Checkout our current blog posts HERE. See you there!

Invest Like a Woman

Face it, there are some things men tend to be better at and some things come easier to women. Let’s take investing for example. Studies have shown, time and again, that women make much better investors over the long-term than men*. Two factors are at play here: risk and emotion.

Investment decisions are often driven by emotion more so than anything else for individuals (and professionals too!) And, sorry guys, but as I’m sure you are aware we women have written the book on emotional swings. As such, we are more in tune with our emotions as we have to control these swings often. Yes, I know it seems impossible that we are controlling our emotions but believe me, you’d hate to see us when these emotions run unchecked.

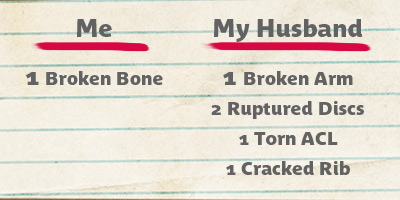

Women tend to take fewer risks than men in many aspects of life. Just look at my major injury history versus my husbands (not that I’m keeping score)

And that is only in the 16 years since I’ve known him!

While taking less risk normally means less return, it does not always work out that way.

By using and managing our emotions instead of repressing them, like men stereotypically tend to, women may make better investment decisions. Because most women have fine-tuned (I’m not claiming perfected) our impulse control, we're more likely to resist overreacting which could lead to trading too much on the latest CNBC report, whether that be selling during market panics or jumping on the bandwagon too far into a rally.

I’d love to see these studies continuously revisited by the academics to see if this data holds true especially if we experience a much longer run to this bull market. But for now it might be a good idea to get in touch with your feminine side!

*Inside the Investor’s Brain (Wiley Trading, 2007)

Boys will be boys: Gender, overconfidence, and common stock investing, by Brad M. Barber and Terrance Odean, The Quarterly Journal of Economics, February 2001.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Angela Palacios and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Angela Palacios and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance is no guarantee of future results.

Retirement “Goals”

If you’re a college sports fanatic like I am, this is one of the best times of the year. March Madness (a.k.a. the NCAA Men’s Basketball Tournament) has been in full swing over the last couple of weeks – 72 of the nation’s top teams competing for the ultimate title of National Champions.

If you’re a college sports fanatic like I am, this is one of the best times of the year. March Madness (a.k.a. the NCAA Men’s Basketball Tournament) has been in full swing over the last couple of weeks – 72 of the nation’s top teams competing for the ultimate title of National Champions.

Watching game after game during the tournament and tracking the winners on the bracket I keep by my side, I can’t help but see a parallel here between the strategies these teams are using to reach their ultimate goal and the strategies we need to use to reach one of our ultimate goals…retirement. That’s right, I’m saying the road to your retirement is like the road to the Final Four. Stay with me as I draw a couple of parallels:

- It All Starts with a Plan –

- Basketball. Once the tournament brackets are in place, each team puts together their best strategy. This includes putting together their strongest line-ups, putting in hours of preparation, and forming game plans to maximize their strengths and minimize the opposing team’s best assets.

- Retirement. Once we choose a retirement goal (age we want to retire, income we will need in retirement, etc.), we work with our financial planner to put together our best strategy. We work hard to maximize tools (income, savings vehicles, investment strategies) while minimizing the risks (rising interest rates, market volatility, changing tax laws, etc.).

- Make Adjustments –

- Basketball. The NCAA tournament is known for its upsets – the smaller or lower seeded teams that find a way to beat the bigger, top rated teams (like Lehigh beating Duke!). If an upset occurs, teams may not be prepared for the team they will be forced to play. Injuries and other unexpected obstacles quickly occur, forcing teams to quickly adapt their strategies to get their next win.

- Retirement. Life happens … sometimes causing our best-laid plans to go off course. A family member gets sick and we have to take time off to care for them. We lose a job, experience a pay freeze, or have major changes to the pension plan we had been counting on. When these unexpected events occur, we need to work with our planner to make the required adjustments to keep us on course, whether it is to work longer, save more, or adjust our retirement income expectations.

The NCAA National Basketball Championship is a team effort…and so is your retirement. Work with your planner to ensure that you have your best plan in place to reach your retirement goals.

The NCAA National Basketball Championship is a team effort…and so is your retirement. Work with your planner to ensure that you have your best plan in place to reach your retirement goals.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

The Anxious Investor

Ripple effects from the global financial crisis and recession of 2008 are etched in our memory. In a previous post, A Fear-Driven Investor, we discussed the tendencies investors display when decisions are driven by fear or greed. When fearful investors can let go of what scares them about the market, the course evens. It’s not unlike letting go of fears in other areas of life.

When I think of the fear-driven investor, I think about what happens to confidence and decision making when we feel worried and anxious. Have you ever tried doing anything when you are worried and anxious? I think about the first time I went kayaking on Lake Huron with my sister.

My sister was more expert than I. I imagined a big, smooth pond and a sleek little kayak but I really had no idea what I was doing especially when the storm clouds blew in. My idea of kayaking was to relax more and stay physically fit; however I was a bit fearful and anxious about tipping over when the waves got bigger!

What happens to anxious kayakers? I quickly found out! When your body is loose, you can move the boat and make adjustments. When you get anxious and stiff, the boat becomes tippy and unstable. Once I understood how one decision affected another, I began to relax and I started doing much better.

If you are driven by news rather than an investment plan, you may end up tipping your portfolio like I tipped my canoe.

Want to avoid getting “wet”? Here are 3 tips for investors to help reduce anxiety and promote a smoother ride:

- Set realistic expectations - Trying to refine the future to a point where you will never be surprised creates a headwind that is hard to overcome.

