Checkout our current blog posts HERE. See you there!

Heard Around the Thanksgiving Day Table

Thanksgiving Day Traditions

Thanksgiving day memories make me smile in gratitude for all of the blessings I have in my life. The tradition of gathering together to share a meal, stories, laughter, love and the good natured rivalry over football games seemingly coming to life out of the TV are all part of the experience.

Every year when mom says, “Time to eat!” we all know what comes next . . . . . you can see the pride and joy in mom’s eyes when she asks all of us to hold hands around the table so she can take it all in and say out loud how much it means to share the day together. Laurie Renchik

I am thankful for adoption and marriage! I’m living my happily ever after with the three loves of my life. Kimberly Wyman

Thanksgiving frames family memories from times gone by and challenges me to make the lasting special memories for my family today. I think of North Texas Novembers and large family gatherings as I was growing up. There was the annual family picture on my grandmother’s front porch, sneaking a seat at the adult table (always closest to the mashed potatoes), syrupy, delicious pecan pie, and always Dallas Cowboys Football after a big meal.

This year, the Detroit Lions will take priority over the Cowboys. My scenery has changed from dusty open Texas ranges to a quaint northern Michigan village sharing the day with my husband and our family. I will always be grateful for the special memories that keep me close to family near and far, here and gone, and savor the opportunity to continue to experience priceless moments entwined with a truly American holiday. Melissa Joy

I am thankful for both of my families…my personal family and my Center family. I cannot imagine being able to do the work that I love or being able to pursue my passion for financial gerontology without the support of both of my families. I am thankful for and truly cherish my relationships with my husband, children and parents, as well as my co-workers and clients. I wish everyone a Happy Thanksgiving! Sandy Adams

Year End Tax Planning: Capital Gains -- Good or Bad?

The holiday season is the perfect antidote to the sadness of yet another beautiful fall ending. Once the last leaves have fallen off of the trees and the smell of them burning in our fire pits has wafted away, it is promptly replaced with good food, family and the smell of something baking in my oven. The holiday season is an exciting time of the year with many of us frantically buying Christmas presents, and some even planning New Year’s celebrations. However, in the middle of the holiday hustle and bustle, it is important to stop and put your taxpayer hat on.

The holiday season is the perfect antidote to the sadness of yet another beautiful fall ending. Once the last leaves have fallen off of the trees and the smell of them burning in our fire pits has wafted away, it is promptly replaced with good food, family and the smell of something baking in my oven. The holiday season is an exciting time of the year with many of us frantically buying Christmas presents, and some even planning New Year’s celebrations. However, in the middle of the holiday hustle and bustle, it is important to stop and put your taxpayer hat on.

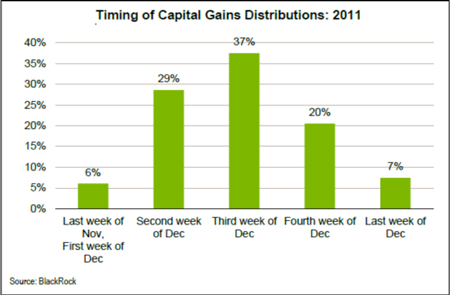

Typically from mid-November to the end of the year investment companies must pay out their capital gains distributions. As you can see from the chart below, the majority of firms tend to distribute in December.

If you own mutual funds in a taxable account and the distributions are anticipated to be large, you should weigh the advantages and disadvantages of owning the investment and incurring the capital gain. By incurring the capital gain you are increasing your basis in the investment. This year is a unique year with the complications of the fiscal cliff. It may be a good time to incur those gains this year to have fewer in coming years! You will want to consult with your tax advisor and financial planner to determine this for yourself.

Many companies will release estimates in October and November as a service to their shareholders, but not all do. You can typically find these by checking the company’s website. So take some time out from all the shopping mall traffic this holiday season and talk to your financial planner today!

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!

Year End Retirement Savings: From 401ks to IRAs

It should come as no surprise that saving for retirement is a financial priority that takes discipline, diligence and oversight. One important year-end financial move to help keep your retirement savings in check is to review your contributions to 401k plans and IRA’s for the year.

It should come as no surprise that saving for retirement is a financial priority that takes discipline, diligence and oversight. One important year-end financial move to help keep your retirement savings in check is to review your contributions to 401k plans and IRA’s for the year.

If you received a year-end bonus, you may want to go ahead put some of it into your retirement to max out your contributions for the year (see our post on year-end planning for your bonus). Likewise, if you’ve received a raise, can you increase your regular contributions?

Year-End Tips for 401k Participants:

✔ Max out 401k contributions if cash flow permits. For 2012 the limit is $17,000 and if you are over age 50 you can contribute an extra $5500 per year. To calculate your maximum percentage divide $17,000 by your annual salary.

