![]() Contributed by: Angela Palacios, CFP®, AIF®

Contributed by: Angela Palacios, CFP®, AIF®

Contributed by: Nicholas Boguth, CFA®, CFP®

Contributed by: Nicholas Boguth, CFA®, CFP®

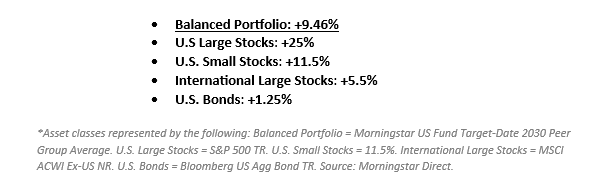

As we close out 2025, global markets have successfully navigated a year of disruption. Tariffs, AI, and a weaker US dollar have influenced investment outcomes. Inflation continued to trend closer to the Federal Reserve target, while bonds quietly rallied as interest rates were cut. Equity markets reflected this pivot, with leadership broadening beyond mega-cap technology as cyclical sectors regained footing amid improving global demand.

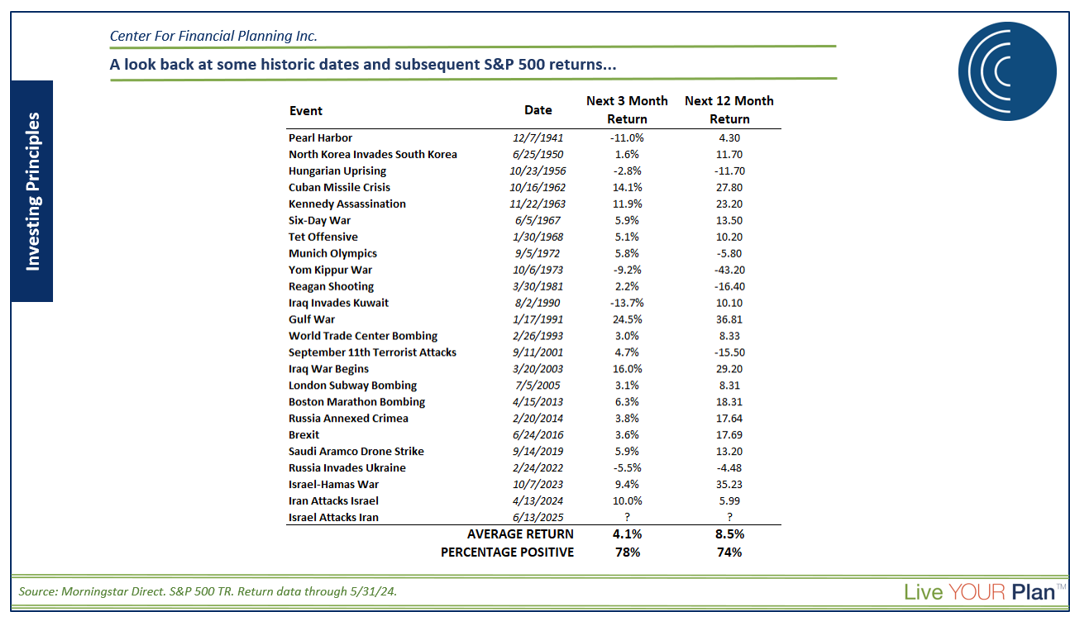

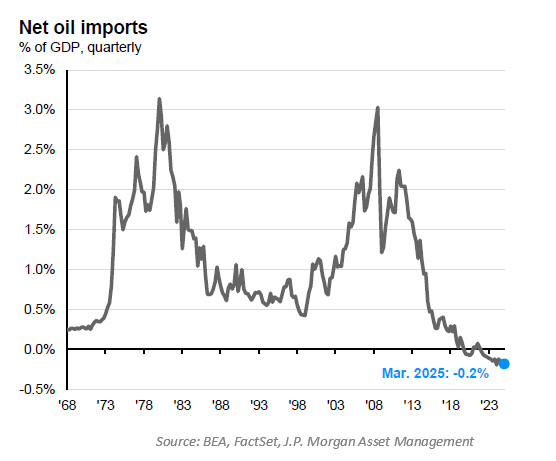

Investor sentiment seemed to fluctuate between optimism and caution over structural headwinds—from persistent fiscal deficits to geopolitical uncertainties. Geopolitics have been in the forefront of headlines to start out the new year with the capture of Nicolas Maduro and his wife. Check out this whitepaper for more information on what that could mean for oil markets. While cryptocurrencies fell out of favor, precious metals have regained the spotlight as governments view these as critical resources. As we look ahead, we are cautiously optimistic for a market environment that could prize discipline and adaptability. The S&P 500 ended the year up almost 18% even after it was down almost 20% back in April, while international markets represented by the MSCI ACWI Ex-US rallied even more up over 32%, and lastly bonds were up over 7%. For an idea of where that left diversified portfolios, Morningstar’s “Moderate Allocation” category had an average return of 12.5%.

Interest Rates, Inflation, and Unemployment

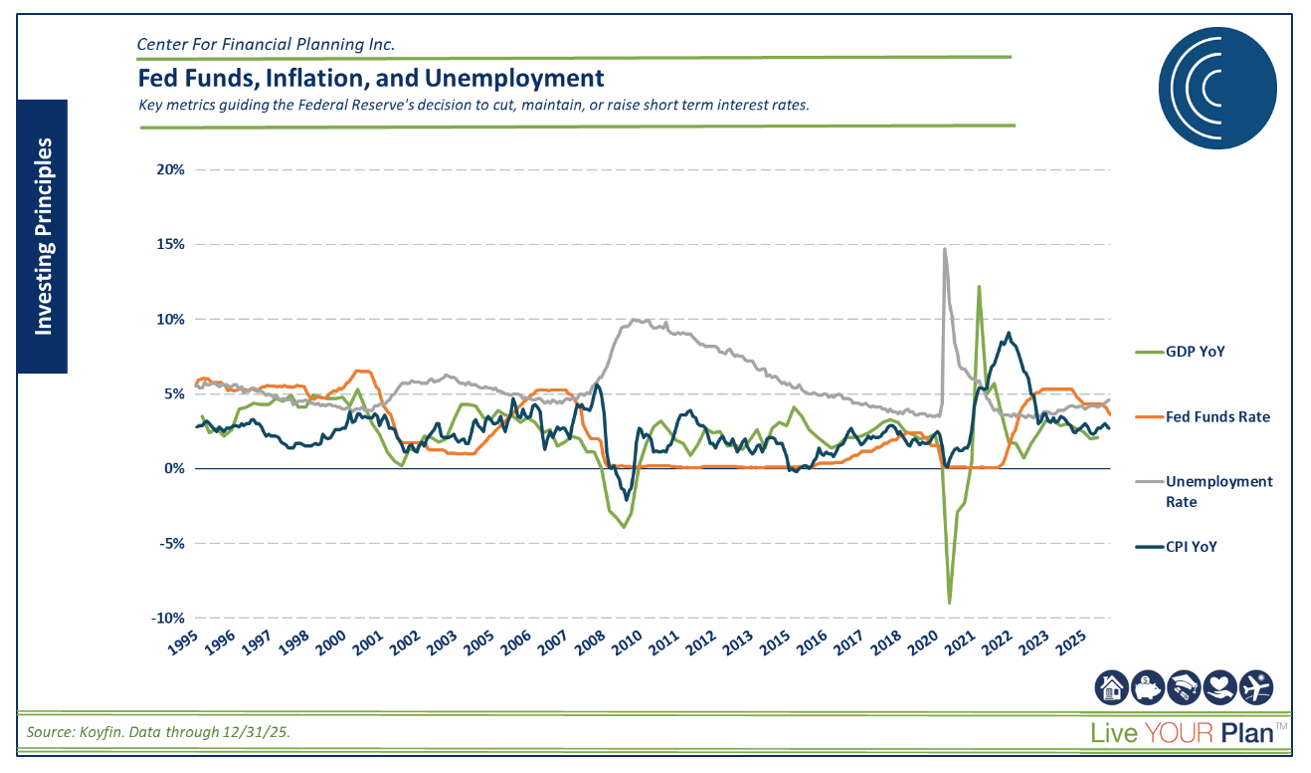

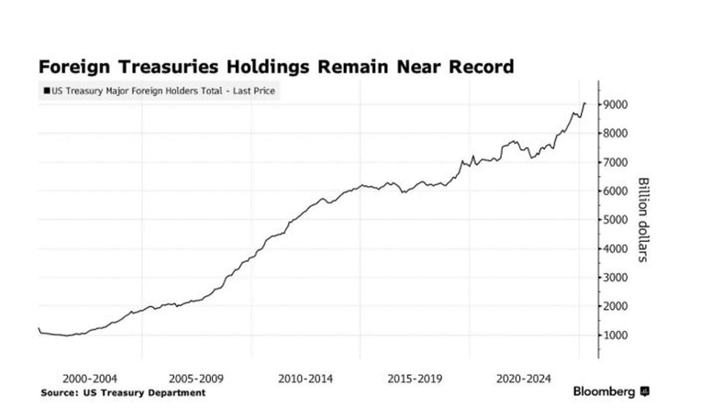

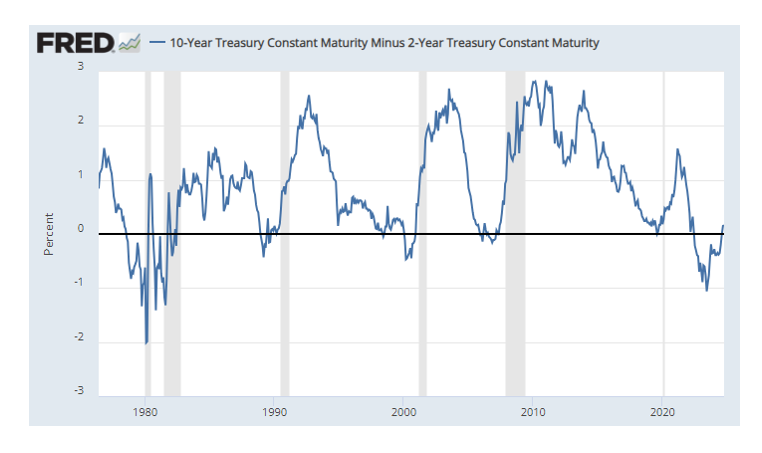

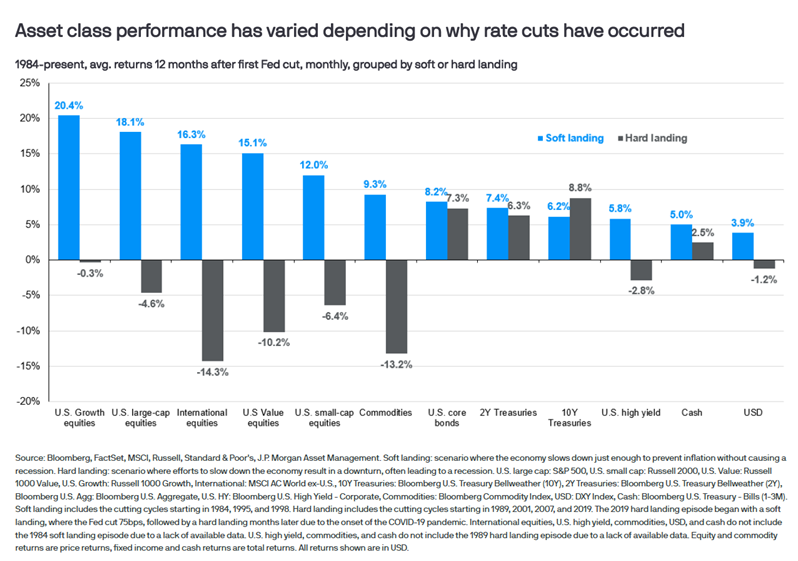

The Federal Reserve’s (the Fed) policy stance in 2025 marked a shift back to a more accommodative approach. After holding rates steady through the summer to ensure inflation was firmly trending toward its 2% target as tariffs were introduced, the Fed initiated a series of measured cuts late in the year as economic data allowed. These reductions, totaling 75 basis points, were framed by Fed chair, Jerome Powell, as a normalization rather than an emergency response, aiming to support moderating growth without reigniting inflation pressures. The Fed emphasized its data-dependent posture, leaving room for flexibility should labor markets or inflation dynamics deviate from expectations.

So what “data” is the Fed watching? Inflation and unemployment are the two main factors they focus on. Core Consumer Price Index (CPI) is the Fed’s preferred gauge of inflation. As of late December, inflation was sitting around 2.6%. The Fed would like to see it continue to trend down toward 2%, but they seem content with numbers coming in below 3%. On the other hand, unemployment is currently sitting at 4.6% in December, and this number has trended up from near 4% earlier this year. When the Fed cuts interest rates, it risks spurring inflation, but it also helps keep unemployment low or lower. While they don’t seem too concerned about unemployment levels, the two levels trending in the direction they have this year seem to be giving the Fed reason to cut.

Despite rate cuts, some outstanding opportunities have flown under the radar of many. Municipal bonds! For high-tax bracket investors, municipal bonds that pay high-quality income allowed them to lock in very attractive taxable-equivalent yields throughout 2025. Even though short term interest rates were pushed lower by cuts from the Federal Reserve, longer-dated municipal bonds actually saw interest rates increase due to higher than normal issuance, tax uncertainty under a new President, and investor outflows! This area could be poised for a nice rebound.

