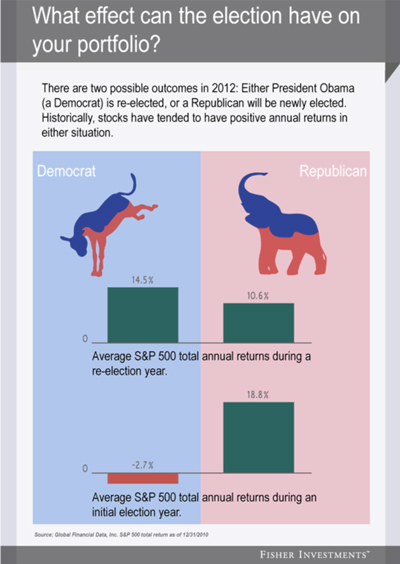

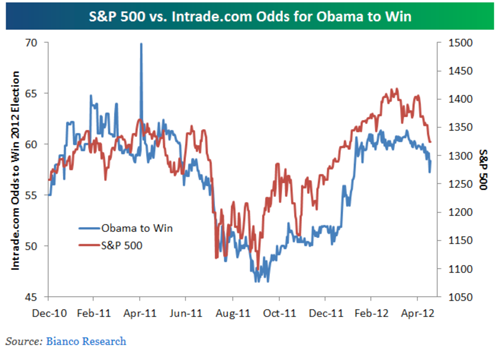

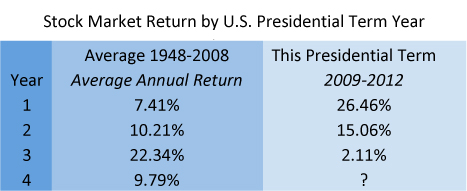

"The economy is suffering" and "Job loss" and "Euro crisis" ... you've likely been reading a lot of bad news about the economy lately. Especially in this election season, the worst often gets pushed center stage in campaign ads and speeches. But instead of focusing on the buzz, take a look at the facts. Below is a chart of returns over the past year from 8/20/2011 to 8/21/2012. The S&P 500 returned over 28% including dividends!!!

"The economy is suffering" and "Job loss" and "Euro crisis" ... you've likely been reading a lot of bad news about the economy lately. Especially in this election season, the worst often gets pushed center stage in campaign ads and speeches. But instead of focusing on the buzz, take a look at the facts. Below is a chart of returns over the past year from 8/20/2011 to 8/21/2012. The S&P 500 returned over 28% including dividends!!!

Source: Morningstar Direct

Source: Morningstar Direct

This has happened during a time when:

- United States Treasuries lost their coveted AAA rating from S&P debt rating agency

- National Unemployment remains high

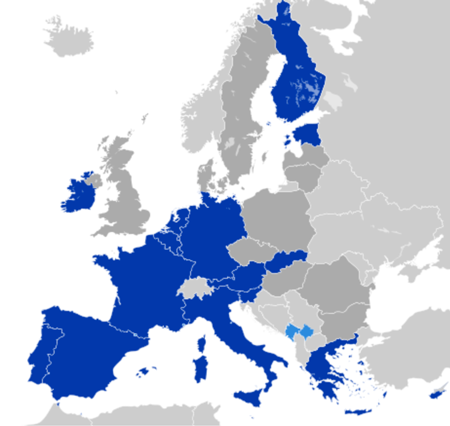

- The Euro Zone continues to be engulfed by concerns over debt

And that is just to name a few of the scary headlines we’ve witnessed over the past year. Regardless, though, the market continues to march on.

Unfortunately, the average investor has been divesting in the U.S. markets consistently since 2008 rather than investing. The chart below shows that the average retail investor (that is you and me), represented by the blue and orange areas, has been consistently pulling money out of US stocks while institutions, represented by the green area, have been consistently investing.

Source: Morningstar Direct

Source: Morningstar Direct

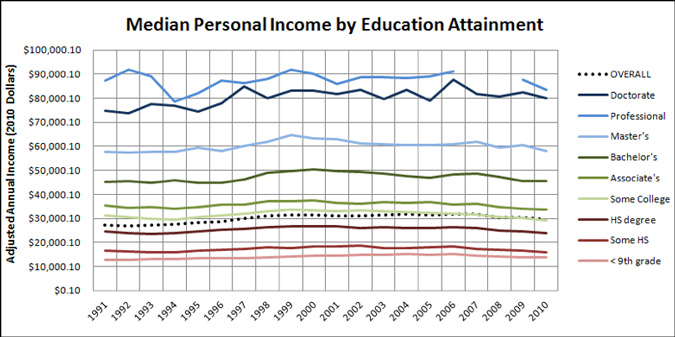

You might ask where has the money been going.

- A large amount has been flowing into U.S. Bonds (despite the downgrade and historically low interest rates)

- Some has left the market to pay down consumer debt

- Many are moving over to exchange traded instruments to find their U.S. Stock exposure

It is hard to say if the average investor is permanently scared away from buying U.S. Stocks, but do not count on the media to make it feel any easier!

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. The S&P 500 is an unmanaged index or the 500 widely held stocks that are generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual performance. Individual investor’s results will vary. Past performance does not guarantee future results. Dividends are not guaranteed and must be authorized by the company’s board of directors.