✔ Review your employer match policy to make sure you are not leaving money on the table.

✔ Plan for 2013. The maximum contribution amount for 2013 is $17,500; an increase of $500 from 2012.

✔ If you have left an employer and have an old 401k sitting around, you may want to consider rolling over to an IRA.

Year-End Tips for IRA Owners:

✔ The 2012 maximum contribution amount for IRA’s is $5000.

✔ Don’t forget about the “Catch-up” contribution if you are 50 or older. That’s an extra $1000 you can contribute for a total of $6000. (Note: Total combined contributions to Roth and/or traditional IRA’s cannot exceed these amounts)

✔ Do you have multiple IRA accounts? Consider combining them to simplify record keeping and management.

✔ SEP-IRA: Maximum contribution limits for self-employed and small business owners is 25% of salary or $50,000; whichever is smaller.

✔ Plan for 2013. The IRA contribution limit is $5500 and the SEP-IRA limit is 25% or $55,000; whichever is smaller

So, before you bid farewell to 2012, spend some time with these checklists. Your future is worth the time it takes to properly plan today. If you need help, we’re always ready with answers.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Sandy Adams Attends Inaugural Alzheimer's Conference

Sandy Adams, CFP® represented the Center as a sponsor of the first annual Alzheimer’s conference on November 1, 2012. The conference, a collaborative conference put on by the Alzheimer’s Association Greater Michigan Chapter and the Wayne State University Institute of Gerontology, was put on for an audience of health care professionals and caregivers.

Sandy Adams, CFP® represented the Center as a sponsor of the first annual Alzheimer’s conference on November 1, 2012. The conference, a collaborative conference put on by the Alzheimer’s Association Greater Michigan Chapter and the Wayne State University Institute of Gerontology, was put on for an audience of health care professionals and caregivers.

This year’s conference, entitled “A Meaningful Life with Alzheimer’s Disease” brought highly recognized speakers to discuss issues such as person centered care, financial capacity and vulnerability and pain management. Well over 200 participants attended the first annual conference. Sandy has been invited to be a part of the planning committee for the 2013 conference.

Post-Election Investment Update: Cold Shoulder and the Fiscal Cliff

It’s been a year and almost $6 billion dollars since the kick-off of the presidential campaign cycle. After all that, we are left with relatively few changes in terms of the composition of the executive and legislative branches. President Barack Obama decisively won in the Electoral College race, but when all was said and done, he garnered less than a 3% advantage over Mitt Romney. In the election aftermath or afterglow, depending on your perspective, all eyes are now on the Fiscal Cliff and other looming issues that the president and Congress were unable to tackle in the last four years. Here are our thoughts on the impact of the election for the economy and your investments.

The Fiscal Cliff

There are wide-ranging tax increases and spending cuts set to occur after January 1st. These included mandatory spending cuts across the board, the end of the Bush-era tax cuts, Alternative Minimum Tax expansion and the Affordable Care Act (Obamacare), investment income taxes, payroll tax holiday coming to an end, and more. All of this adds up to about $650 billion.

Some hoped for shifting control on Capitol Hill to address these issues, but this was not to be. With the same actors who could not resolve these issues for the last two years remaining in office, that seems to be wishful thinking. Some potential considerations:

- Compromise possible: Some components of the Fiscal Cliff are not attractive to either party and government doesn’t have to figure out everything at once. Look for the possibility of compromises for things like AMT and mandatory spending cuts to occur prior to congressional recess in December.

- Bush Tax Cuts: With much of the Republican House beholden to a “no tax increase” pledge, the expiration of Bush tax cuts as of the end of the year and then a roll-back of some of those increases for lower brackets is a threat favored by the most liberal wing of the Democratic Party. To us, this would be a disappointing result, but not out of the realm of possibility. Keep an eye on the discussion of what income level is left out. President Obama has said he wants tax increases for those making over $250,000. This is a starting point, but others have talked about levels upwards of $500,000 or $1,000,000.

- Kicking the Can Down the Road: It’s certainly possible that a compromise will not be reached or mapped out prior to year-end. In the past, this has resulted in an infuriating form of procrastination by agreeing to delay a decision until some date down the road. The more this occurs, the worse off we are. We are especially concerned if there is a delay today because of the impact on corporate decision-making which is thirsting for some clear guidance about the road ahead. Further, if the arbitrary date gets too close to mid-term elections, we’ll be left with even longer odds for an agreement. That said, if there is true desire from those involved to tackle more significant tax overhaul, buying more time may be critical. The last major tax policy shift occurred in 1986. President Reagan and a Democrat-controlled Congress took two years to put a deal together, and they were more agreeable counterparties.