Importance of Small Businesses

Small businesses are the backbone of our economy here in the U.S. The unemployment situation is largely influenced by whether small businesses (which make up 44% of our Gross Domestic Product (GDP) here in the U.S.) are hiring or pulling back. Small business bankruptcies are one way to monitor their health. In 2025, we saw small business bankruptcies up over 8% from the prior year and rising faster than those of larger businesses. Small-company stocks, as represented by the Russell 2000, are worth watching, as they tend to be the “canary in the coal mine” if a recession is around the corner. While small businesses that aren’t publicly traded might be experiencing difficulty, the Russell 2000 has rallied strongly this year.

A.I. and Tech Outperformance

We can’t have a commentary without including one of the hottest topics of the year – Artificial Intelligence! Companies are making eye-popping investments into developing technology, building infrastructure, and figuring out how to implement this fast-growing technology into their businesses. Only time will tell if those investments turn out to be profitable or not, but the market is clearly excited about the prospects as it has rewarded most of those A.I. related companies with higher stock prices. The tech sector slightly lagged in Q4, but it led the way as the top-performing sector in 2025.

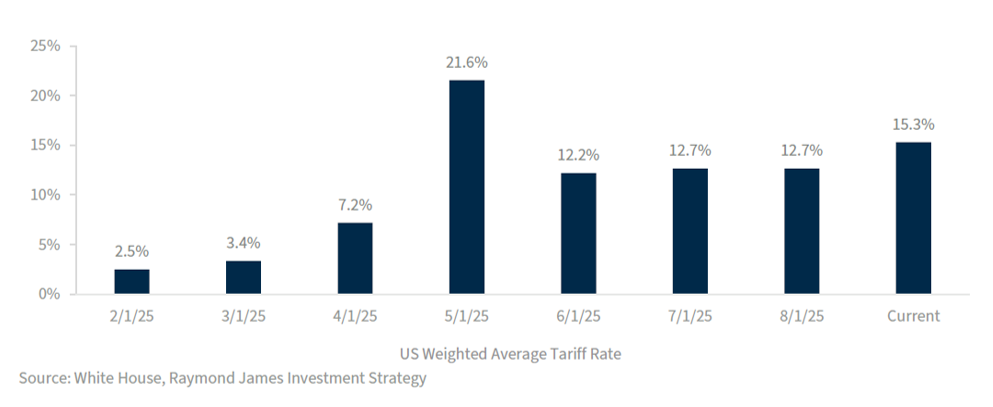

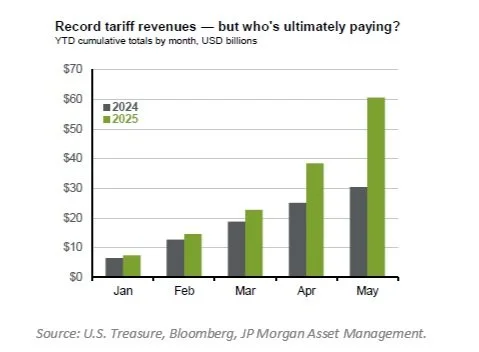

International Outperformance and Tariffs

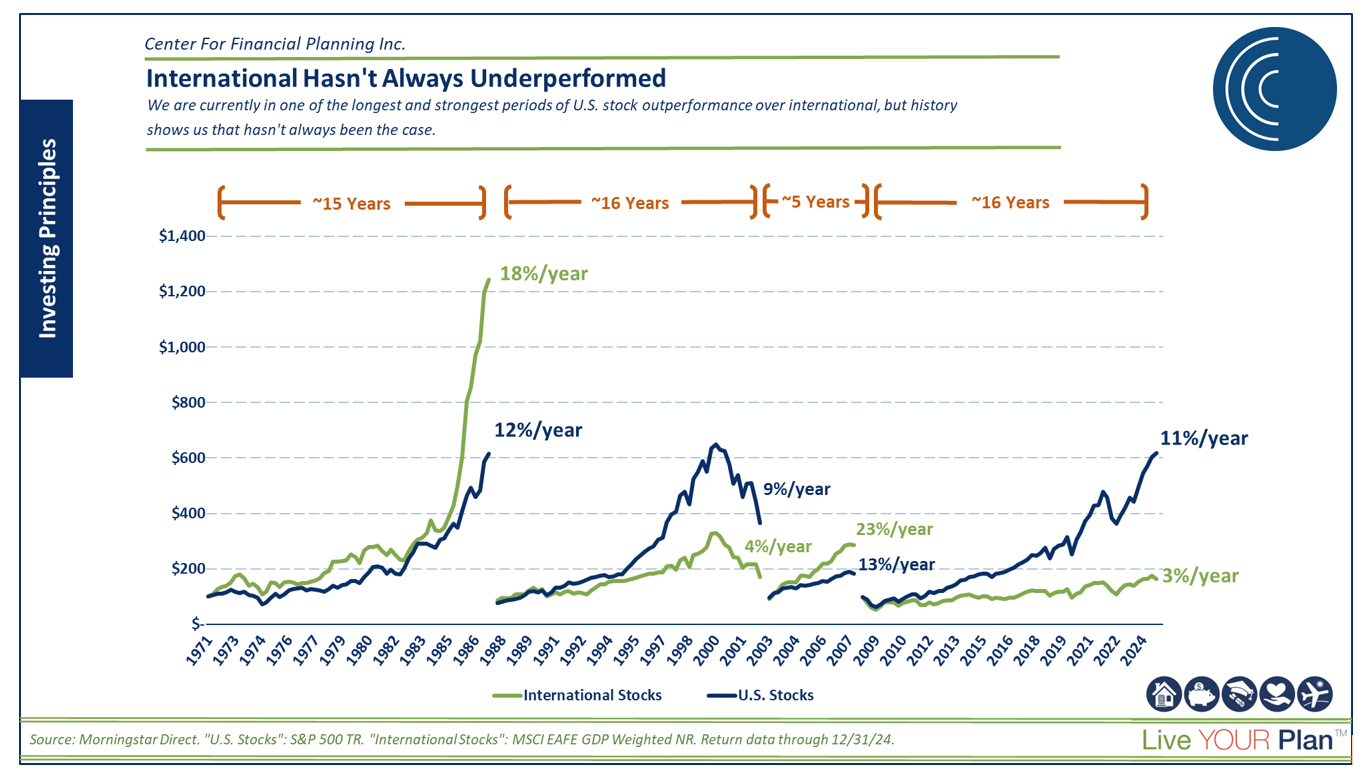

Speaking of outperformance – were you invested in international equities this year? It has been a rough past decade for international stocks compared to their U.S. large counterparts, but the script flipped in 2025. International stocks (MSCI ACWI Ex-US) beat U.S. stocks (S&P 500) by ~15% this year, finishing with an impressive return of +32% for 2025. Could this be a turning point in market leadership going forward? No one knows for sure, but history has shown these two asset classes taking turns outperforming each other, and international stocks do have a major tailwind given their discounted starting valuations compared to the extremely elevated valuations of the U.S.

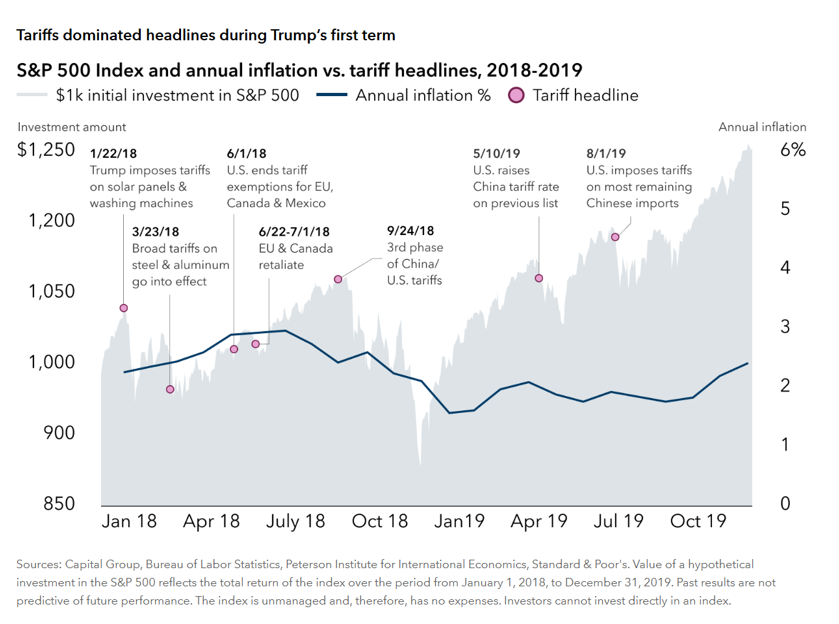

International performance might be the most surprising outcome of the year, given the political backdrop to start the year. Trump started his presidency with a focus on American leadership, which might suggest stock outperformance, and then introduced tariffs to improve America’s trading position and penalize unfair foreign trade practices… which, at face value, also seems to suggest U.S. stock outperformance! But here we are at year-end with international outperformance that nobody saw coming. To us, this just further reinforces our belief in diversification and a disciplined process for our portfolios. Chasing headlines or short-term gains may have led investors to miss the strong run in international stocks this year.

