Every day I get questions from clients regarding the market being high. Yes, the market’s nominal price is at an all-time high. But consider the following situation: Over 20 years, with an average annual gain of 9% per year, the equity market could be looking at a DOW JONES average in the 80,000 range. Twenty years ago the Dow Jones was hovering around 3,500 and since then we have had a 12 year period when the Dow did not make a new high, but still averaged almost 9% a year.

Every day I get questions from clients regarding the market being high. Yes, the market’s nominal price is at an all-time high. But consider the following situation: Over 20 years, with an average annual gain of 9% per year, the equity market could be looking at a DOW JONES average in the 80,000 range. Twenty years ago the Dow Jones was hovering around 3,500 and since then we have had a 12 year period when the Dow did not make a new high, but still averaged almost 9% a year.

The three things that tend to kill a bull market are inflation, interest rates, and valuations, and none of them are present yet.

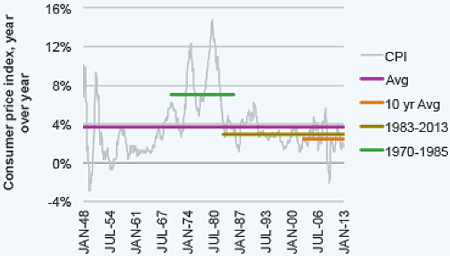

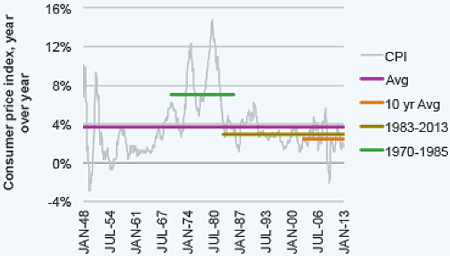

A Look at Inflation

Notice that we are tracking at one of the lowest rates in history. You’ll see the Consumer price Index is well below the 10-year average. Just compare the difference between the price level of consumer goods and services in 2013 and in early 1980’s:

Sources: Bloomberg and Legg Mason. Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. The graph above is for illustrative purposes only and is not reflective an actual investment.

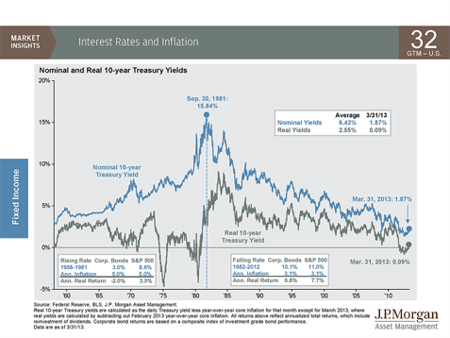

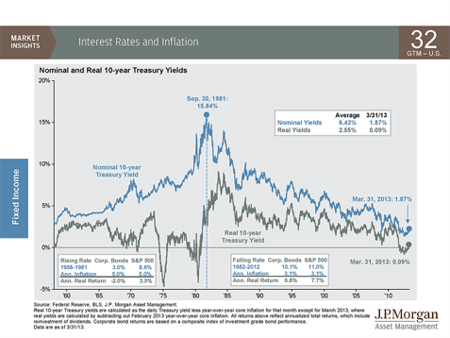

I don’t think I would be the first to remind you that interest rates are still at the lowest levels in history. This chart tracks interest rates and inflation as both trended down in recent years.

Interest Rates and Inflation

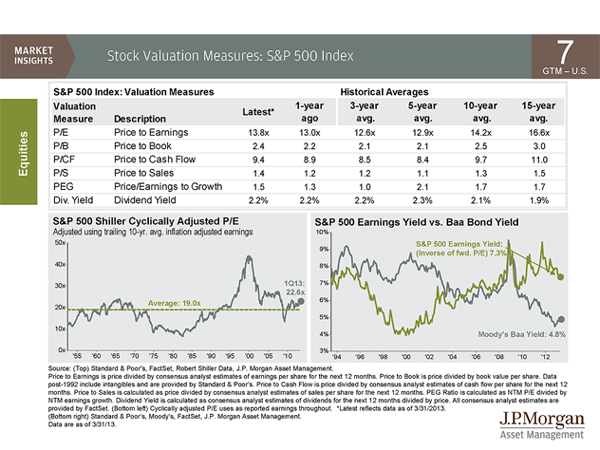

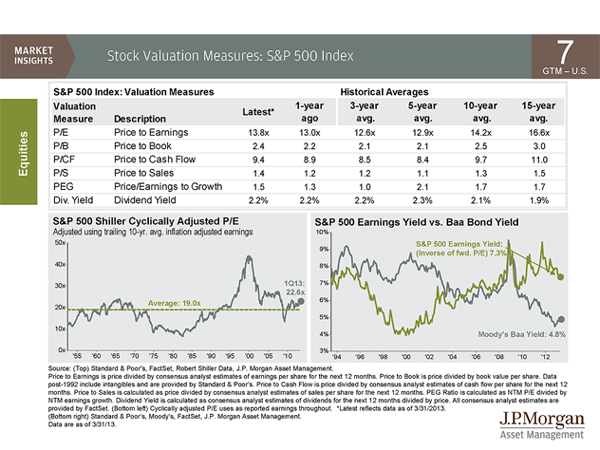

And when looking at the final potential bull killer, equity valuations, you’ll see the measures are in line with historical averages. Not expensive and not cheap.

Equity Valuations

History as our guide would tell us that until all three or at least one of the bull market killers are present this bull is still alive and well.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc. Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions. In 2012 and 2013, Matt was named to the Five Star Wealth Managers list in Detroit Hour magazine.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. The Dow Jones Industrial Average (DJIA) is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

The Center's Team enjoys sharing their knowledge with the press to help stories come to life, share facts and bring important topics to the forefront. We are also honored when we are recognized by media and publications for our work and service to our profession. Here's what's new:

The Center's Team enjoys sharing their knowledge with the press to help stories come to life, share facts and bring important topics to the forefront. We are also honored when we are recognized by media and publications for our work and service to our profession. Here's what's new: