Checkout our current blog posts HERE. See you there!

June 2012 Investment Update

The year opened with a quarter of exceptional returns for markets such as the S&P 500. This rising tide was quickly curtailed in April and May. The ongoing European troubles have reached a new crescendo. Withering employment and housing numbers in the US added fuel to the fire in May.

The situation in Europe is complicated and includes both real economic challenges and unresolved political questions. The combination has led to a slow-moving crisis without the sign of an end. The primary issues we're watching today:

- Greece Unraveling. We do not know of any credible experts who think that Greece is solvent today. The insolvency is a foregone conclusion but related political upheaval has escalated the crisis. We now look to June 17 elections to determine remaining support for continued membership in the EU. A so-called "Grexit" would be unprecedented and would bring even more challenges to Greek recovery.

- Contagion in Spain & Italy. While Greeks have been wreaking havoc on their banks by hoarding Euros, Spain and Italy seem to be experiencing their own quiet bank run. Unemployment rates are very high in Spain and Italy and borrowing costs continue to rise for the governments. Earlier in the year, the ECB fiscal relief program infused money into banks, but did little to fix their exposure to bad sovereign debt along with other bad loans. Finding a way to secure investor sentiment in these economies remains critical.

- Slowing Growth. The odds of a European recession are high and growing. Meanwhile, signs of slowing growth are cropping up in places like China and here in the US.

- End of US Stimulus. "Operation Twist" is scheduled to wind down this spring and summer. We have long seen 2013 as challenging regardless of the presidential victor because of agreed-upon fiscal cuts plus tax breaks which are scheduled to expire. Add to that the need to rehash the debt ceiling discussion, and we know the US Government and Economy will be in headlines that rival Europe in the coming months. With US interest rates at record lows (going back to WWII), a new Fed program to buy even more treasuries would seem to offer very little in the form of help for investors.

What actions should investors take? We can share some strategies that we’re using with our clients from a financial planning and wealth management perspective.

- Work with a professional who is looking forward with today’s situation in mind. The challenges listed above have been on our minds and on the minds of our portfolio managers regardless of market returns. We discuss these issues on a daily and weekly basis within the firm as well as with money managers and peers. For many managers, a European outcome may be a "United States of Europe" approach with more centralized EU power. This, they say, will not happen without considerable effort and time.

- Look at your risk orientation. In 2011, we considered significant changes to positions for our clients in anticipation of sustained volatility (which we saw last summer and seems to be popping up again). From our point of view we may continue to see more uncertainty this summer and through the presidential election cycle in November. We have been underweight dedicated international positions and our managers have tilted portfolios toward Asia and away from Europe. We have incorporated alternative strategies which have historically had a less direct relationship to the whims of stocks and bonds. This is not a blanket prescription but our point of view. You should know your own posture in terms of investment mix.

- Stick with your plan. Because of the changes last year, we continue to be comfortable with portfolio positions today and do not anticipate a significant overhaul to portfolios. That said, our focus on monitoring investment mix in light of current scenarios is as vigilant as ever. If you have started a plan, you need too much change or doubt may result in a drag on your portfolio’s returns.

- Rebalance when appropriate. If markets continue to decline, we may rebalance portfolios into the assets that have declined. This is by design and meant to position investments through a forward-looking lens rather than the natural human tendency of focusing on the rear-view mirror. Ultimately, we believe that volatility will lead to buying opportunities.

- Talk to someone when you have concerns. Working with a CERTIFIED FINANCIAL PLANNER™ is a partnership. A financial planner can help uncover your concerns and find answers for your fears! Most importantly, when your financial situation is changing, make sure to update your overall financial plan and analyze your investment mix based upon the new information.

As the summer gets going, you should be able to enjoy barbecues with family and friends rather than worry about the ups and downs of stocks and bonds. Ultimately, you are investing so that you can achieve your financial goals. If you ever have questions about investing or comprehensive financial planning, don’t hesitate to contact us.

Sincerely,

Melissa Joy, CFP®

Partner, Director of Investments

Investment Advisor Representative, RJFS

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Melissa Joy and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance may not be indicative of future results. Please note that international investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Alternative investments are available only to those who meet specific suitability requirements, including minimum net worth tests. There are special risks involved with alternative investments, including investment strategies, and different regulatory and reporting requirements. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Consumer Alert: Have GM and Ford provided one of the greatest Money Grabs for the Financial Services Industry?

