Dear clients and friends,

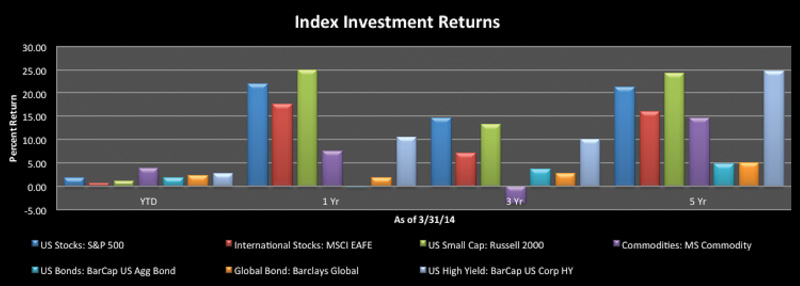

We’re four months into 2014 and so far there is not much to show for when it comes to year-to-date investment returns. Markets have treaded water in 2014 so far. Looking further out to the last 12 months, 3 years or 5 years and most investors in stocks or a diversified portfolio of stocks and bonds have been rewarded for their commitment to investing.

I mention this as we have just passed the five year anniversary of market lows in March 2009. I think it’s a healthy exercise to remember today your state of mind five years ago as an investor. Did you feel it was appropriate to put your faith in investment markets at the time? How do you contrast the stress that you may have felt along with most investors to the feelings related to quite positive stock market returns over the last several years?

The past few weeks marked another milestone as you likely filed taxes. High earners saw the bill from new taxes and rates. While tax burdens have become larger for many, the opportunities to manage taxes are coming to the forefront in the wealth management field. Strategies including asset location, cost basis election, and tax-loss harvesting are employed where appropriate.

If you’re a client of The Center, make sure you send a copy of your 2013 tax return. Information from this is used to evaluate your current tax circumstances and helps us to make more informed decisions on your investments and general financial planning strategies both on a before and after-tax basis.

We’ve done some sprucing up on our investment commentary website. Here are some things to look for this quarter:

-

A tactical asset allocation dashboard is available with our investment committee’s latest weightings. Today we have bonds slightly underweight due to the low interest rate environment and stocks slightly overweight. We’re concerned about valuations for small company stocks in the US and have underweighted these positions. We are finding international equities more attractive due to valuations and have increased our allocations from underweight to neutral in the last six months.

-

We have launched a quarterly investment pulse which gives you some insight to research and conversations with other investment professionals. Angie Palacios’ first edition of this update highlights our thoughts on municipal bonds, stock market valuations, and a manager departure at PIMCO.

-

Investment returns as of the end of the first quarter are available along with Raymond James capital markets review summarizing current economic and investment data.

Whether markets are recently up or down, your commitment to a diligent investment process and focus on overall financial goals is to be commended. Please don’t hesitate to let us know if you have any questions regarding general investment strategies as well as your specific portfolio. Thanks as always for your trust and commitment to the financial planning process.

On behalf of everyone at The Center,

Melissa Joy, CFP®

Partner, Director of Investments

CERTIFIED FINANCIAL PLANNER™

Melissa Joy, CFP®is Partner and Director of Investments at Center for Financial Planning, Inc. In 2013, Melissa was honored by Financial Advisor magazine in the Research All Star List for the third consecutive year. In addition to her contributions to Money Centered blogs, she writes investment updates at The Center and is regularly quoted in national media publications including The Chicago Tribune, Investment News, and Morningstar Advisor.

Financial Advisor magazine's inaugural Research All Star List is based on job function of the person evaluated, fund selections and evaluation process used, study of rejected fund examples, and evaluation of challenges faced in the job and actions taken to overcome those challenges. Evaluations are independently conducted by Financial Advisor Magazine.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Melissa Joy and not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. You should discuss any tax or legal matters with the appropriate professional. Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected.