![]() Contributed by: Angela Palacios, CFP®, AIF®

Contributed by: Angela Palacios, CFP®, AIF®

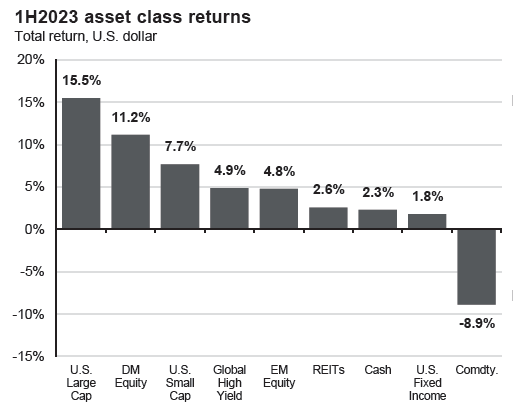

While Federal Reserve (the Fed) policy, macroeconomic headlines such as inflation, and geopolitical uncertainty are themes investors continue to hear about, U.S. large cap stocks finished the first half of 2023 up 15.5%. It is important to look under the hood of these returns as they have been entirely driven by the market's largest stocks, with the top 10 companies in the S&P 500 accounting for over 95% of gains. Beyond the largest companies, performance fell off quickly. Developed markets equity (International) has had notable returns year to date ending over 11% in positive territory for the year so far. While their returns struggled to eclipse the top 10 companies in the S&P 500, international investments handily outpaced the balance of the companies in the S&P 500. Commodities struggled the most as economies and production started to slow, and inflation is coming down (even though it is still elevated higher than we would like to see).

Much of the quarter was dominated by the banking sector headlines that cropped up at the end of the first quarter and debt ceiling negotiations in Washington. Two larger regional bank failures put the markets on edge, waiting for contagion to kick off this quarter. However, the backstop provided by the government and FDIC quickly seemed to curb potential contagion. Then all attention turned toward Washington dragging its feet over raising the debt ceiling, which led to intra-quarter volatility. As the U.S. government approached the date it was expected to run out of money to pay its bills, a deal was reached on June 1st to suspend the debt ceiling through January 2025 while cutting federal spending. As we mentioned in our previous commentary, this is the outcome that would likely occur as history has served as a guide for this. This agreement averted a U.S. government default ahead of the deadline.

The strong equity returns in the year's first half may have taken many by surprise. The question is, where do we go from here? Summer tends to be a time of weakness for markets, and a strong first half of the year could cause buyers to pause. It's not uncommon to see the market stop and gather itself and digest strong gains after they occur.

Higher interest rates

We have witnessed a large amount of excitement surrounding higher interest rates in CDs, money markets, and short-term treasuries. While this is great for money, we need to keep liquid for a shorter-term need or a place to park cash while implementing a dollar-cost averaging strategy; it is important to not give up on investing in a diversified portfolio. When rates were attractive in the early 2000s, it may have been tempting to divert some of your equity investments into cash equivalents rather than invest in the S&P 500 during a recession and continue with this throughout the years. But the opportunity cost is high. The chart below shows how investing $12,000 per year into equities, whether perfectly timed or the most poorly timed, outweighs diverting excess additions beyond need into cash equivalents. Even the worst timing over the years ended up well ahead of cash equivalents.

So, what has happened in the shorter term after times when CD rates peaked and seemed their most attractive? The chart below shows 12-month forward returns for different asset classes after rates peaked. While they may offer the added protection of FDIC insurance, notice that the 6-month CDs never returned more than the peak rate. This makes sense, as you are locking in a rate. The dark blue is the U.S. bond index, the light blue is high-yield bonds, and the green is the S&P 500. As you can see, the other asset classes returned far more than the CD rates 12 months after rates peaked in most of the periods shown below.

Again this reiterates the point not to allocate more than is appropriate for you into short-term fixed strategies.

Check out the video for an economic update!

This summer, all eyes will be on the next Fed decision when the FOMC meets at the end of July. In June, the Fed decided to pause and let the economy digest the drastic rate increases of 2022 and earlier this year. They did signal that we could likely see up to two more rate hikes this summer/fall. The U.S. economy still looks strong, so the FED feels they have room to continue to increase interest rates, even though at a much slower pace to get inflation under control. GDP growth worldwide continues to hold up, signaling we aren't in a recession yet (see the chart below). The Fed will continue to remain very data-dependent when determining their next steps, but the risk is rising that they will overtighten and push the economy into recession.

While the taxable bond yield curve remains strongly inverted, the Municipal bond yield curve is less inverted. This means that investors are better compensated for moving out longer in duration. For those in a higher tax bracket, municipal bonds can provide attractive taxable equivalent yields.

Continue to expect some volatility through the summer as markets digest hefty first-half returns, and we learn more regarding future interest rate action. A sound financial plan and regular rebalancing, when needed, help bring a portfolio through uncertain times. We are here to answer any questions you might have! Do not hesitate to reach out! Thank you for the trust you place in us each and every day!

Angela Palacios, CFP®, AIF®, is a partner and Director of Investments at Center for Financial Planning, Inc.® She chairs The Center Investment Committee and pens a quarterly Investment Commentary.

Any opinions are those of the Angela Palacios, CFP®, AIF® and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance is not a guarantee or a predictor of future results. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.