The automobile industry has played an important role in many Michiganders’ lives. I recall my own great-grandfather Mel working for Ford Motor in Dearborn. Mel was able to provide my great-grandmother and their children (my grandmother) a comfortable middle-class lifestyle thanks to his work there. Today, hundreds of thousands of people—both current employees and retirees--continue to depend upon automobile companies to help care for their families.

Ford and GM have both recently announced changes to their pension benefits affecting an estimated 130,000 retirees. More of the details are laid out in my two recent blogs (May 4th blog titled “Why is Ford Motor Company Offering to Pay-Off 90,000 Retirees?” and June 13 blog titled “GM Pensions to Follow Ford...With a Twist”), but the essence of the change comes down to choosing between (1) continuing to receive a monthly pension check that will be payable for the rest of your life, and (2) electing to forgo monthly payments and taking a one-time lump sum.

Consumer Alert: Let’s face it – the financial services industry doesn’t have the greatest track record. Several firms in the financial services industry are already geared up to get their share of the lump sum payments via “free” seminars and “free” consultations. I am sure many of you were given the same sage advice my great-grandfather shared with me one time: there’s no such thing as a free lunch.

Those in the financial planning industry get compensated in a variety of ways: fees, commissions, or a combination of both. Professionals that provide value deserve to be compensated. However, some advisors in the financial services industry do not get compensated for advising you to continue to take the monthly pension. And yet, this might be the most prudent decision for anyone with a normal life expectancy.

Financial advisors/consultants/salespeople/insurance agents/stock brokers are often biased for you to elect the lump sum option. A professional financial advisor will start with a clean slate – learn about your unique situation and objectives – and then provide tailored recommendations based on the tradeoffs between the options. Any advisor advocating only one option should be avoided.

What to do? The tricky situation with the GM and Ford offers is that general rules and rules of thumb just don’t work. You must take a lot of factors into consideration. So, run the numbers (you are encouraged to consult with a financial planner and/or tax advisor) and then weigh the risks before deciding. We have been working with several clients over the last few weeks. In some cases the lump sum offer made the most sense, but in others, we advised sticking to the pension option. Each situation is unique, and we have come to different conclusions based upon their individual circumstances, so make sure you are getting the best advice possible and not just a “free lunch” offer.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

GM Pensions to Follow Ford...With a Twist

Much like Ford Motor Company’s recent announcement, GM is making pension offers to reduce their pension liabilities. [See my May 4th blog titled “Why is Ford Motor Company Offering to Pay-Off 90,000 Retirees?”]

Companies like GM usually desire to pay pensions via a lump sum as this can make their balance sheet look better. Moreover, due to legislation going back to the Pension Protection Act of 2006 (that is now fully in effect), the cost of paying a lump sum for companies has been reduced.

Now the twist:

GM retirees that elect to continue the monthly pension method will now have their payments “administered” by The Prudential Insurance Company of America. Administered in this case has a special meaning; checks will come from Prudential and no longer receive the benefit of being covered and insured by the Pension Benefit Guaranty Corporation (PBGC), a U.S. Government Agency (www.PBGC.gov). Rather, annuity payments from Prudential will carry more limited guarantees from each state (For Michigan see www.milifega.org). Fortunately the insurance industry as a whole has been reliable in terms of paying benefits. In fact, Prudential has never missed paying an annuity payment. So, there are arguably less guarantees associated with payments from Prudential – but probably not enough to affect the decision in either direction.

What to do? General rules and rules of thumb just don’t work here. First, run the numbers (you are encouraged to consult with a financial planner and/or tax advisor) and then weigh the risks before deciding. We have been working with several clients over the last few weeks. Each situation is unique and we have come to different conclusions depending on their individual circumstances. If we can help you make an informed and prudent decision – one that has the potential to significantly impact (positively or negatively) your wealth for years to come - please feel free to call or email me.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James

Charitable Giving: Your Annual Giving Plan

Once you have determined the causes you want to support and have done your homework on those chosen charities, it’s time to put together your giving plan. A giving plan can help you track your giving on an annual basis, to document your legacy giving wishes, and to communicate your giving desires to your family.

Once you have determined the causes you want to support and have done your homework on those chosen charities, it’s time to put together your giving plan. A giving plan can help you track your giving on an annual basis, to document your legacy giving wishes, and to communicate your giving desires to your family.

Your annual giving plan could look something like this and helps you outline your giving based on:

- Funding areas – Cultural arts, education, social programs, the environment, animals, religious affiliations, support programs, health/research, etc.

- Local versus Global reach – Determine your desire to support organizations that serve close to home versus those that serve a broader/global community.

- Identify the Specific Organization(s) in each funding area

- Identify specific organizations and specific gifting – Determine your annual giving amount in dollars and/or percentages and track when you’ve met each annual goal.

- Identify your Legacy Gifting Wishes – Document the organizations you have identified to receive charitable dollars from your estate. While this form does not have any legal authority and does not replace the needed legal documents (trusts, wills, etc.), it is a way to communicate your charitable giving desires.

Your annual giving plan will help you (1) plan and track your annual giving and (2) provide a tool with which to communicate your charitable giving with your family. Feel free to use our Giving Plan (link form here) form, or develop a format that works best for you. The important part is to develop your personal giving goals based on what is important to you, to verify the organizations you choose use your gifts to provide the most good, and to make sure that your gifting fits into your overall financial plan.

“What we have done for ourselves alone dies with us; what we have done for others and the world remains and is immortal.” ~Albert Pike

Changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. Please discuss tax matters with the appropriate professional. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Sandy Adams Quoted in Wall Street Journal

A Written Plan Can Help Your Portfolio

A Written Plan Can Help Your Portfolio

Foundations and other big investors have investment-policy statements. Some pros say you should, too.

May 30, 2012

By Thomas Coyle

Write it down.

That's the message increasing numbers of investors and advisers are hearing. And when they actually follow through, they reap the rewards.

For all kinds of investors, creating a written investment-policy statement—and sticking to it—can be a good way to produce steadier returns in volatile times. It instills discipline. It can clarify strategies. For investors with advisers, it can define what both parties expect from the relationship right from the start.

Sandra Adams is a lead financial planner with the Center for Financial Planning in Southfield, Mich., a firm with more than $700 million under management. In the four or five years since that firm's advisers started using investment-policy statements, she and her colleagues have noticed that it can help the children of clients who have become incapacitated understand that their parents' assets are being managed with their best long-term interests in mind.

Many times, the children have had no previous contact with the firm, Ms. Adams says, so seeing the statement "can bring families up to speed on how we're working for their parents in a way that creates a lot of trust."

Elections and the Markets: What have you done for me lately?

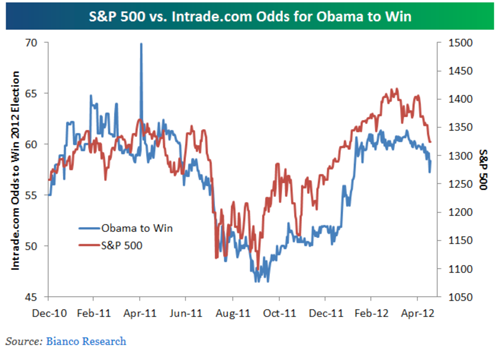

It’s not just a catchy Janet Jackson song, it’s a question many voters are going to be asking of the President when they head to the polls this November. One indicator that seems to be more effective than any campaign ad for voters is the stock market. The chart below shows just how highly correlated the odds are that Obama is going to win (based on voter polling from Intrade.com) with the S&P 500. The higher the S&P come voting time, the more likely he should be to win the election.

It’s not just a catchy Janet Jackson song, it’s a question many voters are going to be asking of the President when they head to the polls this November. One indicator that seems to be more effective than any campaign ad for voters is the stock market. The chart below shows just how highly correlated the odds are that Obama is going to win (based on voter polling from Intrade.com) with the S&P 500. The higher the S&P come voting time, the more likely he should be to win the election.

In a study done by John Nofsinger, "The Stock Market and Political Cycles," which was published in The Journal of Socio-Economics in 2007, Nofsinger proposed that the stock market may be able to predict which candidate will be elected. He analyzed the relationship between the social mood of the country and the presidential election and concluded that when the country is optimistic about the future, the stock market tends to be high and voters are more likely to vote for those in power. When the social mood is pessimistic, the market is low and people tend to vote out the incumbent and put a new party in power.

So, while Janet Jackson had relationships in mind rather than elections when she helped write the song, “What Have You Done for Me Lately”, if you can look past those mid-1980’s shoulder pads and frizzy hair, you can find she hits a chord when it comes to how we elect the leaders of our country!

