I learned to play chess when I was 8 years old. The game always appealed to me because of the complex strategy and tactics involved. Although I always enjoyed the game I never took it seriously until I was a little older. After I graduated college and had a little money in my pocket, I decided to start competing in major tournaments and was very proud to win the state of Michigan Chess Championship in 2009 and 2011. With this strong love and passion for the game of chess, it’s no coincidence that I ended up in finance. There are several parallels between chess and finance, but here are a few of the most noteworthy.

I learned to play chess when I was 8 years old. The game always appealed to me because of the complex strategy and tactics involved. Although I always enjoyed the game I never took it seriously until I was a little older. After I graduated college and had a little money in my pocket, I decided to start competing in major tournaments and was very proud to win the state of Michigan Chess Championship in 2009 and 2011. With this strong love and passion for the game of chess, it’s no coincidence that I ended up in finance. There are several parallels between chess and finance, but here are a few of the most noteworthy.

Coordination of Pieces

In chess utilizing your pieces in a coordinated approach is one of the biggest keys to success. To the amateur chess player this can be a very daunting task. How could a knight, queen, bishop, pawn, and rook, which all move differently, be used in a coordinated, synchronized attack? The exact answer to that could fill a whole book, but suffice to say it can be done. Similarly, in finance, think of all the moving parts to your personal situation and think of all the relevant questions that might stem from the various personal financial decisions. Am I saving enough for retirement? When can I retire? What are the tax implications of my investments? Do I have enough Life Insurance? Do I have the right type of Insurances? Do I need a will and a trust? Should I have an emergency savings account and how much should be in it? Am I maximizing my benefits at work? These are just a few of the hundreds of potential questions that we at The Center answer on a daily basis. In chess terms we would say don’t consider moving one piece without considering what effect it will have on the rest of the army.

Patience and Discipline

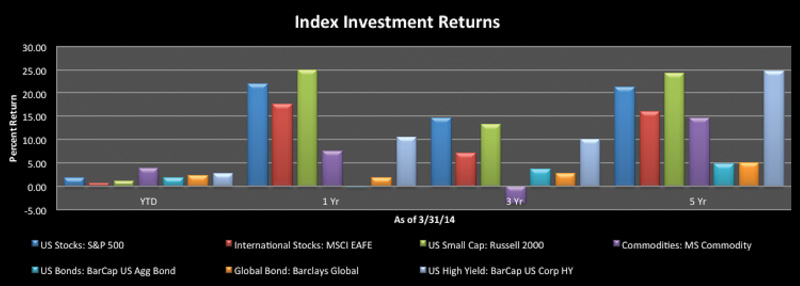

Playing competitive chess at a high level you have to be very patient and disciplined. If you’re too hasty you could easily squander your advantage. It’s best to slowly improve your position until your army is as efficiently placed as possible. In finance, especially with retirement investing, you have to be very disciplined to stick to your asset allocation in good times and in bad.

Controlling Emotions

Let’s face it, money can be a very emotional subject. However, making emotional decisions when it comes to money is seldom a good idea. The same is true for chess. It’s not unusual to find yourself in a difficult position where your opponent is throwing everything but the kitchen sink at you. The emotional response is to give up and throw in the towel, but the true chess masters are able to control that natural human response and fight on. I have had many beautiful games where I was dead lost, but I refused to give up, and ultimately was able to pull through. Many investors probably felt the same way in 2008 when it might have seemed the entire stock market was going to implode. A lot of people couldn’t handle the emotions involved, and unfortunately moved to cash at the worst possible time. Those able to overcome the natural human response to flee to cash were probably in a better position when the market rebounded.

Team Game

Chess is a team sport. Well not really…but I’ve found the biggest improvements I’ve made as a player have come when other professional chess players critique my games. No matter how good you are, there is always room for improvement and ways to look at the same old positions in a different light. The same is true in finance. At The Center, each of our clients has a dedicated team of professionals to service their personal financial situation. The lead financial planner, the support planner, and the client service associate are always making sure we are working as diligently as possible to help clients improve their overall financial position.

You should never feel like a pawn when it comes to your financial plan. You are in control and with coordination, patience, control, and helpful advisors you can find a suitable strategy.

Matthew Trujillo is a Registered Support Associate at Center for Financial Planning, Inc. Matt currently assists Center planners and clients, and is a contributor to Money Centered.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc. and not necessarily those of Raymond James. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. C14-009192