WDIV Channel 4 sits down with The Center's Timothy Wyman, CFP, JD to talk about tough pension choices General Motors retirees face. Watch the video and read more here.

Need help making good financial decisions?

You are not alone. There are few people who should even attempt charting their financial course without consulting someone else. Even experts ask others for advice! So, I offer 7 key components to helping you find the right person to help you make the best decisions possible for you:

You are not alone. There are few people who should even attempt charting their financial course without consulting someone else. Even experts ask others for advice! So, I offer 7 key components to helping you find the right person to help you make the best decisions possible for you:

- Experience: Reflecting back on my career, I am always amazed at how green we are in the first 10 years of our careers. I would recommend that you seek an advisor with a minimum of 10 years of on-the-job work experience before handing over the keys to your largest financial decisions. Make sure that the work experience is hands-on and specific to your needs. Ask them about their experimental practice history. What was their greatest mistake or great new awareness surrounding the people they help?

- Qualifications: Make sure the financial professional is a CFP® practitioner, a Certified Public Accountant-Personal Financial Specialist (CPA-PFS), or a Chartered Financial Consultant (ChFC).

- Services: Ideally, the first meeting is free so you can see if the relationship is a good fit. At the first meeting, spend time trying to understand if your values are aligned and if the financial planning professional really cares about you and your goals. Ask for a list of services the financial planner offers or the scope of the engagement options. This should define the scope of work and the costs. Ask the planner to provide you with a written agreement that details the services that will be provided. Keep this document in your files for future reference.

- How their firm works: The financial planner may work with you or have others in the office assist. You may want to meet everyone who will be working with you. If the planner works with professionals outside his/her own practice (such as attorneys, insurance agents or tax specialists) to develop or carry out financial planning recommendations, get a list of their names to check on them all out.

- Compensation: As part of your financial planning agreement, the financial planner should clearly tell you in writing how he/she will be paid for the services to be provided. Planners can be paid in several ways (i.e. Commissions, fees, or a combination).

- Other costs: While the amount you pay the planner will depend on your particular needs, the financial planner should be able to provide you with an estimate of possible costs based on the work to be performed. Such costs should include the planner’s hourly rates or fees or the percentage he would receive as commission on products you may purchase as part of the financial planning recommendations.

- Complaint history: Ask what organizations the planner is regulated by and contact these groups to conduct a background check. All financial planners who have registered as investment advisers with the Securities and Exchange Commission or state securities agencies. Or, if they are associated with a company that is registered as an investment adviser, they must be able to provide you with a disclosure form called Form ADV Part II or the state equivalent of that form.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Angela Palacios & Melissa Joy attend Morningstar Investment Conference

Our Investment Department capped off a busy investment research spring by attending the Morningstar Investment Conference in Chicago this June. The annual conference features portfolio managers, thought leaders in the investment profession, and academics on timely topics.

“This is always a highlight of the year for the investment department. We see more portfolio managers and friends in our business than at any other time,” said Melissa Joy. “I especially enjoy the conference because it is exclusively focused on investing so you have three days to think deeply about the investment landscape today.”

Highlights this year included a variety of opinions on the EuroZone, discussions on the impacts of trading costs to portfolios, and one-on-one discussions with portfolio managers. The Center has been at the conference for each of the last 10 years.

Angela Palacios attended a pre-conference training on our new investment research software, Morningstar Direct. This upgrades our investment research capabilities going from a database of only the US public investment universe to an institutional investment platform that offers global investment research with rigorous analytics.

Angela said “It was a great opportunity to attend a training and user conference for our new software. I’m confident the software will streamline our research process and give us more accurate and in-depth knowledge to make investment decisions.” She was able to hear from Senior Research Analysts and Economists with Morningstar and also speak with other firms with a dedication to investment research.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any opinions are those of Melissa Joy and Angela Palacios and not necessarily those of RJFS or Raymond James

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE.

The Perfect Recipe for a Balanced Life for the Sandwich Generation

I think I’m like many Americans that struggle to find personal time amongst the chaos of working full time, raising two children, balancing family relationships, and other obligations (school, church, volunteer work, etc.). And I am not even one of the many Americans between the ages of 40 and 60 who are raising children AND assisting aging parents. If I have trouble finding time to balance my life with only one family to raise, how can these members of the “Sandwich Generation” do it?

