Contributed by: Jaclyn Jackson

Contributed by: Jaclyn Jackson

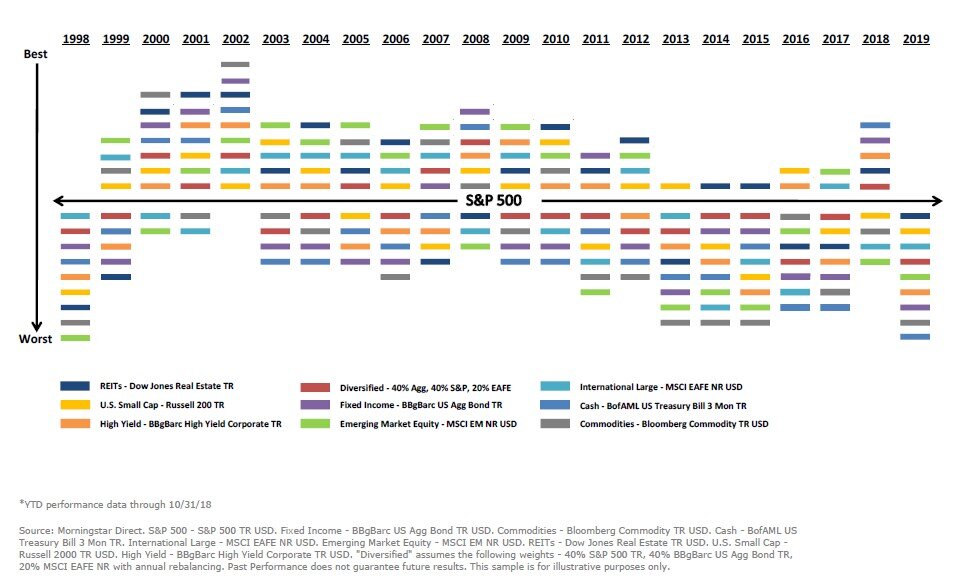

Let’s face it, the S&P 500 has consistently beat diversified portfolios since 2009. Demonstrated below, a diversified portfolio of bonds, domestic stocks, and international stocks (crimson bar) was edged out by the S&P 500 nine of the last ten years. With the S&P’s winning streak, why would investors consider putting money to work anywhere else but US equities?

What The Fund?

For decades, investment professionals have preached the merits of portfolio diversification and asset allocation, but lately, performance hasn’t supported their conviction. So why are investment professionals adamant about diversification? It began in 1952 when Harry Markowitz (a graduate student who became a

Nobel Prize winning economist) published an article in the Journal of Finance where he outlined the premise of his popularized Modern Portfolio Theory. Essentially, the theory highlights the relationship between risk and reward for different types of investments. It then mathematically assesses investors’ ability to take on risks with performance expectations to create an optimal portfolio. In other words, Markowitz laid the groundwork to help investors discover the right combination of investment products to achieve a certain level of performance without taking unnecessary risks.

A Case for Portfolio Diversification

If you were looking to maximize portfolio growth over the last decade, you could have easily been tempted to scrap diversification in favor of the S&P 500. Yet, there is evidence that Markowitz’s theory is still relevant for today’s investors. Craig L. Israelsen, PhD and Executive-in-Residence in the Personal Financial Planning Program at Utah Valley University, did compelling research around portfolio diversification worth reviewing. He compared five portfolios that represent different risks levels and asset allocations over 50-years, from 1970-2019. While there is much to glean from his research, I’d like to zoom in on his comparison of two moderately aggressive portfolios because it shows the value of portfolio diversification.

The first Moderately Aggressive Portfolio has a traditional 60% US Stock, 40% Bond asset allocation. The second Moderately Aggressive Portfolio has a 14.3% allocation to seven different asset classes. In 2019, a year dominated by the S&P 500, the first portfolio (having a larger composition of the S&P 500) predictably outperformed the second portfolio. On the other hand, over the 50-year period the second portfolio had similar annualized gross return with a lower standard deviation. An investor in the second, 7-Asset Diversified Portfolio, had similar returns without taking as much risk as an investor in the first portfolio.

There is another point worth spotlighting here. Imagine if you only invested in the S&P 500, as represented by the Very Aggressive 100% US Stock portfolio, over that 50-year period. Compared with the 7-Asset Diversified Portfolio, the 100% US Stock portfolio had a 7% greater standard deviation for just under a percent greater return. The diversified portfolio would have given you most of the return for half the headache.

Complex Portfolios for Complex Living

Investors don’t invest in a bubble or just for kicks. In reality, investors use portfolios to serve needs and meet financial goals. Digging deeper into Israelsen’s research, he explores a real-life need and a common portfolio use: supplementing retirement. His research evaluates a $250,000 initial investment for each portfolio over 26 rolling 25-year periods from 1970-2019 and assumes a 5% initial end-of-year withdrawal with 3% annual cost of living adjustment taken at the end of each year.

Again, looking at the two Moderately Aggressive Portfolios, the 60% US Stock, 40% Bond Portfolio had a median ending balance of $1,234,749 after 25 years compared to the 7-Asset Diversified Portfolio median ending balance of $1,806,565. Likewise, if someone had aggressively invested in US Stock over that time, (s)he would still end up with less money than the diversified portfolio at $1,500.554. This best illustrates why Modern Portfolio Theory (limiting risk through diversification) still matters. Retirees want to avoid choppy investment experiences as they pull money from their accounts and create even returns through diversification that extend the longevity of their portfolios.

Pulling it all together, life is complex and investors use their investment portfolios to manage those complexities. Investor needs and financial goals punctuate the necessity of investing in ways that diminish excessive risk-taking and extend the life of portfolios. Everything considered, risks mitigation through portfolio diversification stands true today, even for investors who’ve witnessed an S&P 500 tear over the last decade.

Jaclyn Jackson is a Portfolio Administrator at Center for Financial Planning, Inc.® She manages client portfolios and performs investment research.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author, and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Standard deviation measures the fluctuation of returns around the arithmetic average return of investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns.

Performance of hypothetical investments do not reflect transaction costs, taxes, or returns that any investor actually attained and may not reflect the true costs, including management fees, of an actual portfolio. Changes in any assumption may have a material impact on the hypothetical returns presented. Illustrations does not include fees and expenses which would reduce returns.