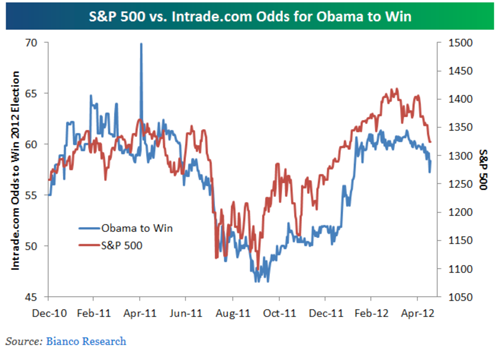

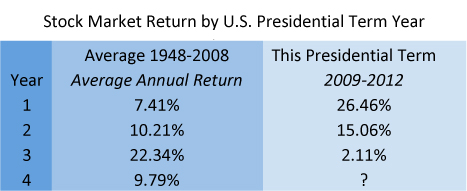

It’s not just a catchy Janet Jackson song, it’s a question many voters are going to be asking of the President when they head to the polls this November. One indicator that seems to be more effective than any campaign ad for voters is the stock market. The chart below shows just how highly correlated the odds are that Obama is going to win (based on voter polling from Intrade.com) with the S&P 500. The higher the S&P come voting time, the more likely he should be to win the election.

It’s not just a catchy Janet Jackson song, it’s a question many voters are going to be asking of the President when they head to the polls this November. One indicator that seems to be more effective than any campaign ad for voters is the stock market. The chart below shows just how highly correlated the odds are that Obama is going to win (based on voter polling from Intrade.com) with the S&P 500. The higher the S&P come voting time, the more likely he should be to win the election.

In a study done by John Nofsinger, "The Stock Market and Political Cycles," which was published in The Journal of Socio-Economics in 2007, Nofsinger proposed that the stock market may be able to predict which candidate will be elected. He analyzed the relationship between the social mood of the country and the presidential election and concluded that when the country is optimistic about the future, the stock market tends to be high and voters are more likely to vote for those in power. When the social mood is pessimistic, the market is low and people tend to vote out the incumbent and put a new party in power.

So, while Janet Jackson had relationships in mind rather than elections when she helped write the song, “What Have You Done for Me Lately”, if you can look past those mid-1980’s shoulder pads and frizzy hair, you can find she hits a chord when it comes to how we elect the leaders of our country!

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. You cannot invest directly in an index.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.