In our busy lives, both at home and at work, it can often seem as if there are just not enough hours in the day to accomplish everything we’d like. Despite our busy schedules, it is our responsibility as trusted advisors to step out of the office occasionally to better ourselves both professionally and personally. I was fortunate enough to attend the 2013 Financial Planning Association (FPA) Fall Symposium in late September. The FPA is a well-known and respected organization in the financial planning profession giving advisors the chance to network; discuss better business practices and, most importantly, learn from each other’s experiences. Over the two-day event, Matt Trujillo, Sandy Adams and I attended close to 10 presentations regarding the market, the economy and various financial planning strategies. While I won’t bore you with every “take-away” we found extremely helpful and useful, here are some key points discussed at the conference that I felt clients would find valuable and beneficial:

In our busy lives, both at home and at work, it can often seem as if there are just not enough hours in the day to accomplish everything we’d like. Despite our busy schedules, it is our responsibility as trusted advisors to step out of the office occasionally to better ourselves both professionally and personally. I was fortunate enough to attend the 2013 Financial Planning Association (FPA) Fall Symposium in late September. The FPA is a well-known and respected organization in the financial planning profession giving advisors the chance to network; discuss better business practices and, most importantly, learn from each other’s experiences. Over the two-day event, Matt Trujillo, Sandy Adams and I attended close to 10 presentations regarding the market, the economy and various financial planning strategies. While I won’t bore you with every “take-away” we found extremely helpful and useful, here are some key points discussed at the conference that I felt clients would find valuable and beneficial:

Key Points

- Stay Smart: Under stress (such as experiencing a market downturn) studies have shown that IQ levels drop an average of 13%. It is extremely important for us to remind clients of the negative effects of poor investment decisions during stressful periods in the market and to help guide them through these turbulent times.

- Make it Personal: Labeling accounts has been shown to increase saving on average by 50%. For example, labeling a checking or savings account as “Jane’s college fund” greatly increases the savings level by adding a personal touch or goal to the account.

- What to Watch: Although domestic equities have done phenomenally this year, valuations still point to potential further appreciation, as price-to-earning (P/E) ratios are approximately 7% below the historical average.

- Eye on Europe: Many portfolio managers and market strategists are forecasting a strong outlook for international equities in the coming years as Europe emerges out of their recession.

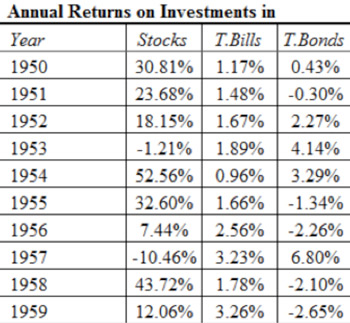

- Bond Buzz: Despite rising interest rate environments, investors should still consider bonds! Bonds act as a diversifier to the equity portion of the portfolio and can be a very integral piece of the investment puzzle. We think investors should be focusing on shorter duration bonds to hedge against interest rate risk.

Several of these points have been on our investment team’s radar for quite some time and we are still implementing them within client portfolios. It is, however, a nice feeling to know many of the suggestions made by some very bright speakers were things we at the Center do for clients on a daily basis.

One of my favorite quotes from the symposium was this: “The future is more consistent than the present”. As much as I wish I had that highly sought-after crystal ball, we cannot possibly predict what the market will do on a day-to-day basis. What we can do, however, is help guide clients over many years and walk them through each stage of their financial plan to help ensure long-term success, which as the quote states, is far more predictable –something we can all value and appreciate.

Nick Defenthaler, CFP® is a Support Associate at Center for Financial Planning, Inc. Nick currently assists Center planners and clients, and is a contributor to Money Centered and Center Connections.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation or an offer to buy or sell any investment referred to herein. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Any opinions are those of Nick Defenthaler, CFP and not necessarily those of RJFS or Raymond James. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing involves risk and investors may incur a profit or a loss. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation or an offer to buy or sell any investment referred to herein. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Any opinions are those of [FANAME] and not necessarily those of RJFS or Raymond James. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise,bond prices fall and when interest rates fall, bond prices generally rise. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing involves risk and investors may incur a profit or a loss. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.