- Return of Volatility: Markets this year have had exceptionally low volatility when compared to recent years. Uncertainty and extreme possibilities will likely usher in very volatile returns through at least the end of the year and we’re already seeing this today. The more pain there is in the markets, the more likely that estranged parties become willing to work together for a solution. Do not be surprised if stock prices respond very positively and quickly if a compromise is reached.

Also on the Horizon

The Fiscal Cliff is not all that we should focus on as a result of the election. We are also watching:

- Federal Reserve: A Romney win would have meant much more uncertainty as to the future leader of the Federal Reserve vs. President Obama’s continued allegiance to Chairman Ben Bernanke. While Bernanke has said that he does not want to stay for another term (which ends in 2014), it is likely that the low interest rate mandate will remain with a Bernanke-esque nominee. Possible reasons for a change to the current zero interest rate policy? Robust GDP growth or significant inflation which we think may be more likely the longer easy money sticks around.

- Debt Ceiling: The current debt ceiling limit would be breached in early 2013 and coincides with the Fiscal Cliff discussions. Washington needs to remain on speaking terms to avoid the detriments of another failure to act on this issue.

- Treasury Secretary: Timothy Geithner has said he is not interested in remaining at the Treasury. President Obama’s nomination for replacement will be very important in terms of cooperation with Congress as well as opportunities to tackle the long-term debt issues for the US. Watch to see if the nominee has a reputation of bipartisanship and dealing with Congress or a more ideological persona. While the Fiscal Cliff is in the spotlight today, we believe a long-term path to sustainable growth coupled with lower government debt is a much more critical issue.

We are encouraged by several factors that may lead to better resolutions to the serious issues that must be resolved by Washington powers today. A second-term president moves from a focus on reelection to the desire for a lasting legacy. In our estimation, nothing would be deemed more critical, both by Americans today and the history books, than creating a long-term plan for debt while leaving the economy in better shape than it is today. While Republicans, especially in the House of Representatives, spent the last two years working to deny President Obama reelection, they will need more constructive accomplishments on their resume as they look toward mid-term elections in two years. Finally, there seems to be stronger organized encouragement from the business community led by Fortune 500 CEO’s encouraging both sides to set aside their differences and to come to the table.

While markets have welcomed the election results with a cold shoulder, year-to-date returns remain positive for many investments. As stated earlier, we are not surprised by more disrupted markets post-election. Uncertainty breeds volatility and we expect weeks and possibly months of posturing before we have a more clear direction going forward.

I encourage you to follow the 80/20 rule when it comes to concerns with the market: spend 80% of your time focusing on financial decisions you can control and less than 20% of your time on external worry and fear. As always, we’re here to help. Please don’t hesitate to contact us if you have any questions or concerns.

On behalf of everyone at The Center,

Melissa Joy, CFP®

Partner, Director of Investments

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Melissa Joy, CFP® and not necessarily those of RJFS or Raymond James. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users.

Year End Planning: Bonuses

Less than half of all businesses provide a year-end bonus to employees*. During the last decade, prior to the financial crisis, more than half of companies handed out bonuses. My grandfather worked for Ford Motor Company and received many bonuses over his 30 years there. But one word of wisdom that he shared with me that stuck: You don’t live on your bonus, that’s for savings.

Less than half of all businesses provide a year-end bonus to employees*. During the last decade, prior to the financial crisis, more than half of companies handed out bonuses. My grandfather worked for Ford Motor Company and received many bonuses over his 30 years there. But one word of wisdom that he shared with me that stuck: You don’t live on your bonus, that’s for savings.

Here are 5 things to consider in allocating your year-end bonus:

- Review your financial plan. Are there any changes since you last updated your financial goals?

- Have you accumulated any additional revolving debt that you don’t want to retain, if so consider paying off the highest costing debt first if you don’t have a cash flow issue?

- Are your emergency cash reserves at the appropriate level to provide for your comfort? If not consider beefing them back up.

- Are your insurance coverages where they need to be to cover anything unexpected? If not, consider re-evaluating these plans.

- Review your tax situation for the year. Make an additional deposit to the IRS if you have income that has not yet been taxed so you don’t have to make that payment and potential penalties next April.

If you can tick through the list and don’t need to put your bonus to any of those purposes, here are some other ideas: If you’re lucky enough to save your bonus, like my grandfather, consider maximizing your retirement plan at work, including the catch-up provision if you’re over 50. Also consider maximizing a ROTH IRA, if eligible, or investing in a stock purchase program at work if one is offered. Another idea is a 529 plan, which is a good vehicle for savings for educational goals. If all of these are maximized, then consider saving in your after tax (non-retirement accounts) with diversified investments.