- Understand the effect your financial decisions have on other financial issues - Focus on your own behavior, not the market’s behavior.

- Re-evaluate your investment plan periodically - Small and consistent course corrections are just as important as the plan.

I still kayak on occasion, and I’m always reminding myself to stay relaxed and in the flow. It’s something I remind myself on a regular basis when planning investments as well. It’s much easier to keep your boat afloat when you loosen up, especially when the investment waters get choppy.

I still kayak on occasion, and I’m always reminding myself to stay relaxed and in the flow. It’s something I remind myself on a regular basis when planning investments as well. It’s much easier to keep your boat afloat when you loosen up, especially when the investment waters get choppy.

Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Investing involves risk, including risk of loss.

Healthcare Forecast Breakfast

The Center’s health and wellness initiatives were recently recognized at a Healthcare Forecast Breakfast sponsored by the Birmingham Bloomfield Chamber of Commerce.

The Center’s health and wellness initiatives were recently recognized at a Healthcare Forecast Breakfast sponsored by the Birmingham Bloomfield Chamber of Commerce.

Center Operations Manager Gregg Bloomfield was one of three panelists leading the healthcare and wellness discussion. Panel members provided insights on how health care reform and wellness and employee benefit programs are shaping business today.

After the event, Gregg commented, “Small businesses have particular challenges and opportunities in the area of employee healthcare. I was pleased to share with this audience the inspiring results of our in-house health and wellness program.

The Center team leadership has worked very effectively with our community partners -- American Heart Association and Blue Care Network – to improve overall wellness at our workplace.”

Center team members and friends in attendance included: Sandy Adams, Gerri Harmer, Marilynn Levin, Laurie Renchik, Kimberly Wyman and Troy Wyman.

2012 Cystinosis Fun Run/Walk

On May 6th we will hold the 6th Annual Cystinosis Fun Run/Walk in honor of our daughter, Kacy Wyman. In the past we have had over 300 walkers and runners support the event and Kacy. We understand that there are many worthy causes and feel very fortunate that so many have chosen to support Kacy’s cause in the past – and appreciate you considering a financial contribution for our May 6th event. All proceeds benefit Cystinosis Research Network. CRN is an all-volunteer, non-profit 501(c)(3) organization. The CRN Federal Tax ID# is 04-3323789.

On May 6th we will hold the 6th Annual Cystinosis Fun Run/Walk in honor of our daughter, Kacy Wyman. In the past we have had over 300 walkers and runners support the event and Kacy. We understand that there are many worthy causes and feel very fortunate that so many have chosen to support Kacy’s cause in the past – and appreciate you considering a financial contribution for our May 6th event. All proceeds benefit Cystinosis Research Network. CRN is an all-volunteer, non-profit 501(c)(3) organization. The CRN Federal Tax ID# is 04-3323789.

|

|

|

Thanks to 37 pills a day, eye drops 8-10 times per day and 7 liters of water Kacy’s condition is stable – but we need a cure. Your financial support is making a difference in Kacy’s life and all of the children enduring this rare disease called Cystinosis (Sis-ta-know-sis). Your support drives research and gives us hope that a cure will be found during Kacy’s lifetime. Thank you again for considering.

With Love & Gratitude,

Tim & Jen Wyman

Checks should be made payable and sent to:

Cystinosis Research Network

c/o Center for Financial Planning, Inc.

40 Oak Hollow Street, Suite 125

Southfield, MI 48033

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!

Tools of the Trade

Just as Luke Skywalker had his light saber and Emeril Lagasse his garlic (BAM!), the Investment Management business has…FI 360®??

Most investors have heard of Morningstar, which is a financial data provider that provides data on literally millions of different investments. This is very widely used by the investment community for up-to-date data and financial analysis on a wide variety of investment instruments. To a lesser degree, you may have even heard of Ibbotson Associates, recently acquired by Morningstar, which has data on portfolio construction and implementation.

Most, however, even within our wealth management profession, have not heard of another tool we use called FI360®. This company offers a full circle approach to investment fiduciary education and support.

This software helps us with our fiduciary responsibility to monitor our investment managers on a regular basis and gives us a red flag if there is something to be concerned about. These are some of the factors FI360® reviews:

- Manager Tenure – alerts us to recent leadership change

- Composition of the portfolio – alerts us if the investment is taking a larger amount of risk in some aspect of the portfolio by greatly over- or underweighting something compared to other like investments

- Expenses – alerts us to increased or higher than average expenses

- 1, 3 and 5 year returns – alerts us if an investment is underperforming like investments over those periods of time.

When looking at this information on a regular basis we can understand where we need to dig deeper to make sure the investment is in the best interest of our clients’ portfolios. It’s important to look often but not too often. Keeping an eye on short-term trends can obscure more meaningful long term data. For us, that means  a semi-annual review of our recommended investments using FI360® analytics.

a semi-annual review of our recommended investments using FI360® analytics.

Keeping on top of investments requires tools of the trade. We feel fortunate to have fi360 to get the job done and hope you find the proper tools to help you achieve investment success. May the force be with you!

http://www.fi360.com/main/about.jsp

2012: Financial Planning Opportunities & Challenges

Client Presentation Now Available on Video!

The Center's informative library presentation "2012: Financial Planning and Investment Opportunities," given recently for clients and friends, is now available on demand as web-based video on YouTube.

This presentation includes:

- a brief look back at the investment environment in 2011

- financial planning opportunities likely to be in the forefront for 2012

- updates on state taxation of pension income

- the investment outlook for 2012

- advice for keeping emotions at bay when making investment decisions

All six YouTube videos are available on the Presentations page of The Center's website.