With the bond bear potentially rearing its’ ugly head, it is important to understand what a bond bear market looks like to properly prepare a portfolio for it.

With the bond bear potentially rearing its’ ugly head, it is important to understand what a bond bear market looks like to properly prepare a portfolio for it.

Only one in five investors know how interest rates affect bond prices

In a 2009 study on financial capability, only 21% of respondents knew that prices on existing bonds generally go down when interest rates go up (National Financial Capability Study, 2009 National Survey, Financial Industry Regulatory Authority). Prices and rates typically move inversely because older bonds with lower rates are less attractive to buyers than newly issued bonds that offer higher rates.

If bond prices have been at all-time lows this stands to reason that bond prices have a long way to fall and indeed they began this fall earlier this year.

When rates go up, prices go down

Take a look at the examples below, illustrating the effect of rising rates on a 5‑year US Treasury bond.

Source: MFS

Source: MFS

This is a hypothetical example that represents the effect a rise in the interest rate of a new issue bond may have on the price of existing bond issues. Although bond prices and interest rates typically move inversely, a change in interest rates is only one factor determining the price of a bond security.

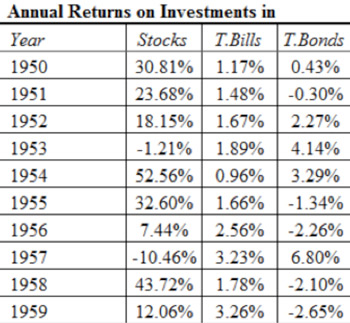

However, what bond bear markets lack in depth, they make up for in length. In Part 1 I suggested we are in a time similar to the early 1950’s when rates bottomed out at similar levels to where we are today. Below is a table of returns for the 10 years following rates bottoming taken from the Federal Reserve database in St. Louis.

*Stock represented by the S&P 500, Treasury bill rate is a 3-month rate and the Treasury bond is the constant maturity 10-year bond, but the Treasury bond return includes coupon and price appreciation

Rising rates historically means rising income and total returns. If rates rise slowly, interest has a chance to outweigh loss of principal over time as you can see in the chart above. Devastating returns are not seen on the bond side of the ledger, but rather slow returns that tend not to keep up with long term inflation rates.

Diversification rather than Doomsday

While we are not at doom’s doorstep, diversification is certainly the key, as it always is. Most likely, not all areas of the bond market will suffer at all times over the coming years. Investors must be careful of certain investments with characteristics similar to that of bonds (i.e. “bond proxies”) though. Investing in something like dividend paying stocks in place of your bonds could add a lot of potential risk to the portfolio. These types of positions will not support a portfolio in times of a stock market correction like bonds generally do. It is important now more than ever to work with your financial planner to make sure you have a well-diversified portfolio and are making decisions with your overall financial goals in mind.

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

Diversification does not ensure a profit or guarantee against a loss. The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any investment referred to herein. Investments mentioned may not be suitable for all investors. Investing involves risk and investors may incur a profit or a loss. Dividends are not guaranteed and must be authorized by the company’s board of directors. Past performance is not a guarantee of future results.