What does a financial planning geek do for fun? He visits the Wharton School of the University of Pennsylvania for a day of lectures! The first part of the day was spent hearing from Professor Richard C. Marston. Professor Marston is the James R.F. Guy Professor at Wharton, a graduate of Yale, MIT, and Oxford (on the east coast they would call him “wicked smart”). Moreover, he has taught asset allocation for over twenty years and in 2011 wrote the book Portfolio Design: A Modern Approach to Asset Allocation (Wiley, 2011). Needless to say, it was a thought-provoking and worthwhile day.

What does a financial planning geek do for fun? He visits the Wharton School of the University of Pennsylvania for a day of lectures! The first part of the day was spent hearing from Professor Richard C. Marston. Professor Marston is the James R.F. Guy Professor at Wharton, a graduate of Yale, MIT, and Oxford (on the east coast they would call him “wicked smart”). Moreover, he has taught asset allocation for over twenty years and in 2011 wrote the book Portfolio Design: A Modern Approach to Asset Allocation (Wiley, 2011). Needless to say, it was a thought-provoking and worthwhile day.

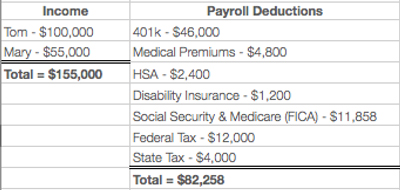

In two lectures -- the first taken from his new book, Investing for a Lifetime” Managing Wealth for the “New Normal” and the second titled “Investing with a Fifteen Year Perspective: Past and Future” – Marston shared what he believes to be some “best practices” in savings and investing. He talked about choosing an asset allocation focusing on stocks when you are still years from retirement. You then gradually shift towards a 50/50 portfolio while saving 15%-20% of income during the accumulation period. And once you reach retirement, he discussed spending 4% of accumulated wealth. My sense is that these are consistent messages that our clients have heard from us over the years.

During one of the wicked smart professor’s lectures, he shared that as he gets older, he has a greater appreciation for the role that investor and advisor behavior plays in ultimate investment success. For example, he believes in using active managers. He also believes that selecting the right investments is important (and he is paid by several family offices to do so), but behavior such as letting fear or greed control actions plays a critical role as well.

Professor Marston’s recent work also focuses on determining a savings goal for retirement. A common rule of thumb is that investors must save 8 times their income before they retire. So, if you earn $100k, then you need $800k saved at retirement. Professor Marston was intrigued by the simplicity of the general rule and decided to put it through his own analysis. In the end, his analysis suggested that 8 times income is probably too low for most people. His own conclusions, obviously depending on the exact assumptions, ranged from 11.5 to 18.4 times income. In his opinion, your savings goals will vary widely depending on two main factors:

- If you are single: Your savings must be higher because a couple will receive more in social security benefits at the same earnings (consider it a marriage premium).

- If you earn much more than $100k: Your savings rate needs to be higher because social security plays a lessor role in your retirement income.

As a quick aside, I was pleased to hear Professor Marston include and emphasize the importance of social security in the retirement planning analysis. Without it, the savings rates above would need to be increased significantly. I invite you to read our many previous posts on social security and let us know if we can help answer any questions.

On the flight home from the lectures, I read Professor Marston’s newest book Investing for a Lifetime (Wiley, 2014). It’s about making saving and investing understandable to the investor. Probably the most important statement, that occurs early and often, is SAVING IS MORE DIFFICULT THAN INVESTING. Meeting your life goals, such as retirement, is much more dependent on our savings than getting another 1% from investment portfolios. As I have written in the past, saving is much more than dollars and cents; it takes discipline and perseverance.

For our long-time clients, the book would provide a good refresher on many of the concepts we have discussed and encouraged over the years. If you have a family member or friend starting their career or looking to take more control of their finances, Professor Marston has the ability to make the complex simple and I think his books would be a wonderful gift.

The second part of my Wharton School visit was spent hearing from Professor Christopher Geczy, Ph.D., another wicked smart guy. I will leave that review for another post. If you like Alpha, Beta, Correlation coefficient, Standard Deviation, R Squared, Systematic risk, and Idiosyncratic risk…well you are in for a treat!

Timothy Wyman, CFP®, JD is the Managing Partner and Financial Planner at Center for Financial Planning, Inc. and is a frequent contributor to national media including appearances on Good Morning America Weekend Edition and WDIV Channel 4 News and published articles including Forbes and The Wall Street Journal. A leader in his profession, Tim served on the National Board of Directors for the 28,000 member Financial Planning Association™ (FPA®), trained and mentored hundreds of CFP® practitioners and is a frequent speaker to organizations and businesses on various financial planning topics.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning Inc. and Richard C. Marston and not necessarily those of RJFS or Raymond James. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involves risk and you may incur a profit or a loss regardless of strategy selected. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Asset allocation does not ensure a profit or guarantee against a loss. C14-026186

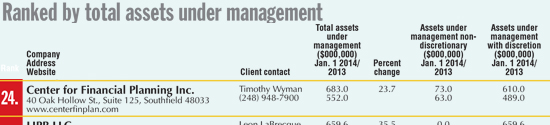

For the second consecutive year, Center for Financial Planning has been recognized as one of the Detroit area’s largest money managers. The annual Top 25 recognition is a big deal to us because it means we are making our mark in southeast Michigan and beyond.

For the second consecutive year, Center for Financial Planning has been recognized as one of the Detroit area’s largest money managers. The annual Top 25 recognition is a big deal to us because it means we are making our mark in southeast Michigan and beyond.