Have you ever had one of those dreams where you were just about ready to fall off a cliff … and thankfully you woke up just before looking like Wile E. Coyote? Known as “The Coyote” to many who grew up watching “The Road Runner” and “Looney Tunes”, Wile E. Coyote fell off more than his share of cliffs in many an episode.

Have you ever had one of those dreams where you were just about ready to fall off a cliff … and thankfully you woke up just before looking like Wile E. Coyote? Known as “The Coyote” to many who grew up watching “The Road Runner” and “Looney Tunes”, Wile E. Coyote fell off more than his share of cliffs in many an episode.

Hopefully U.S. taxpayers will not end up like The Coyote as our nation faces a “fiscal cliff”. While Chuck Jones created Wile E. Coyote, we have Ben Bernanke, Federal Reserve Chairman, credited with introducing the fiscal cliff metaphor.

The fiscal cliff essentially stands for the possible economic challenges coming should Congress fail to act on some important measures, most notably:

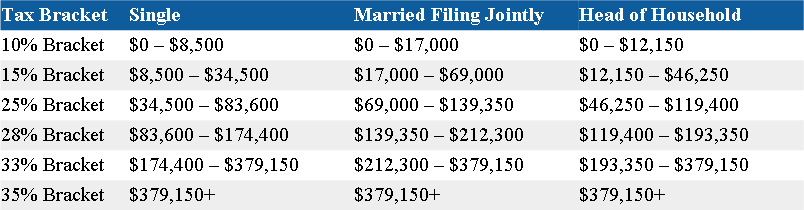

- The expiration of the Bush Tax Cuts

- The expiration of the 2% reduction in payroll taxes

- Scheduled (forced) federal government spending cuts

Add ‘em up and in the profound words of The Road Runner … beep beep. Congress must act or the above measures are set to become law. If Congress doesn’t address the fiscal cliff successfully, economic growth as measured by gross domestic product in 2013 will be muted at best and contracted at worst.

Without taking a political position or laying blame, Congress has unfortunately shown an inability to ACT in the past. Consider this your warning sign: Fiscal cliff ahead! You can keep running like The Coyote, or you can stop and pay attention to the sign. Proper advanced planning is critical in achieving your most important financial and life goals. If you would like more information, email me and request a copy of our “Financial Planning in an Uncertain Tax Landscape” white paper from our partner Raymond James. If you would like to schedule a time to discuss your specific planning needs, feel free to call or email to schedule a meeting.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.