP®, is a Certified Financial Planner™ at Center for Financial Planning, Inc. Matt currently assists Center planners and clients, and is a contributor to Money Centered.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of Matthew Trujillo and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. You should discuss any tax or legal matters with the appropriate professional.

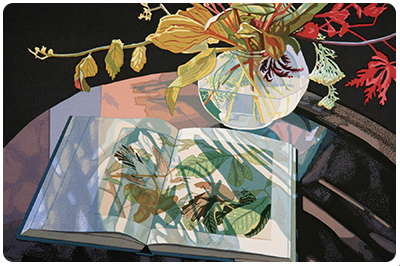

Live Your Plan: 35 Years of Printmaking

Contributed by: Timothy Wyman, CFP®, JD

There’s nothing more satisfying than seeing a client turn a dream into reality. To me, that’s what financial planning is all about. My clients Norm and Susan Stewart are a shining example. They turned creative talents into a successful 35-year printmaking business in Bloomfield Hills. At Stewart & Stewart, Norm is the Master printer and partner Susan is the graphic designer. If you have ever driven down Wing Lake Road between Maple & Quarton, you may have seen their workshop. Their collection resides not only in Michigan, but all across America and Europe. And now they’ve been featured in the Journal of the Print World. I’m proud to serve folks like the Stewarts each day. On behalf of everyone at The Center – Congrats!

For another inspirational story of clients living their plans, check out this blog about two more of my clients who authored “A Poetic Life”. Their insight on living each day to the fullest could have you thinking about intentional living.

Timothy Wyman, CFP®, JD is the Managing Partner and Financial Planner at Center for Financial Planning, Inc. and is a contributor to national media and publications such as Forbes and The Wall Street Journal and has appeared on Good Morning America Weekend Edition and WDIV Channel 4. A leader in his profession, Tim served on the National Board of Directors for the 28,000 member Financial Planning Association™ (FPA®), mentored many CFP® practitioners and is a frequent speaker to organizations and businesses on various financial planning topics.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Raymond James is not affiliated with Stewart & Stewart.

Beyond Retirement: An End of Life Planning Lesson

Contributed by: Sandra Adams, CFP®

As we work with clients at The Center, we talk about how to “live your plan.” To us, that means focusing and achieving your financial goals so that you can you can live those goals that you have been envisioning within your planning. To be honest, this phrase often arises in the context of conversations about living out dream retirement wishes, like traveling the world, writing that book you always dreamed of writing, or owning a second home on the beach – not in the context of end of life planning.

I recently witnessed a client “live” her end of life plan. While you might not think this to be a very significant or exciting accomplishment, it brings me to tears and smiles (all at the same time) every time I think of it.

Communicating Your Wishes

“Ann” was in her early 90’s and quite a strong character. Although she suffered from a chronic disease, she was relatively active early on in our planning. She needed to update her estate planning because she had outlived all of her blood relatives and needed to put plans in place for when she knew she might not be able to handle her own affairs. What she did know was that she would NEVER want to go to a nursing home – she wanted to be cared for her in her own home and we needed to find to a way to make that happen. Ann put her wishes in writing and communicated those wishes to everyone involved along the way.

Outlining Your Plan

Over the next several years, Ann’s health worsened and she needed to hire a geriatric care manager and caregivers. Toward the end, there were caregivers at her home nearly 24 hours a day with some Hospice care provided. With careful planning, Ann was able to support this with her financial resources. I do not tell you that this was easy. There were many times over the years when Ann became anxious, claimed she was living too long, and wasn’t sure what to do. But she was never willing to compromise on moving from her home. Ann had specifically outlined how she wanted to live (and how she didn’t want to live – in a nursing home). On one of her last days, Ann said, “I am happy.” To me, this confirmed that she had carried out her plan for her end of life to her satisfaction. These are the types of situations that I help my clients with often.

End of Life Reading

Being Mortal by Atul Gawande is a book that I read recently on end of life issues. It brings to light that most of us do a very poor job of planning for or thinking about our end of life, and we certainly don’t communicate our wishes to our families. We do a lot to plan for our ideal lives, our ideal retirements, so why not end our lives right? By taking the next steps and planning for the end of our lives, as well, we can make this happen (even though it is not always the most pleasant topic to discuss). My favorite takeaway from the book is this:

“All we ask is to be allowed to remain the writers of our own story. That story is ever changing. Over the course of our lives, we may encounter unimaginable difficulties. Our concerns and desires may shift. But whatever happens, we want to retain the freedom to shape our lives in ways consistent with our character and loyalties.” -Atul Gawande

Sandra Adams, CFP® is a Partner and Financial Planner at Center for Financial Planning, Inc. Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In 2012-2014 Sandy has been named to the Five Star Wealth Managers list in Detroit Hour magazine. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of Sandra D. Adams, CFP®, and not necessarily those of Raymond James. Raymond James is not affiliated with and does not endorse the opinions of Atul Gawande. You should discuss any legal matters with the appropriate professional. The experience described here may not be representative of any future experience of our clients. Past performance is not indicative of future results.