Contributed by: Nick Defenthaler, CFP®

Contributed by: Nick Defenthaler, CFP®

Saving 1% more towards retirement for the final 10 years of one’s career has the same impact as working one month longer.

Yes, you read that correctly. Saving 15% in your 401k instead of 14% for the 10 years leading up to retirement has the same impact as delaying retirement by only 30 days! Hard to believe but that’s exactly what the National Bureau of Economic Research found in their 2018 research paper titled “The Power of Working Longer”. To make your eyes pop even more, consider that saving 1% more for 30 years was shown to have the same impact as working 3-4 months longer. Wow!

If you’re like me, you find these statistics absolutely incredible. This clearly highlights the impact that working longer has on your retirement plan. As we’re getting very close to retirement (usually five years or less), most of us won’t be able to make a meaningful impact on our 25-35 year retirement horizon by increasing our savings rate. At this point in our careers, it just doesn’t move the needle the way you might think it would.

Without question, the best way you can increase the probability of success for your retirement income strategy in the latter stages of your career is to work longer. But when I say “working longer”, I don’t necessarily mean working longer on a full-time basis.

A trend I am seeing more and more, one that excites me, is a concept known as “phased retirement”. This essentially means that you’re easing into retirement and not going from working full-time to quitting work cold turkey. We as humans tend to view retirement as “all on” or “all off”. If you ask me, that’s the wrong approach. We need to start thinking of part-time employment as part of an overall financial game plan.

Let’s look at a real-life client I recently encountered (whose name was changed to protect identity):

Mary, age 62, came in for her annual planning meeting and shared with me that the stress of her well-paying sales position was completely wearing her down. At this stage in her life and career, she no longer had the energy for the 50-hour work weeks and frequent travel. Now a grandmother of three, she wanted to spend more time with her kids and grandkids but feared that retiring at 62, compared with our plan of 65, would impact her long-term financial picture.

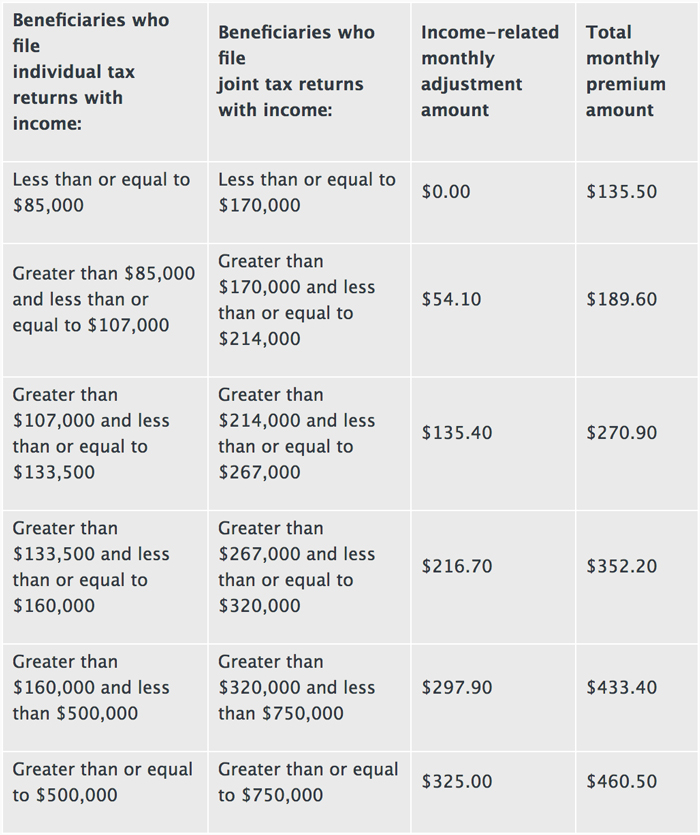

The more we talked, the more clear it became that Mary did not want to completely stop working; she just could not take the full-time grind anymore. When we put pen to paper, we concluded that she could still achieve her desired retirement income goal by working part-time for the next three years (to get her to Medicare age). Her income would drop to a level that would not allow her to save at all for retirement, but believe it or not, that had no meaningful impact on her long-term plan. Earning enough money to cover virtually all of her living expenses and not dipping into her portfolio until age 65 was the key factor.

Having conversations around your desired retirement age is obviously a critical component to your overall planning. However, a sometimes overlooked question is, “WHY do you want to retire at that age?”. As a society, we do a good job of creating social norms in many aspects of life, and retirement is not immune to this. I’ve actually heard several clients respond to this question with, “Because that’s the age you’re supposed to retire!”. When I hear this, I get nervous, because these folks usually make it three months into the retirement transition, only to find they are not truly happy. They found purpose in their careers, they enjoyed the social aspects of their jobs, and they loved keeping busy, whether or not they realized it at the time.

The bottom line is this: Don’t discount the effectiveness of easing into full retirement, both from a financial and lifestyle standpoint.

Some clients have found a great deal of happiness during this stage of life by working less, trying a different career, or even starting a small business they’ve dreamed about for years. The possibilities are endless. Have an open mind and find the balance that works for you, that’s what it’s all about.

Nick Defenthaler, CFP®, is a CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® He contributed to a PBS documentary on the importance of saving for retirement and has been a trusted source for national media outlets, including CNBC, MSN Money, Financial Planning Magazine, and OnWallStreet.com.

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Opinions expressed in the attached article are those of the author and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss.