Fall is a wonderful time in Michigan. The leaves are turning, the Tigers gave us some playoff excitement and football season is in full swing. Economists and money managers must agree as many have been visiting the state giving us the opportunity to sit down with various experts over the past couple of weeks here at the Center. One theme kept coming up while I was listening to a couple of these individuals and it was a welcome distraction from the typical debt ceiling/government shutdown conversations…the secular bull market.

Fall is a wonderful time in Michigan. The leaves are turning, the Tigers gave us some playoff excitement and football season is in full swing. Economists and money managers must agree as many have been visiting the state giving us the opportunity to sit down with various experts over the past couple of weeks here at the Center. One theme kept coming up while I was listening to a couple of these individuals and it was a welcome distraction from the typical debt ceiling/government shutdown conversations…the secular bull market.

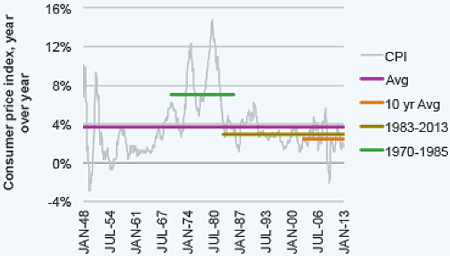

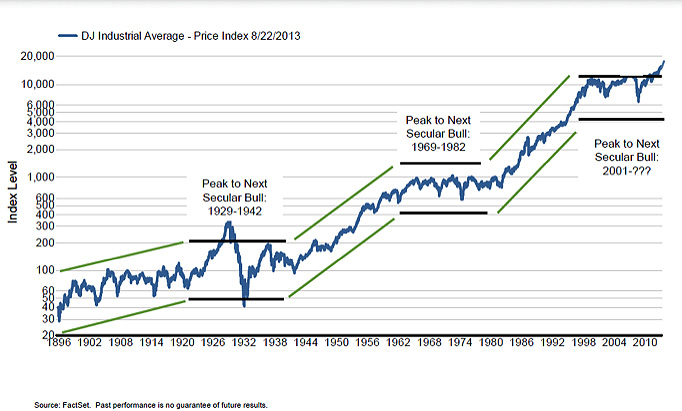

The chart below shows the long-term secular trends for the Dow Jones over the past 100 or so years. You can see that the markets go through long periods of stagnation, in essence going nowhere fast; followed by periods of steady increases. These periods of stedily rising markets (indicated below in green) are referred to as secular bull markets. You can see that this year the Dow has finally broken out of the sideways trading range of the past 12 years.

The U.S. equity markets have been in a positive trend for four years now, yet one expert stated this is the least trusted, least believed bull market he has ever witnessed. Most investors erroneously believe that the environment has to feel good before it is the right time to invest. Unfortunately, once it feels good to invest it is usually the wrong time, think buying technology stocks in 1999.

Whether or not we are in a secular bull market remains to be seen, but once we can say for certain that we are it is usually too late. Having a financial plan and staying disciplined with your investments, I think, is the most important key to successfully meeting your goals.

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

The information contained in this report does not purport to be a complete dexcription of the securities, markets, or developments referred to in this material. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance may not be indicative of future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one’s entire investment.