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. You cannot invest directly in an index.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

Jaclyn Jackson Attends Investment Conference in St. Petersburg, Florida

Jaclyn Jackson was among 37 Raymond James’ financial advisors who attended a three-day program at the Raymond James’ corporate offices in St. Petersburg, FL. These advisors are members of the Institute of Investment Management Consulting’s Portfolio Management Group. Membership into the group is based on their commitment to successfully managing client portfolios.

Jaclyn Jackson was among 37 Raymond James’ financial advisors who attended a three-day program at the Raymond James’ corporate offices in St. Petersburg, FL. These advisors are members of the Institute of Investment Management Consulting’s Portfolio Management Group. Membership into the group is based on their commitment to successfully managing client portfolios.

The Institute of Investment Management Consulting (IIMC) was developed as a forum for financial advisors committed to providing investment consulting and advice to clients. The Portfolio Management Group is a further specialization offered to these select advisors who have demonstrated success in developing and delivering investment portfolios to meet client needs. This forum provides educational programs tailored to their businesses, ongoing collaborative opportunities through a members-only website, and networking with financial advisors who have similar business models as well Raymond James specialists that support their practices.

Charitable Giving: Researching Your Charities

In my previous post, I addressed the reasons that individuals decide to give to charities. Once you have made the conscious decision to give, how do you make sure your contributions are making a real difference and not just funding the salaries of the organization’s executives?

In my previous post, I addressed the reasons that individuals decide to give to charities. Once you have made the conscious decision to give, how do you make sure your contributions are making a real difference and not just funding the salaries of the organization’s executives?

The internet makes it easier than ever to do your own investigating. By doing your own due diligence, you can make better decisions about which charitable organizations most deserve your hard-earned dollars. Here are a few things to look for:

- Look for IRS-Approved Charities – Verifying that a charity is an IRS-approved nonprofit organization will not only ensure that your contribution will be tax deductible, but IRS-approved charities have stringent application and reporting requirements, which generally weeds out those organizations that are ill-intended.

- Look at the Financial Strength and Practices of the Charities – Web sites like Charity Navigator (also a tax-exempt charity) rates over 3,000 of the largest charities by looking at their financial practices (revenue spent on executing programs and services, overall financial strength, etc.). You may have to dig a little deeper on the web to get information on smaller charities. Your local United Way may be of assistance with local charities.

- Look at the Programs and Services Provided by the Charities – The name of the charity itself may not define the scope of the programs or services provided. Be sure you understand whom the organization serves and how they serve them. This way you can make sure you are supporting the cause you are aiming to support.

Once you’ve narrowed down your list of high-quality charities that satisfy your desire to give, you need to put together an annual giving plan. Watch for my next post where I discuss how to put together such a plan.

Changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. Please discuss tax matters with the appropriate professional. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Charitable Giving: Why Do We Give?

Tax-deductible charitable donations are a great way to get even more deductions on your tax return. By itemizing those donations to qualified charities on your 1040 Schedule A, you may be able to reduce your taxable income. In her ‘Tis the Season to Give blog written late last year, Julie Hall, CFP® outlined the different ways to give on a tax-efficient basis. But aside from the attractive benefit of potentially lower taxes, why do we give to charities?

Tax-deductible charitable donations are a great way to get even more deductions on your tax return. By itemizing those donations to qualified charities on your 1040 Schedule A, you may be able to reduce your taxable income. In her ‘Tis the Season to Give blog written late last year, Julie Hall, CFP® outlined the different ways to give on a tax-efficient basis. But aside from the attractive benefit of potentially lower taxes, why do we give to charities?

Individuals give to charities for many different reasons:

- Support a Personal Connection– We may know someone who works for a charity or benefits from the organization in some way (i.e. a relative is a breast cancer survivor, so a donation to the Susan G. Komen Foundation feels like the right way to give back).

- Support Society as a Whole – We may feel like, because we are fortunate to be financially comfortable, we should do our part and give back to those who are less fortunate (i.e. a local food bank).

- Support a Cause We Truly Believe In – We have a passion for a cause (i.e. animal lovers may choose to support the Humane Society).

- Support an alma mater – We give back to our local high school or college as a “thank you” for the educational experience.

- Support a Religious Affiliation – We tithe to our church on a local, national, or international level.

If you’ve made the conscious decision to give to charities, it is important to (1) research the charities you’re interested in to make sure that they are legitimate and that your donations will be used responsibly for the intended cause and (2) track your giving and communicate your giving plan to your family.

In my next post, I will take a closer look at the best ways to research your charities.