Contributed by: Laurie Renchik, CFP®, MBA

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

Washington has been busy and after many twists and turns sweeping tax reform was signed into law on December 22, 2017. There are key changes for homeowners regarding the mortgage and home equity line of credit (HELOC) interest deductions.

Mortgage

If you own a home, mortgage interest is still deductible. The debt cap of deductibility, however, has been lowered. The new cap limits interest deductibility to the first $750,000 of debt principal. Debt principal refers to acquisition indebtedness or loans used to acquire, build, or substantially improve a primary residence. The new $750,000 cap is a reduction from $1,000,000 and an additional $100,000 of home equity debt.

The reduction to $750,000 expires December 31, 2025 and reverts back to $1,000,000 beginning in 2026.

Mortgage debt incurred before December 15, 2017 is grandfathered under the $1,000,000 cap

In the future, a mortgage refinance for debt incurred prior to December 15, 2017 will retain the $1 million debt limit (but only for the remaining debt balance and not any additional debt). In addition, any houses that were under a binding written contract by December 15th to close on a principal residence purchased by January 1, 2018 (and actually close by April 1st) will be grandfathered.

Home Equity Line of Credit (HELOC)

Home equity lines of credit give homeowners the ability to borrow or draw money using equity in the home as collateral. New restrictions mean that home equity loan interest is not necessarily eligible for a deduction.

While you may have read that interest on HELOC’s is no longer deductible, this is only if the loans are cash out or for purposes other than home purchase or improvement. It’s important to note that deductibility is not based on whether the loan is a home equity loan or home equity line of credit. Instead, the determination is based on how the proceeds are used.

If the money is used to consolidate debt, pay for college or used for any other personal spending not associated with home acquisition or substantial improvement, the interest is not deductible; without grandfathering.

Interest on a HELOC up to the total $750,000 cap that is used to build an addition or substantially improve the home is deductible for taxpayers that itemize.

We are here to assist in any way we can. This summary of mortgage and HELOC interest deductibility changes highlights key areas to keep in mind for 2018 tax planning. If you have any questions regarding your personal situation, don’t hesitate to contact us.

Laurie Renchik, CFP®, MBA is a Partner and Senior Financial Planner at Center for Financial Planning, Inc.® In addition to working with women who are in the midst of a transition (career change, receiving an inheritance, losing a life partner, divorce or remarriage), Laurie works with clients who are planning for retirement. Laurie is a member of the Leadership Oakland Alumni Association and is a frequent contributor to Money Centered.

Check out our other Tax Reform articles:

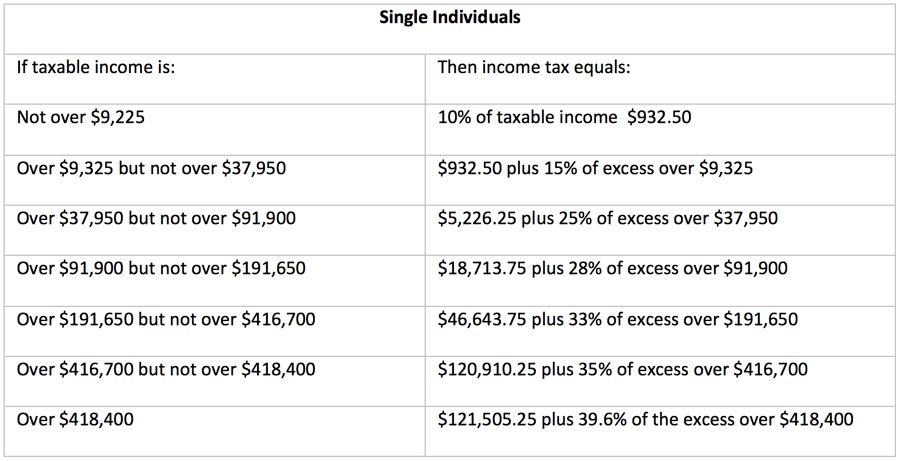

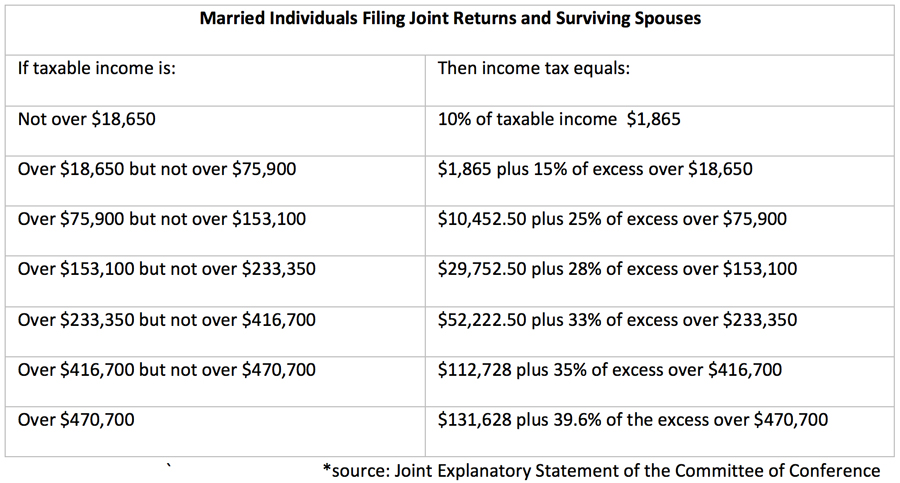

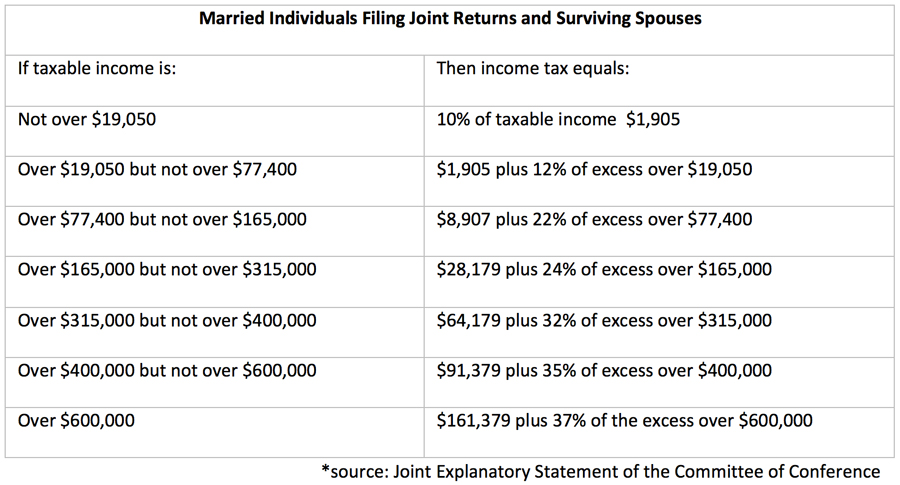

Changes to Federal Income Tax Brackets

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Laurie Renchik and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. This material is being provided for information purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Raymond James Financial Services and your Raymond James Financial Advisors do not solicit or offer residential mortgage products and are unable to accept any residential mortgage loan applications or to offer or negotiate terms of any such loan. You will be referred to a qualified Raymond James Bank employee for your residential mortgage lending needs.