One of the Center’s Core investment beliefs is in “Market Cycles and Risk”. Before I explain our approach, I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of but I do know this: Nothing goes in one direction forever. Trees don’t grow to the sky. And there are few things as dangerous for investor health as insistence on extrapolating today’s events in the future.

One of the Center’s Core investment beliefs is in “Market Cycles and Risk”. Before I explain our approach, I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of but I do know this: Nothing goes in one direction forever. Trees don’t grow to the sky. And there are few things as dangerous for investor health as insistence on extrapolating today’s events in the future.

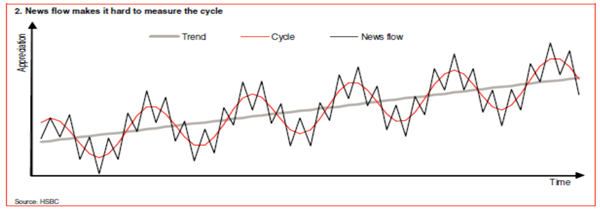

(Above is a sample chart of cycles with a discernible trend over time)

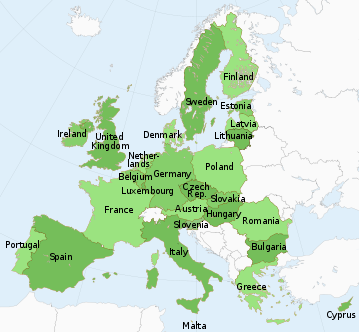

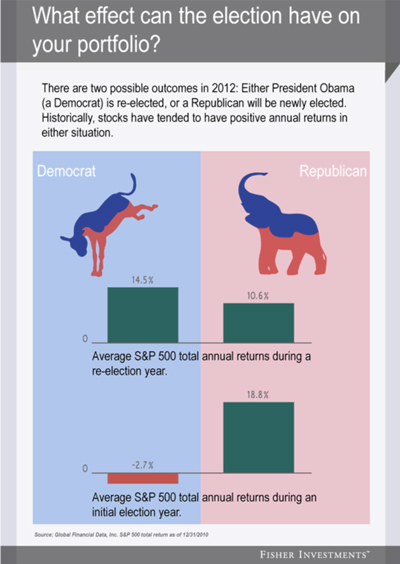

Our lives are full of different types of cycles. There are those that occur naturally, like the cycle of life and those cycles that are biologically driven. There are also manmade cycles like the presidential cycle and the workweek cycle. Ever wonder where we are in the current economic cycle or market cycle? Economic and market cycles are not quite as spherical, but they have different seasons and they do typically rotate in a circular fashion over time.

Below is a graph of the market cycle. The Pink/Purple is the fall at the top is fall, the Red is winter and the capitulation and bottoming process, Green represents the spring a thawing out of a new bull market, and Blue is the summer representing the bull market. Luckily, in the seasons of the market, summer is usually 2-3 times longer than winter, same with contraction and expansionary periods in the economy.

Very few people can consistently pick bottoms of markets within months and even fewer can pick market tops with any accuracy. Some of the best investment strategists make predictions that are years off the mark. But understanding the season is something that we try to do at the Center. In our approach, we attempt to manage the exposure to equities during the late fall and early winter as some inevitable downturns can get very difficult for investors. However, we also attempt to get back to normal allocations in the late winter and early spring. We call this rebalancing and tactical asset allocation of a portfolio. Adding to underweighted asset classes can be emotionally difficult for most investors to do during the winter and spring season when it seems like things in the world are falling apart.

Most people would guess that we are currently in the summer or fall of the current economic cycle. That’s when investors are comfortable, more at ease with a sense of relief and even optimism and excitement can prevail. However, this cycle will end and again we will find ourselves with a different season where markets are uncomfortable and statements are not as cheery. Another winter will be looking us in the face again. Try to remember what was going on both internally (your stomach) and externally (the newspaper, fundamentals and technical indicators) in the last trough and it can help with the next one. Because it’s in the winter that opportunity exists, you just have to remember it doesn’t always feel like opportunity.

The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning and not necessarily those of RJFS or Raymond James. Investing involves risk and investors may incur a profit or a loss. Past performance may not be indicative of future results.