Gratitude comes in many forms. There are the big and obvious and then there are the small or sometimes overlooked. In this season of Thanksgiving, the team at The Center pay tribute to a few of our favorite things. Happy Thanksgiving!

Money Centered BLOG

Gratitude comes in many forms. There are the big and obvious and then there are the small or sometimes overlooked. In this season of Thanksgiving, the team at The Center pay tribute to a few of our favorite things. Happy Thanksgiving!

What goes up... 2013 has been a year of extremes. The stock market[i] has produced dramatically positive total returns. Meanwhile bonds[ii] are suffering their worst losses in almost 15 years. Whether rate rise result in the advent of a new “rising rate regime” where returns have more and more headwind over time is yet to be determined. Meanwhile, stock returns have been so strong (north than 25% as of November 19th) that market watchers are increasingly debating the sustainability of continued positive returns.

Here are full asset class returns through the 3rd quarter. Of note: we have marked the five-year anniversary of Lehman Brother’s collapse – an infamous period in American market history and also a reminder of how far portfolios and personal balance sheets have come since that time.

The extremity of returns is being accompanied by more unexceptional economic growth. While a desirable recovery growth rate might be 4%, the real gross domestic product was most recently measured at 2.8%[iii]. What growth there is has come without a hiring bonanza that Main Street and the Fed are craving; unemployment continues to get better but at an unimpressive pace. There are, however, quite a few bright spots in the economy.

What are the bright spots?

Rather than taking a victory lap, investors are asking what’s around the corner and whether the strong returns of 2013 might be leading into a new bubble. Stock market valuations (measures of whether stocks are more or less expensive) seem to be in the fair value range – trading around a price-earnings ratio between fifteen and sixteen times[v]. We agree that what goes up may at some point come down – there has been very little pull-back in the US market this year and at some point, bigger drawdowns are probably likely.

On the plus side, much of the 2013 sequestration may be behind us, depending on the results of Washington DC negotiations on the budget and debt ceiling. Also, many have kept cash on the sidelines waiting for drawbacks to occur so they can buy at lower prices. We think this “cash on the sideline” may be part of the reason drawbacks have been so shallow this year and there is more cash where that came from. When you couple that cash with the huge pile of bonds people have purchased in the past five years with very low prospects for future return, there may be more fuel for the stock market fire.

We have continued to underweight core bonds in investment portfolios, overweighting multi-sector bond diversifiers and equities in their stead. While reduced in our allocations, we feel there is an enduring role for bonds in many personal investment portfolios. We maintain a neutral weighting to US stocks, have increased our underweight in international stocks to neutral, and maintained an overweight to flexible-tactical managers who can choose between asset classes based upon the changing dynamics of markets. At all times, we recommend that you maintain a rebalancing process and invest with attention to anticipated liquidity needs, tax situations, etc.

We continue to ask you to stick with the discipline of diversified, balanced investing. In some years, you may ask us why we didn’t hunker down in cash because markets declined. At other times, you might be kicking yourself because a pure stock portfolio is up north of 25% and your diversified returns seem less impressive. Our experience leads us to recommend a broadly diversified portfolio to meet your financial goals and objectives. Thank you for your trust in letting us work with you to meet those goals.

On behalf of everyone at The Center,

Melissa Joy, CFP®

Partner, Director of Investments

Melissa Joy, CFP®is Partner and Director of Investments at Center for Financial Planning, Inc. In 2011 and 2012, Melissa was honored by Financial Advisor magazine in the inaugural Research All Star List. In addition to her frequent contributions to Money Centered blogs, she writes frequent investment updates at The Center and is regularly quoted in national media publications including The Chicago Tribune, Investment News, and Morningstar Advisor.

Financial Advisor magazine's inaugural Research All Star List is based on job function of the person evaluated, fund selections and evaluation process used, study of rejected fund examples, and evaluation of challenges faced in the job and actions taken to overcome those challenges. Evaluations are independently conducted by Financial Advisor Magazine.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Melissa Joy, CFP® and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any investment referred to herein. Investments mentioned may not be suitable for all investors. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

[i] As measured by the S&P 500 index

[ii] As measured by the BarCap Aggregate Bond Index

[iii] US Department of Commerce Bureau of Economic Analysis

[iv] As measured by MSCI EAFE NR USD

[v] Source: JPMorgan Weekly Market Recap 11/18/13

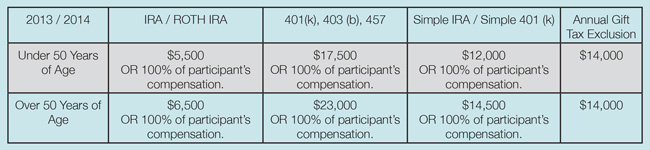

As we approach year-end (yes, already!), it is time to determine what needs to be done to reach your 2013 financial goals AND start preparing for 2014. The 2014 Contribution and Annual Gifting Limits were recently released, and they remain unchanged from 2013 limits. Here is summary of the existing limits for your reference.

As we approach year-end (yes, already!), it is time to determine what needs to be done to reach your 2013 financial goals AND start preparing for 2014. The 2014 Contribution and Annual Gifting Limits were recently released, and they remain unchanged from 2013 limits. Here is summary of the existing limits for your reference.

If you haven’t completed your retirement plan contributions or gifting for 2013, find time to connect with your financial planner to make sure you meet the appropriate deadlines. And make plans now to coordinate with your planner to set your 2014 goals!

Sandra Adams, CFP® is a Financial Planner at Center for Financial Planning, Inc. Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In 2012 and 2013, Sandy was named to the Five Star Wealth Managers list in Detroit Hour magazine. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The Social Security Administration has announced a cost of living adjustment (COLA) to recipients’ monthly Social Security and Supplemental Security Income (SSI) benefits. More than 57 million Americans will see the 1.5% increase in their payments beginning on December 31, 2013.

The Social Security Administration has announced a cost of living adjustment (COLA) to recipients’ monthly Social Security and Supplemental Security Income (SSI) benefits. More than 57 million Americans will see the 1.5% increase in their payments beginning on December 31, 2013.

The increase is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers and was put in place to ensure the purchasing power of these benefits isn’t eroded by inflation. The increase is just less than the 1.7% jump that beneficiaries saw in 2013.

Keep in mind, all federal benefits must be direct deposited. So if you haven’t already started receiving benefits, you need to establish electronic transfers to your bank or financial institution.

"The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete."

Love Starbucks? A lot of us do, but try answering this question I recently heard posed by a behavioral finance professor: “Would you be more inclined to order a latte that was advertised as 95% fat free, or one labeled 5% fat?” The two $5 drinks are the exact same, however, I would venture to say 99.9% of people (including me) would choose the drink that was advertised as 95% fat free. Perception is as powerful force in the coffee world as it is in the investment world. Perception can work against you when it comes to savings or it can fuel you. Much of that depends on how you compartmentalize.

Love Starbucks? A lot of us do, but try answering this question I recently heard posed by a behavioral finance professor: “Would you be more inclined to order a latte that was advertised as 95% fat free, or one labeled 5% fat?” The two $5 drinks are the exact same, however, I would venture to say 99.9% of people (including me) would choose the drink that was advertised as 95% fat free. Perception is as powerful force in the coffee world as it is in the investment world. Perception can work against you when it comes to savings or it can fuel you. Much of that depends on how you compartmentalize.

So what does it mean to compartmentalize? Simply put it is separating two or more things from each other. In personal finance, separating certain accounts to have individual goals can have a tremendous effect on the likelihood of savings and overall success of the individual’s financial plan. For instance, one of the most important pieces of a financial plan is maintaining an adequate emergency fund for the dreaded unknowns – such as job loss, unexpected home improvements, medical expenses, etc. (The Center team usually recommends that clients maintain 3 – 12 months of living expenses in a cash account that is not subject to market risk).

If you find yourself constantly transferring funds from your savings to your checking account each month because they are at the same institution and the ease of the transfer is just to easy to resist, consider making a change! Why not open a savings account at a completely different financial institution and maintain your emergency fund there, knowing this money cannot be touched except for an emergency.

Many banks now allow you to name an account and personalize it. So instead of seeing your account being titled as “Savings” each time you log in, it would read “Emergency fund – don’t touch!” Adding that “name” or “purpose” to the account has been proven to dramatically increase savings levels and decrease the likelihood of spending out of the account.

Separating accounts for each individual goal in retirement, however, is pretty unrealistic. Who wants to have 20 different IRA accounts? At The Center, we like to keep things simple to stay organized and on track. However, our advisors do encourage clients to compartmentalize in their minds when looking at their overall stock/bond/cash allocation to stay focused and not lose track of the purpose of each type of asset that is held within the portfolio. Each “bucket” of funds has a purpose and impact on the total portfolio and it is The Center’s job as your trusted advisor team to help you fill each one and utilize them to their maximum potential.

Nick Defenthaler, CFP® is a Support Associate at Center for Financial Planning, Inc. Nick currently assists Center planners and clients, and is a contributor to Money Centered and Center Connections.

The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

Checkout our current blog posts HERE. See you there!

This post is provided by Zach Gould our former summer intern and current college campus envoy. From his perspective at the University of South Carolina, Zach offers his take on funding the ever-rising cost of a college education.

The time before, during, and after college can be truly hectic. The packing, the dorm room decorating, it can all be mayhem and the financials can easily be forgotten. I should know! I didn’t do a great job of managing the financials when I was applying to college. Sure I spent hundreds of hours finding which school was the best for business, or which schools had the nicest dorms and on-campus restaurant options, but I put the financial aspect on the back-burner. The reality is that there are a ton of resources out there to help pay for college and to help budget money. The biggest thing is taking a look at these resources before the opportunities to utilize them pass you by.

