Contributed by: Nick Defenthaler, CFP®

It’s hard to believe, but it’s been nearly seven years since Governor Snyder signed his budget balancing plan into law in 2011, which became effective January 1, 2012. As a result, Michigan joined the majority of states in the country in taxing pension and retirement account income (401k, 403b, IRA, distributions) at the state income tax rate of 4.25%.

As a refresher, here are the different age categories that will determine the taxability of your pension:

1) IF YOU WERE BORN BEFORE 1946:

Benefits are exempt from Michigan state tax up to $50,509 if filing single, or $101,019 if married filing jointly.

2) IF YOU WERE BORN BETWEEN 1946 AND 1952:

Benefits are exempt from Michigan state tax up to $20,000 if filing single, or $40,000 if married filing jointly.

3) IF YOU WERE BORN AFTER 1952:

Benefits are fully taxable in Michigan.

What happens when spouses have birth years in different age categories? Great question! The state has offered favorable treatment in this situation and uses the oldest spouse’s birthdate to determine the applicable age category. For example, if Mark (age 65, born in 1953) and Tina (age 70, born in 1948) have combined pension and IRA income of $60,000, only $20,000 of it will be subject to Michigan state income tax ($60,000 – $40,000). Tina’s birth year of 1948 is used to determine the applicable exemption amount – in this case, $40,000 because they file their taxes jointly.

While this taxing benefits law angered many, I do think it’s important to note that it’s a very common practice for states to impose a tax on retirement income. The following states are the only ones that do not tax retirement income (most of which do not carry any state tax at all) – Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Illinois, Mississippi, Pennsylvania, and Wyoming. Also, Michigan is 1 of 37 states that still does not tax Social Security benefits.

Here is a neat look at how the various states across the country match up against one another when it comes to the various forms of taxation:

Source: www.michigan.gov/taxes

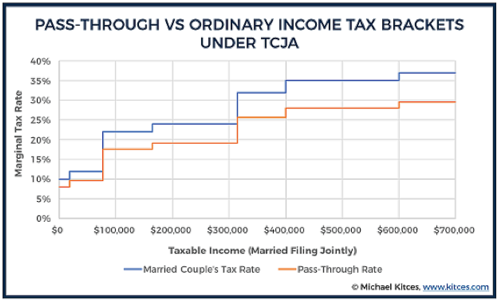

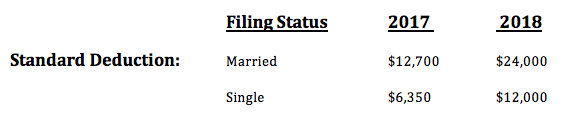

Taxes, both federal and state, play a major role in one’s overall retirement income planning strategy. Often, there are strategies that could potentially reduce your overall tax bill by being intentional on how you draw income once retired. If you’d ever like to dig into your situation to see if there are planning opportunities you should be taking advantage of, please reach out to us for guidance.

Nick Defenthaler, CFP® is a CERTIFIED FINANCIAL PLANNER™ at Center for Financial Planning, Inc.® Nick works closely with Center clients and is also the Director of The Center’s Financial Planning Department. He is also a frequent contributor to the firm’s blogs and educational webinars.

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Nick Defenthaler and not necessarily those of Raymond James. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. The above is a hypothetical example for illustration purposes only.