I think I’m like many Americans that struggle to find personal time amongst the chaos of working full time, raising two children, balancing family relationships, and other obligations (school, church, volunteer work, etc.). And I am not even one of the many Americans between the ages of 40 and 60 who are raising children AND assisting aging parents. If I have trouble finding time to balance my life with only one family to raise, how can these members of the “Sandwich Generation” do it?

I had a client of mine explain it this way, “You have to run your family like a business, that’s the bottom line.” While there are certainly feelings and emotions that complicate the dynamics of these family situations, there has to be a way to get things done without sacrificing all of your time, your relationships, or your sanity.

Here are 3 ways to managing your multi-tiered family like a business:

- Plan Strategically – The key here is to have a plan; to be proactive rather than reactive. Know what has to be done, when it needs to be done, and how it will be paid for. This includes creating master calendars for who needs to be where and arranging transportation).

- Manage Resources – Make sure you have the tools in place to make things happen (legal documents, financial resources, and human resources). If you don’t have the pieces in place to make things happen when the time comes, you end up in crisis mode. This involves making sure legal documents like durable powers of attorney are in place and arranging for help that is either paid or volunteer for things like care assistance, bill paying, etc.

- Departmentalize – You are the manager of the family business, which means you oversee but do not need to perform every task. Make sure that the right people are handling the right tasks, and that everyone is doing their part. This means involving all family members to do their share (including adult siblings) and hiring the right professionals to handle the duties that are outside your area of expertise (Geriatric Care Managers, Elder Law Attorneys, Financial Planners, etc.).

Before trying to handle every duty that comes managing a multi-tiered family, consider viewing your family like a business. Doing so will ensure that everyone is served best, and will provide you time to maintain a balanced and quality life.

Please feel free to contact me for additional tips on establishing and managing your family business.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Investment Commentary - 3rd Quarter 2012

Stock returns as measured by the S&P 500 were in the hole for the quarter coming into June. They rallied somewhat for the month so that those invested accordingly had the potential to recover some. This time of year also marks some of our most intense research activities including the Morningstar Investment Conference. I summed up our thoughts on portfolio positioning and the Eurozone in a special June update so I'd like to discuss some new trends and themes today.

A laundry list of news items are catching our attention today. They converge to create a growing tally of changes at the margin which may have investment implications for you.

-

We've sent you several communications about the changes to General Motors and Ford pensions. Even if you are not directly impacted, there may see similar changes if you have a defined benefit plan. Analysts believe that this is the start of a new wave of offloading pension obligations and that more announcements from other companies may follow. Our experiences show that the decisions to take a pension or lump-sum buyouts is largely personal and complex based upon your overall financial situation.

- Around the world, interest rates have been falling as slowing growth in China and EuroCrisis have been answered by government intervention. This may be one of the reasons that the MSCI EAFE is flat on the year in spite of dire headlines overseas. While interest rates would be challenged to go lower in the US, there is some room for government intervention around the world, especially in emerging markets -- think of Brazil as an example.

-

A surprising slowdown in overall US debt growth has been occurring under our nose. No, the US federal debt load keeps growing, but there has been measurable deleveraging on the state and household levels. Some of this has come through the painful process of personal bankruptcy and foreclosures. States and municipalities have been practicing their own austerity with layoffs and less borrowing.

- The Affordable Care Act was largely upheld by the Supreme Court last month. This will have implications for Americans of all walks of life. For some of you some of the implications will be investment-related due to the 3.8% surtax on investment income in higher earnings brackets. This increase on investment income may not be the end given the pending expiration of "Bush" tax cuts. The coordination between tax strategy and investment management will become more and more critical in coming years.

-

Scandalous headlines resurfaced at big banks, most recently JP Morgan and Barclays. JPM disclosed that it had major losses due to poor risk controls in exotic trades. The Barclay's LIBOR scandal is in its early days and may be much larger than it appears on the surface. Essentially, Barclay's has admitted that it fudged reports of borrowing costs over the last five years. Many Americans may have been negatively impacted since adjustable loans linked to LIBOR are widespread for mortgages, student loans, and car loans.

