Contributed by: Nick Defenthaler, CFP®

If you’re married and eligible to receive a pension upon retirement, chances are you will be making an election for a survivor benefit before you start collecting. What should you choose when it’s time to elect your payment option?

As a quick refresher, when a pension has a survivor benefit attached to it, the income stream the pension provides goes through the lifetime of you and your spouse. Depending on the level of the survivor benefit, you could see a large discrepancy in the payment amount that the pension ultimately provides while both spouses are still alive.

For example, the monthly payment a 100% survivor benefit provides will be much lower than the monthly payment a 25% survivor benefit would provide. This is because the 100% survivor option offers a guaranteed continuation of full benefits to the surviving spouse as compared to only a 25% continuation of benefits. In reality, a survivor benefit is an “insurance policy” on your pension! The reduction in monthly benefits by having a survivor option is like the “monthly premium” on that insurance policy.

Case Study

Let’s take a look at an example of how selecting a survivor option could vary depending on your family’s unique, personal situation:

Nancy (age 65) and Steve (age 64) are evaluating Nancy’s pension options as she approaches retirement in a few months. Unfortunately, Nancy has had heart issues over the years and does not have longevity in her family. Steve on the other hand, is in great shape and plans on living into his nineties. Below are the pension options Nancy has to choose from:

100% Survivor Option

$42,000/year to Nancy: Steve would receive $42,000/year if Nancy dies first

50% Survivor Option

$46,000/year to Nancy: Steve would receive $23,000/year if Nancy dies first

25% Survivor Option

$48,000/year to Nancy: Steve would receive $12,000/year if Nancy dies first

Straight-Life Option (No Survivor Benefit)

$50,000/yr to Nancy: No continuation of payments for Steve when Nancy dies

Due to Nancy’s health issues, the straight-life option would likely not be advisable. There is a very high likelihood that Nancy pre-deceases Steve so they would not want to select an option that would provide zero continuation of benefits, especially considering the size of the pension payment. In a similar vein, Nancy and Steve are not comfortable with Steve only receiving 25% of Nancy’s pension if she passes before him, primarily due to Nancy’s health issues. At this point, they have narrowed their options down to the 100% survivor or 50% survivor benefit election.

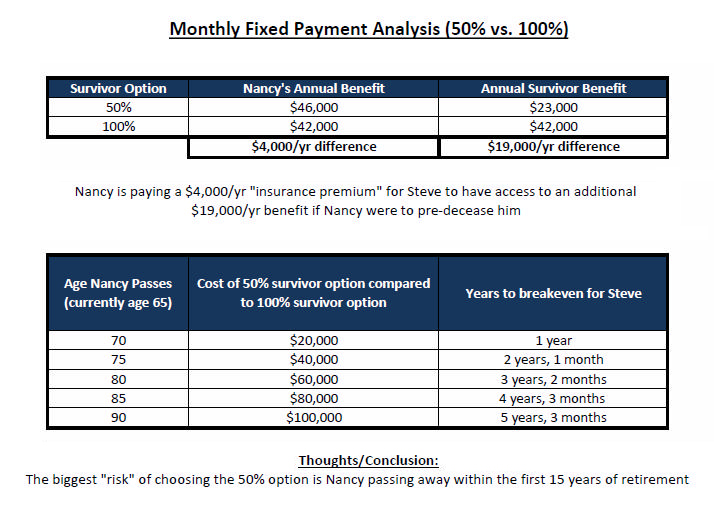

Because Nancy is a number cruncher, we created a spreadsheet to analyze the value of maintaining a larger survivor benefit, assuming she pre-dececeases Steve at various ages:

While it’s all well and good that Steve would receive a higher continuation of benefits if Nancy passes before him under the 100% survivor option, we have to remember that there is a “cost” to this pension option ($4,000/yr lower payout compared to the 50% survivor option). However, as the table above shows, it does not take long at all for Steve to “break even” on the cost of the $4,000/yr “insurance premium”.

After reviewing the numbers in detail, Steve and Nancy decided to elect the 100% survivor option. They arrived at this decision primarily because of Nancy’s reduced life expectancy. In addition, if she does die before Steve within the first 15 years of retirement (a very likely possibility), it only takes several years for the larger survivor benefit to make up for the lower pension payment Nancy would have received during her life, especially taking into consideration Steve’s good health.

As you can see from our example, many factors come into play when selecting a pension benefit and survivor option. While it might be human nature to ask which option is best, unless we have the proverbial crystal ball to look into the future and see what life has in store for us over the next 30+ years, it’s impossible to provide a concrete answer.

When evaluating pension options, my number one goal as a fiduciary advisor is to provide a sound recommendation that aligns with your own personal situation and retirement goals. If our team can be a resource for you in evaluating your pension decision, please feel free to reach out to us.

See Part 2 of the series, What You Need to Know About Pension Benefit Guaranty Corporation or PBGC. Part 3 Explaining the What is "Restore" Option for Pensions I invite you to listen to a replay of my webinar from April 24th at 1:00 pm on Retirement Income Planning: How Will You Get Paid in Retirement?

The case study and accompanying chart have been provided for illustrative purposes only. Individual cases will vary

Nick Defenthaler, CFP® is a CERTIFIED FINANCIAL PLANNER™ at Center for Financial Planning, Inc.® Nick works closely with Center clients and is also the Director of The Center’s Financial Planning Department. He is also a frequent contributor to the firm’s blogs and educational webinars.