Mount Everest. One of the most beautiful, natural wonders in the world. With an elevation of just over 29,000 feet, it is the highest mountain above sea level on the planet. As you would expect, climbing Mount Everest is an incredibly difficult and dangerous feat. Sadly, over 375 people have lost their lives making the trek. One thing that might surprise you is that the vast majority who have died on the mountain, did not pass away while climbing to the top. Believe it or not, it’s actually the climb down, or descent, that has caused the greatest amount of fatalities.

Case in point, Eric Arnold was a multiple Mount Everest climber who sadly died in 2016 on one of his climbs. Before he passed, he was interviewed by a local media outlet and was quoted as saying “two-thirds of the accidents happen on the way down. If you get euphoric and think ‘I have reached my goal,’ the most dangerous part is still ahead of you.” Eric’s quote really struck me and I couldn’t help but think of the parallels his words had with retirement planning and how we, as advisers, help serve clients. Let me explain.

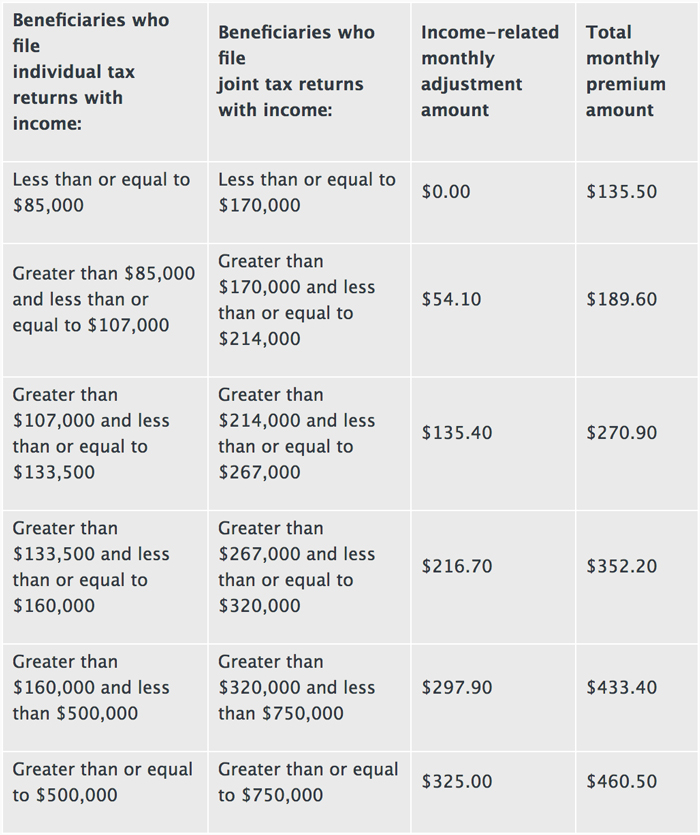

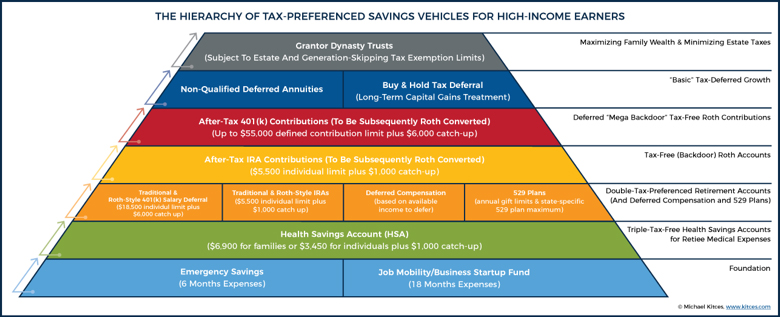

Most of us will work 40+ years, save diligently, and hopefully invest wisely with the guidance of a trusted professional with the goal of retiring and happily living out the ‘golden years.' It can be an exhilarating feeling – getting towards the end of your career, knowing that you’ve accumulated sufficient assets to achieve the goals you’ve set forth for you and your family. However, we can’t forget that the climb is only half way done. We have to continue working together and develop a quality plan to help you on your climb down the mountain as well! When do I take Social Security? Which pension option should I elect? How do I navigate Medicare? Which accounts do I draw from to get me the money I need to live on in the most tax-efficient manner? Even though you’ve reached the peak of the mountain – aka retirement, we have to recognize that the work is far from over. There are still monumental financial decisions that need to be made during the years you aren’t working that most of us simply can’t afford to get wrong.

As with those who climb Mount Everest, many financial plans that are in good shape when entering retirement can easily be derailed on the descent or when funds start to be withdrawn from your portfolio – aka the “decumulation” phase of retirement planning. A quality financial and investment strategy doesn’t end upon retirement – this is the time when proper planning becomes even more critical. Email me if I can help you on the climb – both on the way up and on the way down the mountain. Learn more about our process here.