We live in a heavily regulated financial world. I know this as much as anyone as each of these messages to you is reviewed in-depth by a compliance department prior to publishing. If I had my druthers, my day would involve less red tape and easier direct communication with you. The continued misbehavior of corporations and individuals alike seems to justify at least some of this burdensome regulation.

As the election season heats up, Angie Palacios, CFP®, Portfolio Coordinator, has focused her MoneyCentered blog posts on politics and investing. Click here to read the series.

Speaking of politics, I recently heard Columbia University Professor of History Eric Foner in an interview discussing Abraham Lincoln's presidency and leadership strengths. He mentioned that one of Lincoln’s strongest character traits was the ability to change his mind on critical issues. “Lincoln was a flip-flopper, if you want to use the terminology of modern politics.” While a politician today is accused of something close to political treason each time they tweak or change their mind, I value the ability to keep an open mind as an investor.

We think long and hard about what would be best for you as our clients and what worked yesterday may not always work tomorrow. We take the changing investment landscape into consideration as we make investment decisions while we will stick with our process which encourages us to analyze and evaluate risks and opportunities for you. Perhaps if our elected officials were afforded the same flexibility there would be more compromise and less frustration with our nation’s capital.

I always enjoy hearing from those of you who are reading these investment updates. Don't hesitate to let me know if you have any questions, comments, or suggestions for future topics.

On behalf of everyone here at The Center,

Melissa Joy, CFP®

Partner, Director of Investments

Investment Advisor Representative, RJFS

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Melissa Joy, CFP® and not necessarily those of RJFS or Raymond James. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users.

June 2012 Investment Performance - 2nd Quarter 2012

Source: Morningstar

Bonds represented by Barclay's Aggregate Bond Index a market-weighted index of US bonds. US Large Companies per S&P 500 Index a market-cap weighted index of large company stocks. Barclay’s Global Bond index is a market-cap weighted index of global bonds. US Small Companies per Russell 2000 Index a market-cap weighted index of smaller company stocks. International stocks measured by MSCI EAFE is a stock market index designed to measure the equity market performance of developed markets outside of the US and Canada. Commodities per Morgan Stanley Commodity Index a broadly diversified index designed to track commodity futures contracts on physical commodities.

Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results.

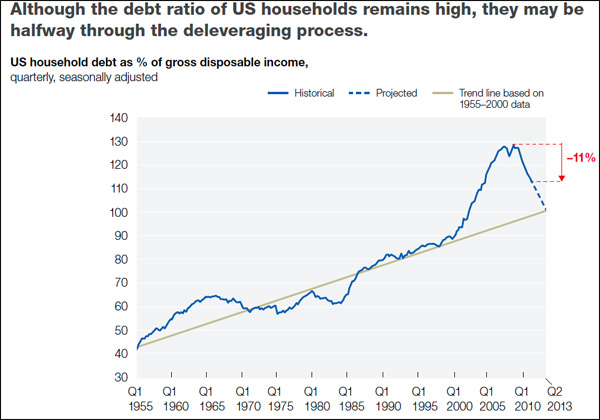

A Debt Surprise - 3rd Quarter 2012

It seems as though we American’s should be giving ourselves a pat on the back. Ever since the financial crisis we have shown a noticeable improvement in our debt levels as a percent of gross disposable income. About half of the excess debt (amount above the trend line or average growth in ratio of debt to disposable income) built up since the year 2000 has been eliminated. The growth in debt over the past ten years sprang from the availability of home equity loans and most of this availability has dried up since the decrease in property values.

Unfortunately our government can’t say the same yet. While government debt is leveling off and slowly drifting downward looking at forward estimates, our politicians have a lot of work to do over the next decade or so tightening their belts.

It is quite common for households and corporations to lead the way in debt reduction during an economic recovery. After all, it is far easier for us to reduce our spending (even though it may not feel like it!) since we don’t have to worry about winning the next election. Also, governments delay their debt reduction in order to attempt to stimulate the economy by spending more so individuals and households can have healthier balance sheets. Later the government can work to reduce their own debt.

When looking under the hood we may not have as much to be proud of as we thought. Sadly, much of the consumer debt reduction has come in the form of foreclosure and defaults. Coming out the other side of this, consumers will have either less or more expensive credit available to them (partially due to lower credit scores and also due to no home equity to borrow upon) and thus won’t be able to fuel the economy quite so much as the government has come to expect in the last decade.

