A few nights ago my 7-year-old daughter and I sat on her bed and opened up her “Ariel the Mermaid” coin bank as it was starting to overflow. While we were rolling up the coins she asked, “What are we going to do with this money?” I explained we are going to the bank and deposit it into her account and, in exchange for holding it, they will pay her more money. Her eyes lit up and she asked how much. Putting it as simply as possible, I explained that her $20 bill would earn about $.05 in one year. She looked at me with her brow furrowed and said why would I do that?

A few nights ago my 7-year-old daughter and I sat on her bed and opened up her “Ariel the Mermaid” coin bank as it was starting to overflow. While we were rolling up the coins she asked, “What are we going to do with this money?” I explained we are going to the bank and deposit it into her account and, in exchange for holding it, they will pay her more money. Her eyes lit up and she asked how much. Putting it as simply as possible, I explained that her $20 bill would earn about $.05 in one year. She looked at me with her brow furrowed and said why would I do that?

Why, indeed, is a good question many savers are asking themselves today. People are feeling compelled to take much more risk in order to earn what a simple savings account was paying me when I was a teenager.

Seeking Higher Returns

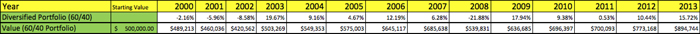

During the recent Morningstar Investment Conference, many portfolio managers were expressing concerns on this vey topic. Investors have gravitated toward high yield and floating rate bonds at alarming rates in the past few years in the absence of a reasonable interest rate from the savings accounts, CDs or treasuries. The chart below shows how many billions of dollars have flowed into strategies that invest in floating rate (blue bar) and high yield bonds (gray bar) each of the last ten years. You can see the spike in the past five years as rates were driven to historical lows by the Federal Reserve.

1st Quarter JP Morgan Guide to the Markets; Flows include ETFs and are as of May 2014. Past performance is not indicative of comparable future results.

Many investors don't realize that high yield bonds are highly correlated to stocks and when stocks go down these types of bonds will also likely take a hit. Even more concerning managers like Ben Inker of GMO and Michael Hasenstab of Franklin Templeton, see a lack of liquidity in this market. This means if they do start to go down and people start running for the exits, there may be no willing buyers in the marketplace until the prices get low enough, resulting in potentially amplified losses to the investors left holding the bonds. Suddenly the 4.9%* interest rate doesn't sound high enough for taking on that level of risk. These types of investments should be no substitute for a regular savings account even though the interest rates are embarrassing!

So while my daughter may never know compelling savings accounts yields in her childhood, I still find teaching her this simple process of money and saving an invaluable lesson to start at a young age!

*Yield on Barclays Capital Corporate High Yield Index as of 6/30/2014

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc. and not necessarily those of RJFS or Raymond James. Bonds are subject to interest rate risks. Bond prices generally fall when interest rates rise. High-yield (below investment grade) bonds are not suitable for all investors. When appropriate, these bonds should only comprise a modest portion of your portfolio. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. The Barclays Capital High Yield Index covers the universe of fixed rate, non-investment grade debt. Pay-in-kind (PIK) bonds, Eurobonds and debt issues from countries designated as emerging markets (e.g., Argentina, Brazil, Venezuela, etc.) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. Original issue zeroes, step-up coupon structures, and 144-As are also included. Michael Hasenstab, Ben Inker and GMO are independent of Raymond James. C14-022057