The first resource is FAFSA, which stands for Free Application for Federal Student Aid. This is a form that I highly recommend filling out before sending in that first tuition check or even choosing a school. FAFSA becomes available every year on Jan 1st. Check with your individual state, as different states have different deadlines for submission. For this past school year, the deadline in the state of Michigan was March 1, 2013. Federal student aid can come in a variety of forms, from work-study programs (where you work part-time and the money goes directly to paying for your tuition), to low or no interest loans, and even to aid that doesn’t require repayment. And don’t think that you don’t qualify because you or your family is well-off. There are a variety of factors that are looked at and it can’t hurt to apply!

While I failed at getting a FAFSA in on-time/at all, I did take advantage of one amazing resource that is offered by almost every college out there: SCHOLARSHIPS. Scholarships are probably the most important and valuable resource in helping to pay for school. I can say with all certainty that without scholarship money, I would not be attending the University of South Carolina. As a resident of North Carolina, I noticed that the out-of-state tuition for almost everywhere was triple if not quadruple the in-state tuition rates at many universities. In fact, the University of Michigan has one of the highest out-of-state tuition rates, coming in at over $40,000 per year before any fees or room and board. The University of South Carolina has a particularly attractive scholarship program. The university offers scholarships to qualified out-of-state students that not only reduce the tuition to the in-state rate, but also take-off additional money. I am currently attending an out-of-state school, while paying less than the rate I would pay for an in-state school. See if any of your potential schools have a similar scholarship. The best place to look ships is on the school’s website. Make sure you take extra note of deadlines, as many scholarships have early deadlines.

In addition to tuition scholarships, there are scholarships or grants to do things while in school. A friend of mine started early in looking at scholarships for her semester of studying abroad in Italy and received a few thousand dollars to help pay for her semester abroad. This gave her more options once abroad to travel and experience the local culture with the money she saved. At the University of South Carolina there are scholarships available through each language department and there are also general study abroad scholarships or grants that could be applied for within or separate from the school. I truly wish I had taken advantage of these scholarships, as I found out very quickly last semester how expensive it is to live for 4 months in Paris. Like the other financial resources, getting scholarship applications submitted early is imperative and many require written recommendations from professors or other references which can often be a lengthy process.

The opinions are those of Zachary Gould and The Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

According to survey results reported by Investment News, a quarter of potential investors have no financial plan and, of that group, close to 40% don’t anticipate building one. The Center’s Director of Investments Melissa Joy told Investment News that she wasn’t surprised by those numbers.

According to survey results reported by Investment News, a quarter of potential investors have no financial plan and, of that group, close to 40% don’t anticipate building one. The Center’s Director of Investments Melissa Joy told Investment News that she wasn’t surprised by those numbers.

If anything, I would think the number might have been higher,” she said of people who don’t have a financial strategy. “Financial planning isn’t a new concept like it was 20 years ago. I’m happy to hear that so many people do have a financial plan in place."

On one hand, there are the duck-and-cover investors, on the other are investors who become too complacent when the markets are rosy. That’s how Melissa described those who pay too much attention to events like the government shutdown and those that miss opportunities when the markets are strong. But ultimately, it isn’t usually a market surge or fall that triggers people to put together a financial plan, Melissa said. The most common triggers are life events. It could be preparing for retirement or helping to support an aging parent that drives investors to formalize a strategy for their assets.

If you need help with your plan, contact us here at the Center. To read more about the investor survey check out the article in Investment News:

http://www.investmentnews.com/article/20131008/FREE/131009906

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

High earners beware! Thanks to the new Medicare Surtax deducting investment management fees becomes even more complicated.

High earners beware! Thanks to the new Medicare Surtax deducting investment management fees becomes even more complicated.

In a blog last year I explained the grey area of deductibility of investment management fees. In general, investment management fees paid in taxable accounts (such as single, joint or living trust accounts) are a tax deductible expense and reported as a Miscellaneous Itemized deduction on Schedule A of Form 1040. However, this only benefits taxpayers whose Miscellaneous Itemized deductions exceed 2% of their Adjusted Gross Income.

But the new Medicare Surtax further fogs up this grey area. The basic rule is that investment management fees are deductible against the 3.8% Medicare surtax on net investment income. However, the 2% “rule” still applies, and to further complicate the issue, the deduction amount must be prorated if you have other miscellaneous deductions.

The good news is that for those working with a professional tax preparer you may not even notice the fog. You will want to continue to provide your tax preparer your yearend tax report from your brokerage firm (such as Raymond James) which contains the necessary information on investment management fees. For those preparing their own tax return, the IRS has stated that they will be providing special IRS forms to assist in the calculation early next year.

As always, if you need help getting through the maze, give us a call.

Timothy Wyman, CFP®, JD is the Managing Partner and Financial Planner at Center for Financial Planning, Inc. and is a frequent contributor to national media including appearances on Good Morning America Weekend Edition and WDIV Channel 4 News and published articles including Forbes and The Wall Street Journal. A leader in his profession, Tim served on the National Board of Directors for the 28,000 member Financial Planning Association™ (FPA®), trained and mentored hundreds of CFP® practitioners and is a frequent speaker to organizations and businesses on various financial planning topics.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Please note, changes in tax laws may occur at any time and could have substantial impact upon each person’s situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.