Reduced consumer spending could make the government’s job much more difficult reducing their own debt. The U.S. government is highly unlikely to default on their debt like consumers did so they would need to depend on GDP growth (among other factors like Inflation) to shrink overall debt levels. And with consumers not spending as much it is unclear where this rebound in GDP will come from.

It seems logical to say “Enough is enough!” and make the hard cuts necessary to win this battle over debt in the coming years. However, nothing is ever that simple when it comes to deciding what programs to actually cut and how that may affect other aspects of the meager economic recovery.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Angela Palacios, CFP® and not necessarily those of RJFS or Raymond James.

Sandy Adams Attends Health Policy Forum Roundtable

Sandy Adams recently attended the June taping of the Altarum Institute’s Health Policy Forum Roundtable entitled “Speak Up! Influential Women Give Voice to the Challenges of Elder Care” at Detroit Public Television studios. The day began with a roundtable discussion by experts in the field discussing how the current health care systems are unprepared for our aging society, and proposing changes in attitudes, policies and technologies to help make needed changes. Sandy then participated in a breakout session where participants brainstormed ideas for making needed change going forward. The dynamic group of leaders in serving our aging communities will plan to continue this conversation later this year. To view a replay of the roundtable webcast, visit: http://www.altarum.org/roundtablejune5.

Sandy Adams recently attended the June taping of the Altarum Institute’s Health Policy Forum Roundtable entitled “Speak Up! Influential Women Give Voice to the Challenges of Elder Care” at Detroit Public Television studios. The day began with a roundtable discussion by experts in the field discussing how the current health care systems are unprepared for our aging society, and proposing changes in attitudes, policies and technologies to help make needed changes. Sandy then participated in a breakout session where participants brainstormed ideas for making needed change going forward. The dynamic group of leaders in serving our aging communities will plan to continue this conversation later this year. To view a replay of the roundtable webcast, visit: http://www.altarum.org/roundtablejune5.

The Altarum Institute integrates independent research and client-centered consulting to create comprehensive, system-based solutions that improve health and health care.

The opinions and services of the speakers and their representative entities are independent of Raymond James. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

Barclay's, LIBOR, and What it Means for You - 3rd Quarter 2012

Just what the world needs today: another financial scandal involving banks and your money! An investigation initiated in 2007 has culminated in a nearly half billion dollar fine from Barclay’s and the possibility of an ever-expanding scandal.

The London Interbank Offered Rate (also known as LIBOR) is a common benchmark for financial instruments based upon the cost of borrowing between large banks around the world. If you read financial headlines, the last time you may have been thinking about LIBOR rate was in 2008 when the cost for borrowing between banks went through the roof. But, whether or not you’re following LIBOR, it’s not obscure. In fact, LIBOR is linked to more than $700 trillion in financial instruments around the world including adjustable mortgages, student loans, and car loans.

It turns out that Barclay’s (and quite probably other banks) were padding their own wallets leading up to the financial crisis by boosting LIBOR rates. This meant that derivatives on their books were paying off for the banks. They could also collect more on the loans they issued linked to LIBOR. It made their operations more profitable, possibly at the expense of your loan costs if you had adjustable rate loans. Another big victim may have been your local government as many municipalities have contracts tied to LIBOR.

That’s not all! Just as it helped to boost the LIBOR in 2007, it was very useful to report lower LIBOR rates amidst the global meltdown. Why? Well, lower borrowing meant you might be a stronger financial institution. This is a good thing if you’re trying to stay in business and prevent a bank run. Again, this goes back to the bank’s profitability with little regard for the victims of such a scam. And fudge those numbers they did!

How, you may ask, could they get away with this? LIBOR is managed based upon a glorified honor system. Banks are expected to look in the mirror each day and report their inter-bank borrowing costs. This self-reporting system seems to have lots of cracks, and many are saying that Barclay’s getting caught is just the tip of the iceberg.

Want to learn more? Here are some resources that further explore this unfolding topic:

-

LIBOR for Mortals Marketplace Radio

-

The Rotten Heart of Finance The Economist

-

Infographic: The LIBOR Scandal Explained AccountingDegree.net via BusinessInsider.com

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Melissa Joy, CFP® and not necessarily those of RJFS or Raymond James. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users.