*Source: Huffington Post

Any information is not a complete summary of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily of RJFS or Raymond James. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making an investment. Investing involves risks and you may incur a profit or loss regardless of strategy selected. Be sure to contact a qualified professional regarding your particular situation before making any investment or withdrawal decision.

FPA National Conference 3 Point Recap

On September 28th financial planners from across the nation converged on San Antonio for the 2012 FPA Experience, a national conference hosted by the Financial Planning Association (FPA). Some of the most influential leaders and contributors within the financial planning community were in attendance.

On September 28th financial planners from across the nation converged on San Antonio for the 2012 FPA Experience, a national conference hosted by the Financial Planning Association (FPA). Some of the most influential leaders and contributors within the financial planning community were in attendance.

Over a four day period they shared their collective wisdom to over 2000 conference attendees. As a first-time attendee, the conference provided an incredible opportunity to sharpen professional skills and bring back a wealth of knowledge to share with colleagues and clients. Here are a few common themes heard throughout the conference.

Retirement Distribution Planning Remains a Primary Focus

Pioneers in the distribution planning field shared extensive research as well as real world applications. Much discussion centered on initial withdrawal rates and innovative research studies that supplement past distribution studies and assumptions. It's exciting to see new approaches and strategies that begin to challenge traditional retirement income planning options. These complex and sophisticated research studies share a common goal. Help clients plan for a fulfilling retirement and in doing so, not run out of money.

Legislative (Tax) Reform Is Coming

Many discussions revolved around the uncertainties we face in tax reform and political landscape. The Fiscal Cliff remains a concern, however, opinions suggest new legislation will eventually pass and the cliff will be avoided (for now!). However, there are many components wrapped in the so-called fiscal cliff and it's likely they will continue to impact our tax and economic landscape. It's too early to say BUT not too early to plan!

Communication Is King

A variety of communication experts shared techniques ranging from compelling conversations to effective writing to social media. A consistent message heard throughout the Conference was that our ability to improve and evolve our communication skills can directly impact our success in both professional and personal lives. We continually look for ways to best provide efficient and meaningful ways to reach our clients. How? By sharing and listening to the best practices of 2000 of our closest peers. The art of communication is truly a life long journey and I believe is best summed up in a Vince Lombardi quote.

"Perfection is not attainable, but if we chase perfection we can catch excellence.

In summary, I hope my thoughts provided a brief glimpse into current and future trends.At the very least, support the "work" involved in attending these education sessions.

Any opinions are those of Center for Financial Planning, Inc. and not necessarily those of RJFS or Raymond James.

Year End Planning: Holiday Spending

Nothing louses up the family budget like the holidays. There is something about those twinkle lights and pine smell that weakens all resolve to control spending. It is estimated the average family spends $750* on gifts and for upper middle income families it is often four times that amount. This figure does not include entertaining, travel, and decorations. We all know what to do, but here are a few reminders as we approach the SEASON.

Nothing louses up the family budget like the holidays. There is something about those twinkle lights and pine smell that weakens all resolve to control spending. It is estimated the average family spends $750* on gifts and for upper middle income families it is often four times that amount. This figure does not include entertaining, travel, and decorations. We all know what to do, but here are a few reminders as we approach the SEASON.

First of all remember what it is all about. Gifting is supposed to have special meaning from the giver to the receiver. Gifting is a way of saying “thank you” or “I love and appreciate you”. If you have a large family, shorten your gift list by drawing names or giving family gifts. This is one way to cut down on the number of gifts and make the one you give more meaningful.

It is important to set a budget for holiday spending. There is no better control mechanism. If you cannot control your use of credit, go back to the old-fashioned method and pay cash. Many stores have reinstituted lay-away plans which help as well. Along with the budget comes the shopping plan. Both cut down on impulse buying.

If you are experiencing financial distress, set expectations among your family and friends. This is particularly important to do with children. Children are often unrealistic with their wish list. Discussing what is possible will help create excitement instead of disappointment. Get children involved in the spirit of the season. Gift certificates are another way to keep within your budget and are often most appreciated by the receiver.

Shop early and shop late. Many folks shop all year for the holidays so they can take advantage of sales. Late shoppers can also get great bargains especially if they can be flexible in their gifting. If you are shipping gifts, seek those stores that give free shipping to save a bundle.

Consider home-made gifts. Busy families and seniors so appreciate a basket of home-made goodies. When one of our daughters was going through a tight financial situation she made the most ingenious gifts—a colorful winter scarf, a charming basket we use for magazine storage, and a hand tiled serving tray. It is interesting that I cherish and use those gifts but I could not tell you what I received last year.

Last but not least, keep your holidays simple and enjoyable. Remember it is not the amount you spend, but rather the quality of the time and thoughtfulness you spend on giving that counts. Happy Holidays.

*Source: National Retail Federation 10/17/2012

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.