Socially responsible investing (SRI) is a rapidly expanding option in the investment arena. This includes Environment, Social and Governance (ESG) criteria in the stock and bond selection process. This approach to investing looks beyond simple financial return, allowing individuals and institutions to express their personal values and ideals with their investments.

Millennials more interested in ESG strategies

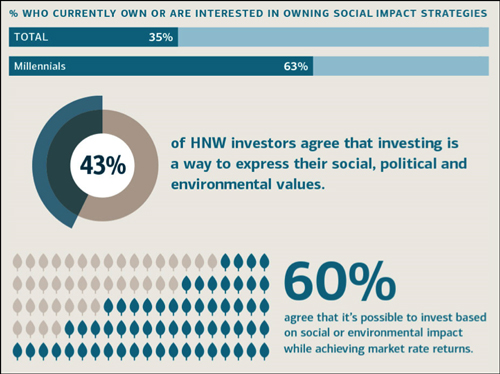

We are starting to see generational differences in investing as younger high net worth investors are more interested in expressing their values through investing. For example, in a survey conducted by U.S. Trust Insights, 63% of Millennials (individuals born between 1980 and 2000) are interested in owning socially responsible strategies versus just 35% of the total number of responders. These investors believe that they also don’t have to give up returns in order to do so as 60% believe it is possible to achieve market rates of returns while investing in ESG strategies.

Source: U.S. Trust Insights on Wealth and Worth Annual Survey

The Center Expands ESG Recommendations

Based on increasing demand from our clients, our investment committee and research department have expanded our recommended list to include companies that offer these types of investment strategies. Having applied our same rigorous due diligence process to these selections, we feel we have an excellent combination of managers in a variety of asset classes that will allow our clients to express their ideals in the way they invest their assets (see our recent blog on this). If you are looking for ways to express your values through your investments don’t hesitate to contact us!

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well as investment updates at The Center.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success. Material is provided for informational purposes only and does not constitute a recommendation. C14-040265