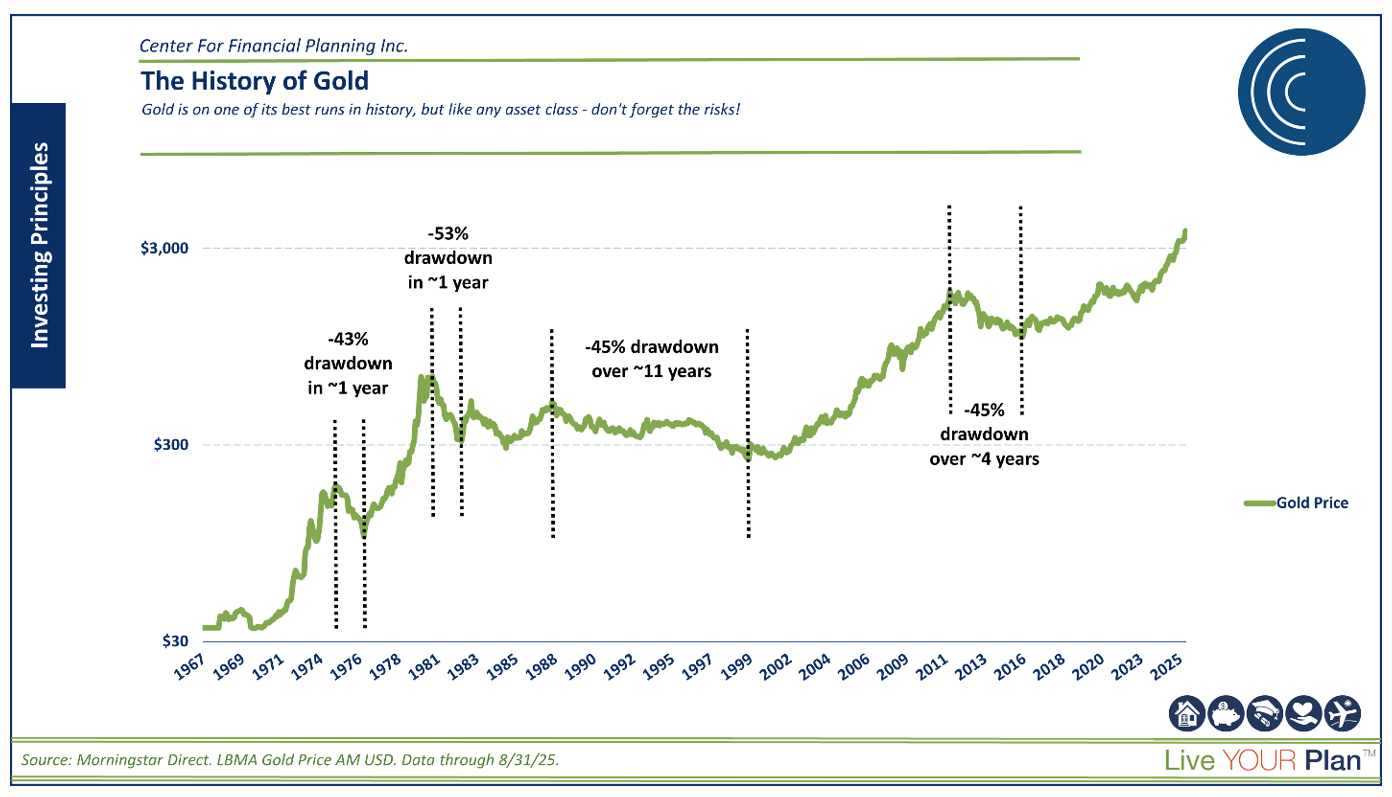

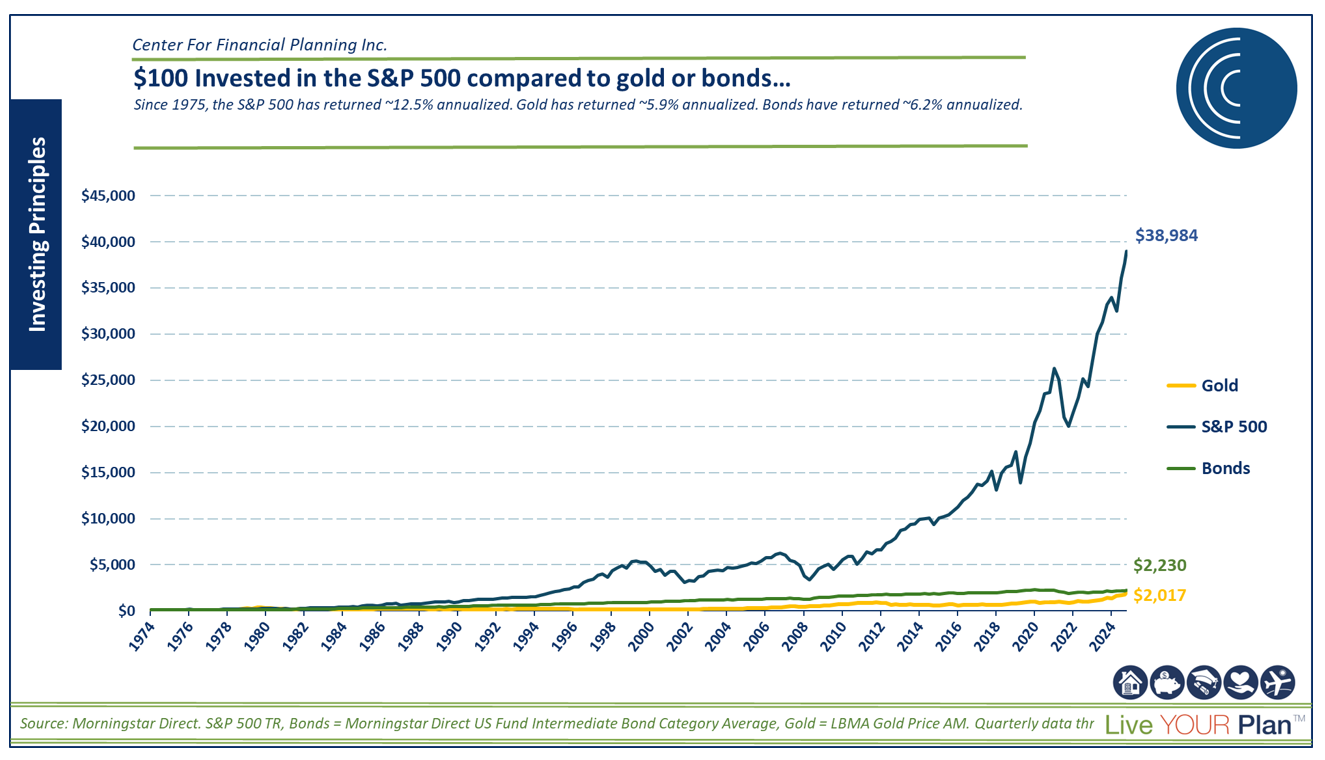

Bitcoin Down and Metals Way Up

After peaking in October, Bitcoin fell over 30% in just over one month and ended the year slightly negative. Gold, on the other hand, had a historic year, rising by over 60%. That is gold’s strongest return since the early 70’s! These alternative asset classes are prone to volatility. What goes up quickly can also come down quickly. Be wary of narratives that try to make sense of these moves or extrapolate them going forward. Is gold’s run an indication of the end of U.S. dollar dominance? Is Bitcoin’s dip an indication of its demise? Or is this normal volatility from historically volatile asset classes that can move violently in both directions? Every investor has to decide for themselves whether alternative asset classes with this kind of volatility belong in their portfolios.

What Major Analysts Think for 2026…and Does It Matter?

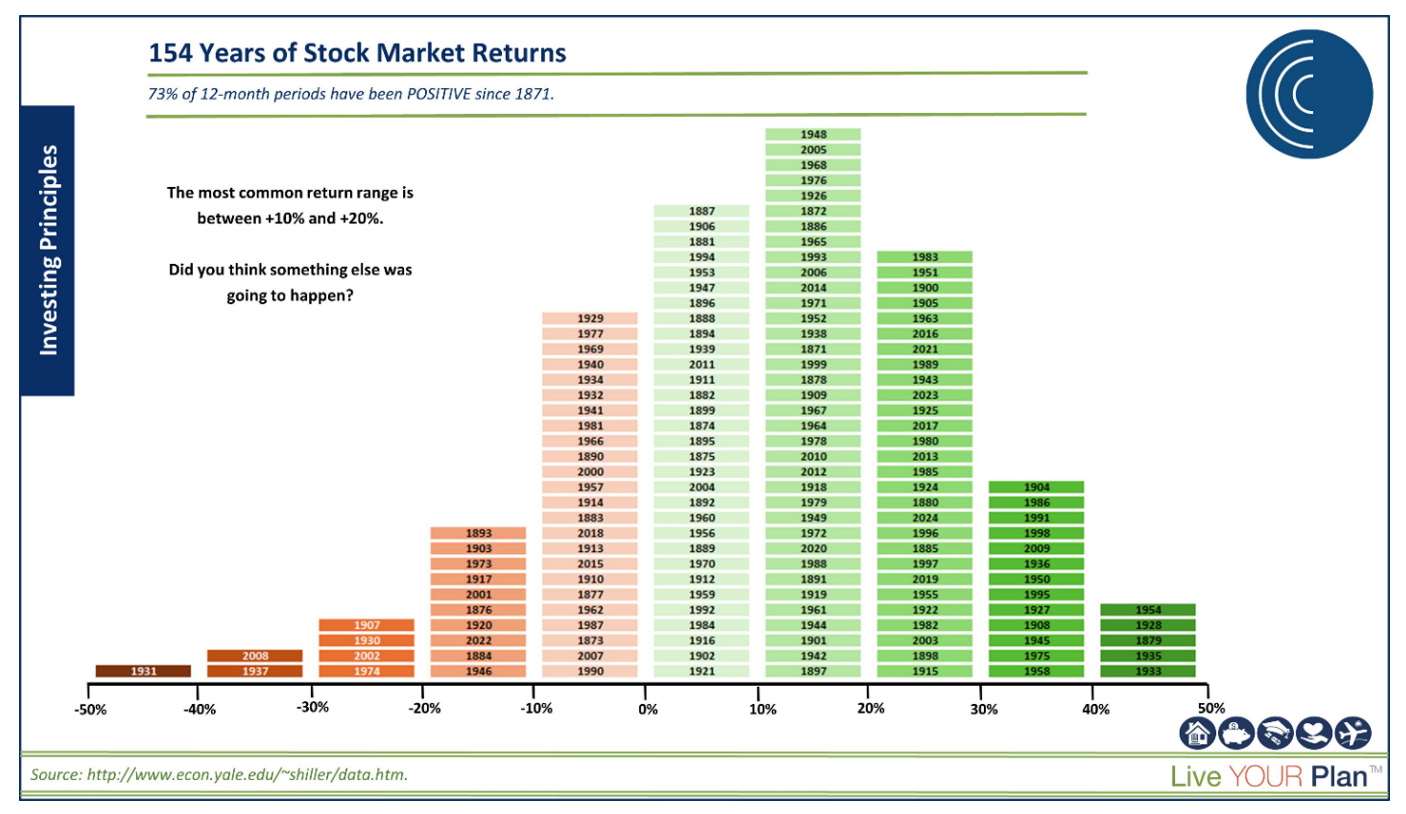

There is an annual practice from big banks and analyst firms to publish their S&P 500 year-end price targets. They are historically not very accurate. We included this in our Q4 commentary last year as well! With that being said, analysts last year were generally bullish, and the stock market was up about 17%…well done to the analysts who nailed it! Or perhaps a betting man would perform best by looking back 150 years and predicting the most common return for the stock market…

2026 analyst predictions are looking mostly bullish again. We’ll review them again next year and see how they did! They may not be the most useful for predicting the future of the stock market, but they are useful for better understanding expectations and what is being priced into the market. Currently, it seems the market is pricing in serious optimism, with bullish analysts and near-record-high valuations.

We will continue to stick to our process, diversify, maintain appropriate cash levels, and, most of all, lean on sound financial planning to ensure we are prepared for whatever the market throws at us next. As always, we are here to help answer any questions you may have regarding your individual financial situation. We hope you had a great year – now onto what we hope is a great 2026!

Angela Palacios, CFP®, AIF®, is a partner and Director of Investments at Center for Financial Planning, Inc.® She chairs The Center Investment Committee and pens a quarterly Investment Commentary.

Nicholas Boguth, CFA®, CFP® is a Senior Portfolio Manager and Associate Financial Planner at Center for Financial Planning, Inc.® He performs investment research and assists with the management of client portfolios.

Any opinions are those of Angela Palacios, CFP®, AIF® and Nick Boguth, CFA®, CFP® and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. Past performance does not guarantee future results. Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance is not a guarantee or a predictor of future results. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

Bitcoin issuers are not registered with the SEC, and the bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk.